Gold Price Prediction: XAG Drops to $2,630; Inflation and Fed Policy Uncertainty Persist

Gold dipped to $2,631 an ounce on Thursday as the dollar rose as inflation signals were mixed. The Core Personal Consumption Expenditures...

Gold dipped to $2,631 an ounce on Thursday as the dollar rose as inflation signals were mixed.

The Core Personal Consumption Expenditures (PCE) index, the key inflation gauge, slowed down and that’s making the Fed’s chances of big rate cuts in the near term uncertain.

Kelvin Wong, OANDA senior market analyst, said the Fed’s 2% inflation target may require a more cautious approach to easing. Current market is pricing in 64.7% chance of 25bps rate cut in December, according to CME Group’s FedWatch Tool.

And to add to the uncertainty, Mexican President Claudia Sheinbaum threatened to retaliate if former President Trump, who’s now running for re-election, imposes 25% tariff. Trade wars could add to the Fed’s rate decision making process by increasing inflationary pressures.

Gold Tests Key Technical Support Levels

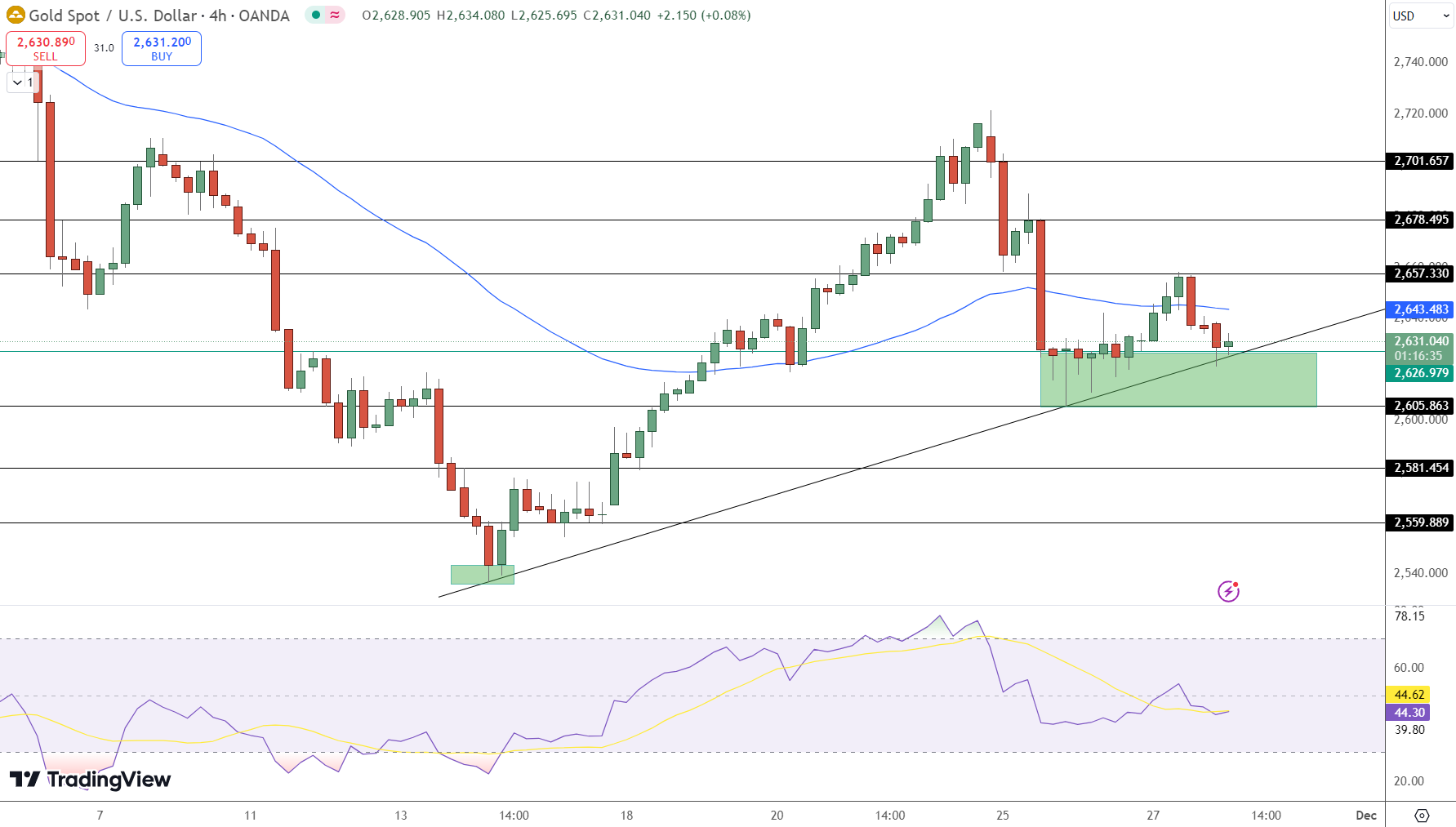

On the technical front, gold prices are navigating a critical support range of $2,626–$2,605, coinciding with a trendline originating in mid-November. Analysts suggest that this zone is pivotal for maintaining bullish momentum. A break below $2,605 could expose prices to the next support at $2,581.

Conversely, immediate resistance lies at $2,643, aligning with the 50-day exponential moving average (EMA). Further upside targets include $2,657 and $2,678, contingent on stronger buyer participation. Technical indicators paint a cautious picture:

-

RSI (Relative Strength Index): Currently at 44.30, signaling mild bearish momentum without indicating oversold conditions.

-

50-EMA: Positioned at $2,643, reinforcing this level as a key barrier for short-term gains.

Safe-Haven Appeal Remains Intact Despite Weakness

Near term may pressure gold but its safe-haven appeal during geopolitical and economic turmoil remains intact. Inflation concerns, trade wars and tariff threats will continue to support long term gold bullishness.

SPDR Gold Trust, the biggest gold ETF, shed 0.1 tonnes to 878.55 tonnes on Wednesday. Trading will be thin through the US Thanksgiving holiday.

Key Insights:

-

Support Levels: $2,626–$2,605; further downside targets at $2,581.

-

Resistance Levels: $2,643 (50-EMA), $2,657, and $2,678.

-

Indicators: RSI hints at mild bearishness; a sustained move above $2,643 may spark recovery.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account