FTSE 100 and DAX 40 Surge Amid Middle East De-escalation; Key Levels to Watch Today

FTSE 100, DAX 40 advance with easing Middle East risks. Check out crucial levels and today’s trading insights for these European indices.

The FTSE 100 saw an uplift, closing 36.78 points higher at 8,285.62, as investors responded to hopes of de-escalation in Middle East tensions and a softer UK retail environment.

Investor focus now shifts to the October 30 UK budget, where Finance Minister Rachel Reeves is expected to tackle a balancing act of tax increases to fund public services. Prime Minister Keir Starmer has expressed support for higher taxes to strengthen the economy.

Israel attack on Iran limited to military targets, not nuclear or oil facilities — CBS News pic.twitter.com/1hFa4tuP67

— UKRAINE WAR SQUAD UPDATES 🇺🇦 (@Ukrainewarsquad) October 26, 2024

Looking ahead, the Bank of England’s rate decision next week is also crucial. Analysts expect a 25 basis point cut, following a British Retail Consortium report showing the sharpest retail price decline in three years.

In October, prices fell 0.8% after a 0.6% drop in September, adding pressure on the BoE to support consumer spending.

FTSE 100 Set for Gains as Retail Prices Drop Ahead of BOE Meeting

The FTSE 100 is expected to start Tuesday on the front foot, like it did the day before, following Wall Street gains overnight and with more major London companies reporting earnings today.

Futures for the Square Mile’s blue-chip benchmark were pointing to a 20-point increase, adding to the nearly 37-point gain yesterday, which left the index at 8,285.6.

UK shop prices fall faster but retailers warn of risks in budget https://t.co/qkWBW6xsfy pic.twitter.com/R6sooJYAMY

— Reuters (@Reuters) October 29, 2024

In the United Kingdom, a survey released overnight by the British Retail Consortium revealed that store prices were falling at the fastest rate in more than three years, adding to pressure on the Bank of England to slash interest rates at its meeting next week. Prices fell 0.8% in October last year, following a 0.6% decrease in September.

FTSE 100 Technical Outlook: Resistance and Support Levels

The FTSE 100 is currently trading around 8,289.5, with immediate resistance at 8,326.1, challenged by a downward trendline at this level. The 50-day EMA at 8,278.1 provides near-term support, suggesting a cautious upward trend.

Should the index break 8,326.1, it could head toward 8,357.9 and 8,394.4. On the downside, support lies at 8,277.1, 8,251.6, and 8,216.3.

The RSI at 59 hints at moderate bullish momentum, leaving room for further gains if conditions align.

Key Takeaways:

- Immediate resistance for FTSE 100 at 8,326.1.

- Downward trendline creates a challenging ceiling.

- RSI suggests moderate bullish momentum remains.

DAX 40: Tech Gains, Auto Sector Lags Amid Demand Concerns

Germany’s DAX index rose modestly, ending Monday up 0.35% to close at 19,532. Tech stocks gained ahead of earnings, with Infineon Technologies and SAP up by 0.91% and 0.75%, respectively.

However, auto stocks struggled on concerns over demand, with Porsche down 1.63% and BMW and Mercedes-Benz Group declining slightly.

⚠️ JUST IN:

*VOLKSWAGEN SEEKS 10% SALARY CUT FOR ALL EMPLOYEES, LABOR CHIEF SAYS

🇩🇪🇩🇪 pic.twitter.com/M64SnoMbr0

— Investing.com (@Investingcom) October 28, 2024

The GfK Consumer Confidence Index, set for release on October 29, is anticipated to show a slight improvement from -21.2 in October to -20.5 in November.

Consumer confidence is key for the DAX, as it impacts spending and inflation expectations.

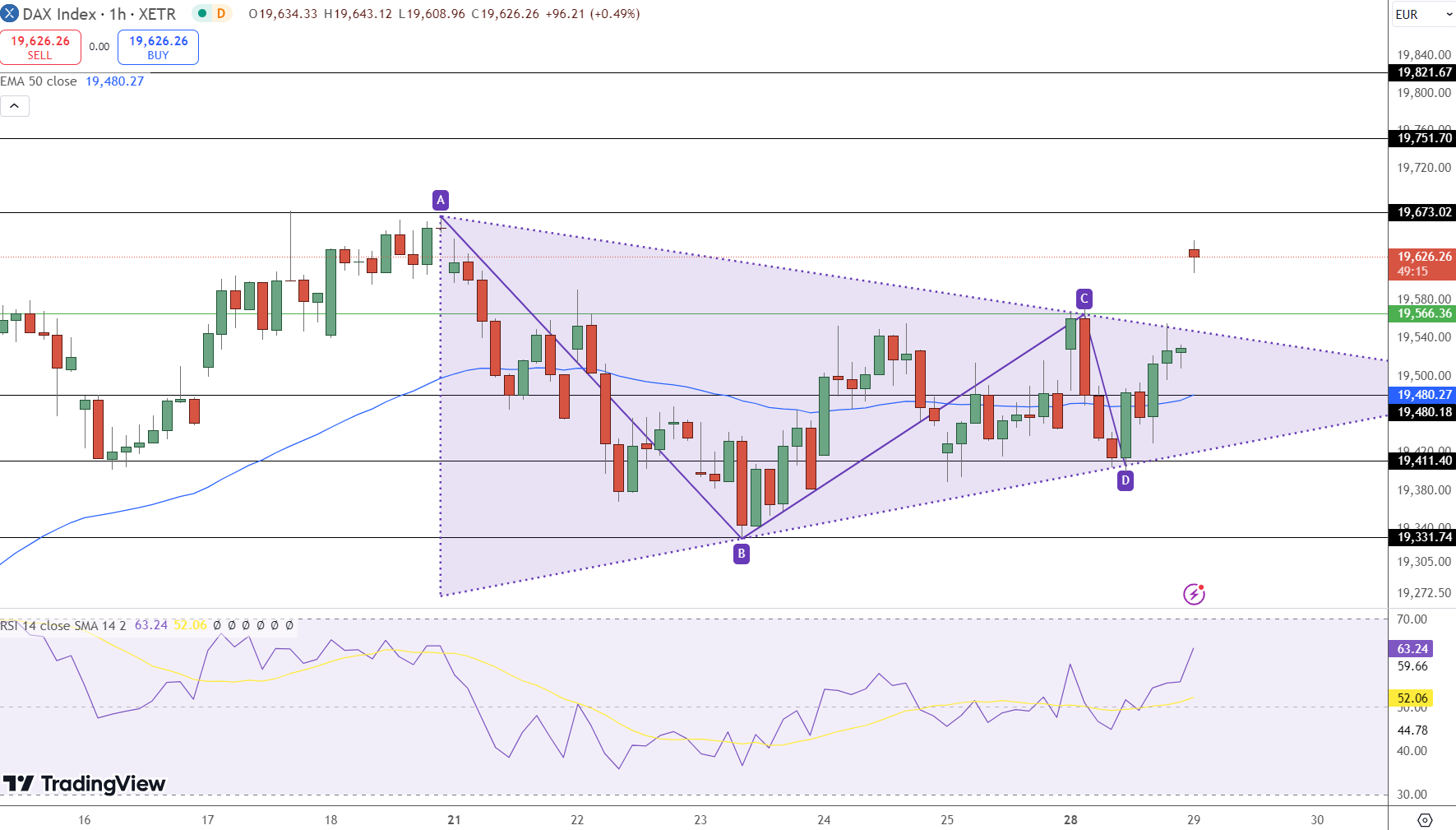

German 30 (DAX) Technical Outlook: Symmetrical Triangle Pattern Holds Key

The DAX Index is trading at 19,626, marking a 0.49% gain. The index remains within a symmetrical triangle, signaling indecision.

Immediate resistance is seen at 19,673, with further levels at 19,751.7, while immediate support is at 19,480, followed by 19,411 and 19,331.

The 50-day EMA at 19,480 offers near-term support, and the RSI at 63.24 reflects moderate bullish sentiment.

A breakout from the symmetrical triangle pattern could signal the next major move. Traders should watch for a decisive push above 19,673 for a bullish breakout or a fall below 19,480 for bearish momentum.

Key Takeaways:

- DAX 40 holds within a symmetrical triangle.

- Immediate resistance at 19,673, support at 19,480.

- RSI suggests potential for an upside breakout.

This detailed analysis of both FTSE 100 and DAX 40 gives a clear picture of the immediate technical levels and market sentiment as the indices respond to broader economic and geopolitical shifts.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account