Forex Signals Brief October 25: Canada Retail Sales Close the Week

Today we have the Tokyo Core CPI and US Durable Goods Orders to close the week, but Canadian retail sales will highlight the week.

Yesterday we had the October Services and Manufacturing PMI reports from many countries, which showed a mixed picture. The German PMI numbers came above expectations, which is a positive sign after many negative reports, helping the Euro, while the GBP remained weak as the UK numbers showed that activity in both sectors is heading toward stagnation.

As U.S. rates fell and stocks recovered, the U.S. dollar surrendered some of its gains. The yen, which had surged on Wednesday, was the main mover, reversing gains and falling to 151.85 after peaking at 152.82. BOJ Governor Ueda’s comments didn’t affect markets, signaling no immediate policy shifts despite FX movements, however other Japanese officials did sound worried later in the day, which helped send the JPY higher and USD/JPY below 152.

The euro also rebounded after three days of selling, with a late-day half-cent recovery. Comments from ECB members didn’t add much to inflation discussions, but short sellers likely profited from the recovery. The USD couldn’t reverse the retreat, despite lower Unemployment Claims and better Services and Manufacturing PMI data.

Today’s Market Expectations

The day today started with the Tokyo Core CPI inflation report for October.

Later on we have the retail sales from Canada for August. Sales have been mostly weak this year, with many declining months, however we saw a jump in July for the summer period, with headline sales increasing by 0.9%. IN August, sales are expected to slow somewhat, but remain positive at 0.5% while core retail sales are expected at 0.3%. The US Durable Goods Orders are expected to turn negative in September, but this report has lost importance somewhat.

Yesterday the USD reversed lower which caught us on the wrong side with two long-USD trades, but we made up with our long signals in Gold and Silver, which resumed the upside after Wednesday’s retreat. We opened 9 trading signals in total, closing the day with 6 signals, four of which were winning forex signals and two were losing trades.

Nothing Can Keep Gold Down

Thanks to early-week investor activity, gold hit a new peak today at $2,758. Despite a $50 dip on Wednesday, gold resumed the upside momentum yesterday and has risen over 30% this year and remains in a strong bullish trend for 2024. After the decline, prices stabilized above $2,700, with XAU starting its upward movement yesterday and will likely make new record highs soon.

XAU/USD – H1 Chart

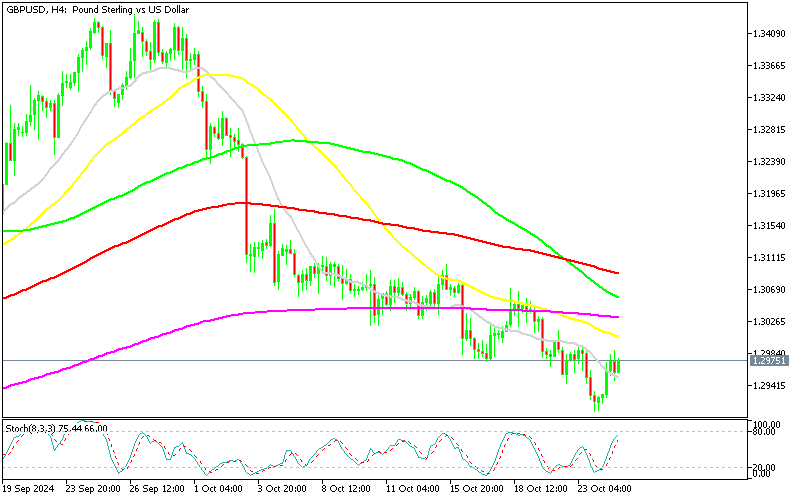

GBP/USD Retracing Toward 1.30

In October, GBP/USD has turned bearish, dropping to 1.29 this week as the Bank of England adopted a dovish stance due to reduced UK inflation. Recent PMI readings highlighted the contrast between the sluggish UK economy and the robust U.S. economy. The GBP/USD exchange rate fell to 1.2907, down over 5 cents in October, although it attempted a recovery toward 1.30. After dipping below that level last week, the pair regained some ground yesterday; however, buyers will need to break through resistance at 1.30 and 1.3030.

GBP/USD – H4 Chart

Cryptocurrency Update

Bitcoin Bounces Off the Top Line of the Channel

Bitcoin, which had been on a downward trend since April, fell from above $70,000 to approximately $50,000 by August. However, following a Federal Reserve interest rate cut, Bitcoin began to rise again in September, nearly reaching $70,000 earlier this week before falling to $65,000. Despite this decline, the upper boundary of the previous trading channel remains intact, indicating potential for Bitcoin to break above its prior range.

BTC/USD – Daily chart

Ethereum Fids Support at the 50 Daily SMA

Ethereum has experienced similar buying pressure. This week, Ethereum buyers managed to breach the 100-day simple moving average (SMA) after reaching $2,700 in October. The price dropped again on Tuesday but found support at the 50-day SMA and recovered above $2,500.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account