Gold Price Forecast: Nonfarm Payrolls & Rate Cut Expectations Shape Outlook

Gold prices rose modestly on Friday but are set to close a second consecutive week of losses. Investors remain cautious ahead of the U.S...

Gold prices rose modestly on Friday but are set to close a second consecutive week of losses.

Investors remain cautious ahead of the U.S. nonfarm payrolls report, expected to provide critical insights into the Federal Reserve’s rate-cut trajectory.

Gold Struggles Amid Interest Rate Uncertainty

Gold spot prices hovered around $2,641.99, down significantly from their record high of $2,790.15 on October 31. Analysts attribute the decline to profit-taking following a massive rally earlier this year.

According to Jigar Trivedi, a senior analyst at Reliance Securities, “Support is seen at $2,550, while resistance sits at $2,700. The short-term outlook is bearish due to anticipated profit booking and a strengthening U.S. dollar.”

Federal Reserve Chair Jerome Powell highlighted on Wednesday that the U.S. economy remains more resilient than previously anticipated, enabling policymakers to approach rate cuts cautiously.

Markets currently price a 70.1% probability of a 25-basis-point rate cut this month, according to the CME Group’s FedWatch Tool. With higher interest rates diminishing the appeal of non-yielding assets like gold, the metal faces near-term downward pressure.

U.S. Payrolls Data Holds the Key

All eyes are on the U.S. payrolls data, scheduled for release at 13:30 GMT. Economists expect nonfarm payrolls to have risen by 200,000 in November, following a modest 12,000 increase in October. Labor market trends remain a pivotal factor in shaping the Federal Reserve’s monetary policy decisions.

Unemployment claims released on Thursday pointed to a slight uptick in filings, signaling gradually easing labor market conditions as 2024 concludes. Analysts suggest that strong payroll numbers could reignite expectations of a slower rate-cut trajectory, further weighing on gold’s recovery potential.

Technical Analysis: Gold Edges Higher, But Risks Remain

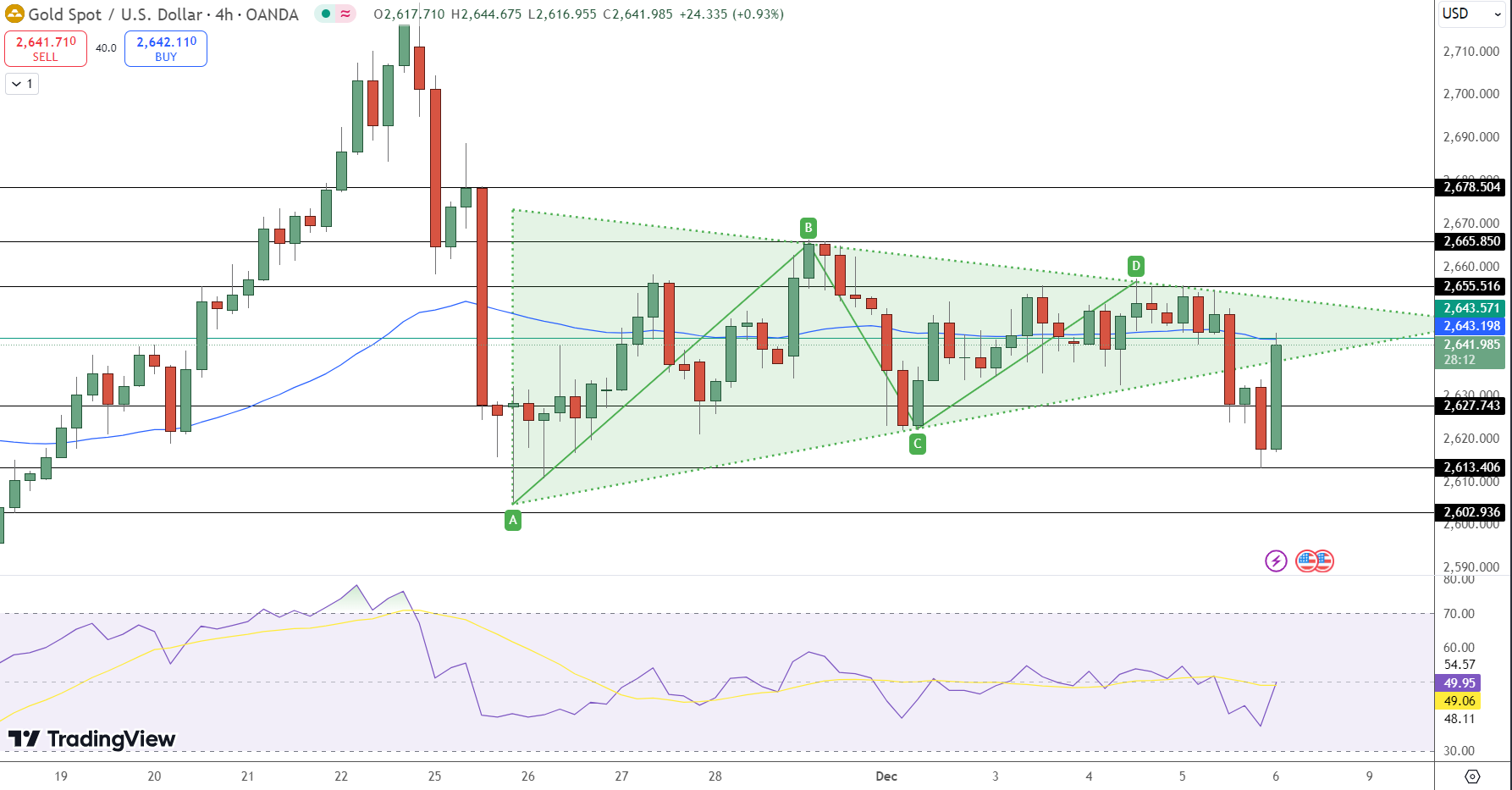

Gold’s technical outlook suggests a cautious recovery. Key resistance levels include $2,655.51 and $2,665.85, while support lies at $2,627.74 and $2,613.40. The Relative Strength Index (RSI) sits at 49.95, reflecting neutral sentiment. A decisive move above $2,655.51 could spark bullish momentum, while a drop below $2,627.74 risks deeper losses.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account