XRP’s $929M Boom: Are ETFs About to Send It to the Moon?

Investment inflows into XRP-focused exchange-traded products (ETPs) skyrocketed by an astonishing 2,433% in 2024, reaching $438 million...

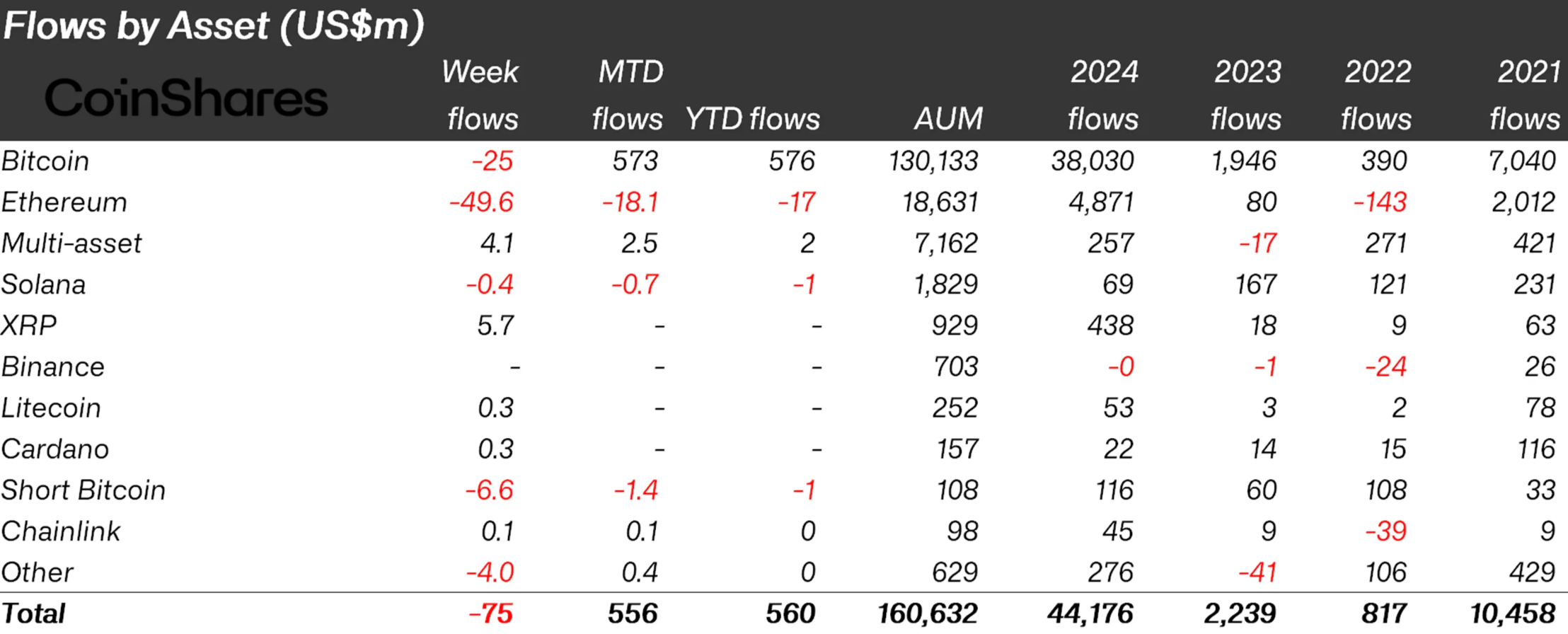

Investment inflows into XRP-focused exchange-traded products (ETPs) skyrocketed by an astonishing 2,433% in 2024, reaching $438 million compared to just $18 million in 2023.

According to CoinShares, the total assets under management (AUM) in XRP ETPs now stand at $929 million, securing its position as the third-largest altcoin in ETP inflows.

The surge follows Ripple’s legal victory against the SEC, which clarified XRP’s status as not being a security. This resolution provided much-needed regulatory certainty, attracting institutional investors previously hesitant due to ambiguity. Speculation regarding potential shifts in U.S. regulatory policy, fueled by SEC Chairman Gary Gensler’s imminent departure, has also contributed to the inflows.

Growing Hype Around XRP ETFs

The anticipation of an XRP exchange-traded fund (ETF) launch in 2025 has further boosted investor sentiment. Several firms, including Bitwise, Canary Capital, 21Shares, and WisdomTree, have already filed applications. An approved XRP ETF would allow institutional and retail investors to gain exposure to XRP without directly owning the asset, offering a simpler and regulated path into the market.

ETFs historically drive significant capital inflows into assets by lowering barriers to entry and enhancing accessibility. XRP’s growing institutional adoption, coupled with the prospect of ETF approval, positions 2025 as a pivotal year for the cryptocurrency.

XRP Technical Outlook: Symmetrical Triangle Patterns Persist

XRP/USD is trading at $, up 0.88% over the last 24 hours, with a market cap of $139.46 billion. The 4-hour chart reveals consolidation within a symmetrical triangle, suggesting an impending breakout.

Key resistance levels include $2.50, $2.71, and $2.90, with a break above $2.50 potentially igniting a bullish trend. On the downside, immediate support rests at $2.35, followed by $2.23 and $2.11. The 50-day EMA at $2.35 reinforces positive sentiment, while the RSI at 58 indicates moderate bullish momentum.

Bullish candles near $2.35 highlight optimism, but traders await a breakout for clearer direction. A move beyond $2.50 could pave the way for a rally toward $2.71, while failure to hold $2.35 might expose XRP to deeper losses.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account