Forex Signals Brief November 22: Services and Mfg. PMI Close the Week

Today we have the Manufacturing and Services PMI report for October from around the globe, which is unlikely to offer any major surprise.

Today we have the Manufacturing and Services PMI report for October from around the globe, which is unlikely to offer any major surprise.

The US dollar showed mixed performance yesterday but maintained an upward bias against the JPY and CAD. Market activity remained relatively subdued until the US session, when the dollar strengthened, gaining 80 pips against most currencies following a 3.4% rise in October’s existing-home sales to a seasonally adjusted annual rate of 3.96 million. This marked the first year-over-year increase in sales, up 2.9% from October 2023. The median price of existing homes climbed to $407,200, reflecting a 4.0% increase from the previous year, despite higher mortgage rates. The 30-year mortgage rate rose to 6.84%, compared to a September low of 6.00%.

In labor market data, US initial jobless claims came in lower than expected at 213K, beating the 220K forecast. However, continuing claims surpassed estimates and last week’s figures, rising to 1.908 million compared to the 1.873 million projected and the prior week’s 1.872 million. This indicates continued strength in the job market despite the slight uptick in ongoing claims.

Today’s Market Expectations

The day started with the inflation report from Japan, which was expected to continue to slowdown. Core-core inflation was in line with forecasts, but the headline CPI was somewhat higher than expected. Japan’s October inflation figures either matched or slightly above expectations. In the meantime, the government has unveiled a 39 trillion yen stimulus package that prioritizes wage growth in order to maintain economic recovery in the face of ongoing inflationary pressures.

October UK retail sales revealed a noticeable slowdown, with a month-over-month decline expected at -0.2%, following a 0.3% increase in September. Projections for the figure vary widely, ranging from -0.6% to 0.2%, underscoring uncertainty in the economic outlook. The British Retail Consortium (BRC) reported a modest year-over-year rise of 0.3% in October sales, a significant drop from the 1.7% growth observed in the prior month. This weaker performance was partly influenced by the school half-term falling a week later than usual, which delayed spending into November. Rising energy costs and economic uncertainty surrounding the government’s upcoming budget also added to consumer caution, further dampening sales. Retailers, however, remain hopeful that November will see a recovery, driven by the delayed half-term effect and the start of holiday shopping activity.

For many major economies, Friday will be the day of the Flash PMIs. Since the Eurozone, UK, and US PMIs are expected to affect interest rate expectations, the market will pay close attention to them, however, no major changes are expected:

- Eurozone Manufacturing PMI: 46.0 expected vs. 46.0 prior.

- Eurozone Services PMI: 51.5 expected vs. 51.6 prior.

- UK Manufacturing PMI: 49.9 expected vs. 49.9 prior.

- UK Services PMI: 52.0 expected vs. 52.0 prior.

- US Manufacturing PMI: 48.8 expected vs. 48.5 prior.

- US Services PMI: 55.3 expected vs. 55.0 prior.

Yesterday, the USD experienced yet another significant market reversal. Early in the day, a shift in sentiment led to declines in European stocks and risk-sensitive currencies. However, as the US session unfolded, the dollar regained strength, reversing the earlier trend. This abrupt and rapid change in direction created a challenging environment, catching many traders off guard with its whipsaw movement.

Gold Bounces Off the 100 Daily SMA

Gold prices have rebounded after falling from $2,790 in late October to a two-month low last Thursday. Following a brief dip to test the 100-day SMA near $2,550, the precious metal regained ground, pushing past the critical $2,600 level and avoiding a close below it. The reversal suggested by Friday’s doji candlestick, combined with this week’s bullish momentum, hints at a potential end to the recent corrective phase. Gold climbed to $2,673 yesterday, reinforcing the view that it may be entering a new upward trajectory.

XAU/USD – Daily Chart

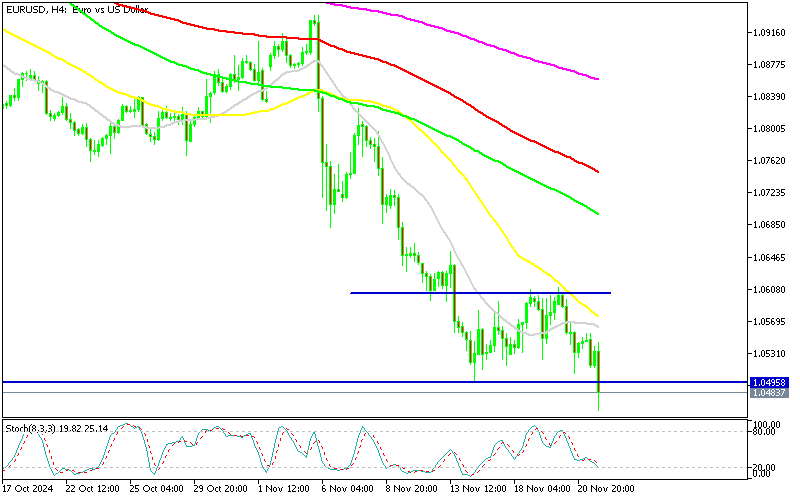

EUR/USD Breaks Below 1.05

The U.S. dollar has maintained its strength, putting significant pressure on the EUR/USD pair. The greenback has been bolstered by robust economic data and a Republican victory in the U.S. elections, which have reignited market optimism. Over the past two months, the euro has weakened considerably, with the EUR/USD exchange rate dropping 7 cents last week to fall below the 1.05 level, marking its lowest point since October 2023. While the 1.05 support level briefly held, the pair now approaches the next key support zone at 1.0440–50. This proximity suggests the potential for further declines, especially as the dollar continues to benefit from strong fundamentals.

EUR/USD – H4 Chart

Cryptocurrency Update

Bitcoin Reaches 100K

The cryptocurrency has demonstrated significant volatility, recovering strongly after a steep summer decline from over $70,000 to just above $50,000. Bitcoin set a new record high of $93,750 on Wednesday, driven by post-election optimism, inching closer to the psychological $100,000 mark. While it briefly fell below $90,000 earlier this week, the rapid recovery underscores increasing market confidence and bullish sentiment.

BTC/USD – Daily chart

Ethereum Retreats but Holds Above $3,000

Ethereum followed a similar recovery path, bouncing back to $3,450 after dipping below $2,500. The cryptocurrency regained its position above the 50-day SMA, supported by Bitcoin’s rally. Despite remaining vulnerable to market swings, both Bitcoin and Ethereum’s recent performance signals renewed investor trust in the digital asset space and points to a potentially bright outlook.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account