Bitcoin Consolidates Above $96K as Markets Eye Trump Inauguration and Institutional Adoption

Bitcoin (BTC) has shown remarkable resilience in early 2025, quickly recovering from a brief dip below $90,000 to stabilize above $96,500

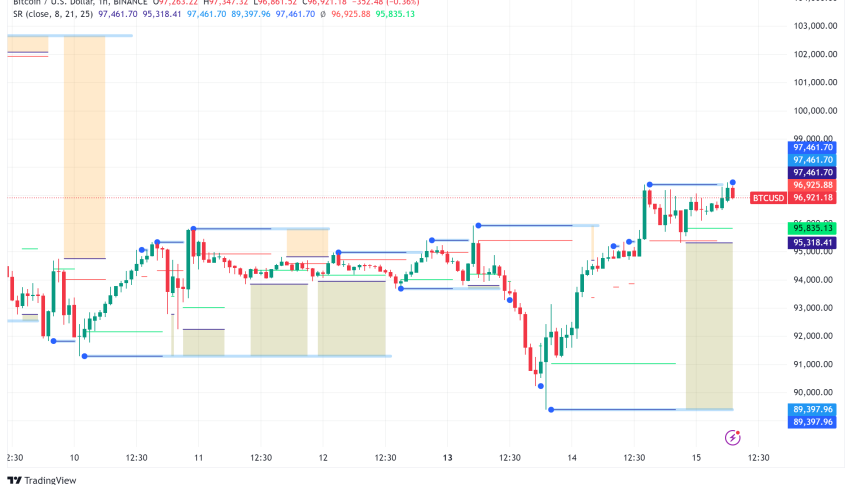

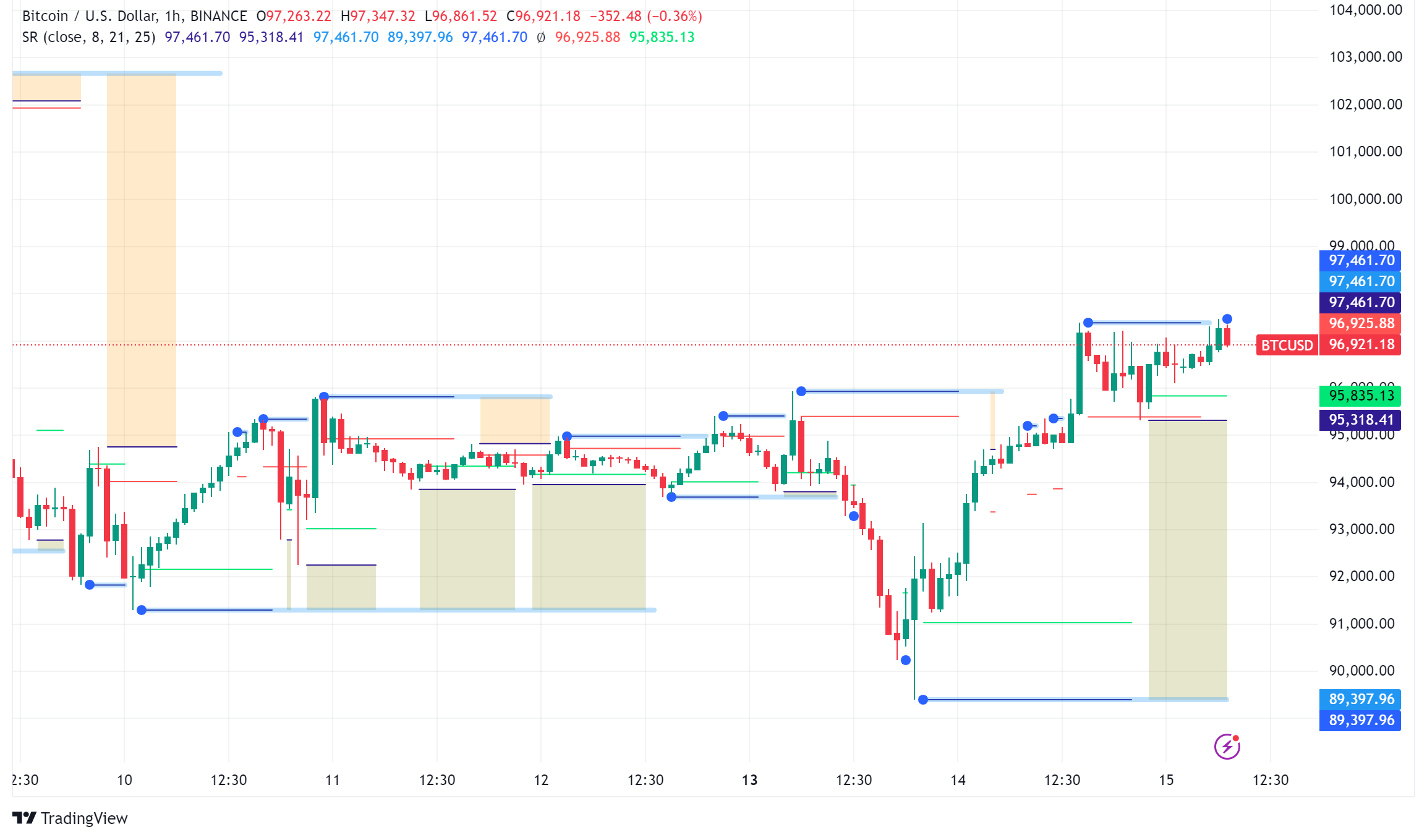

Live BTC/USD Chart

Bitcoin (BTC) has shown remarkable resilience in early 2025, quickly recovering from a brief dip below $90,000 to stabilize above $96,500, as markets digest unprecedented institutional adoption and anticipate policy shifts under the incoming Trump administration.

BTC/USD Technical Analysis and Market Performance

Recent price action of the biggest cryptocurrency shows increasing institutional maturity; drawdowns are especially lighter than in past bull markets. Although BTC/USD showed volatility in December following a fall short of $100,000, present price moves point to a consolidation phase instead of a notable decline.

Based on ARK Invest’s research, the monthly volatility of Bitcoin is rather low in comparison to past trends, suggesting the market has not yet gone into mania. This technical indication, together with robust holder behavior—with 62% of Bitcoin’s supply still undisturbed for more than a year—indicates considerable space for additional upside in 2025.

Institutional Adoption Reaches New Heights

With BlackRock’s iShares Bitcoin Trust (IBIT) building over $52.3 billion in assets over its first year, the success of spot Bitcoin ETFs has beyond all market predictions. This represents the most successful ETF launch in American history. Unprecedented institutional demand is shown by the fast expansion of IBIT options to about 50% of Deribit’s BTC open interest within only two months more.

Bitcoin Price Prediction and Market Outlook

Prominent market analysts have set aspirational but reasonable pricing forecasts for 2025:

- While noting possible short-term dips to $70,000 depending on Fibonacci retracement levels, Fundstrat’s Tom Lee estimates a year-end objective of $200,000-$250,000.

- Technical signs point to the current consolidation between $90,000 and $100,000 as a launching pad for the next big move upward.

- According to analysis by ARK Invest, the market structure is still sound and relative volatility suggests space for notable expansion in 2025.

Catalysts and Risk Factors

Several important events can greatly affect the direction of Bitcoin’s price in the next months:

- January 20: Trump’s inauguration Day one markets are expecting pro-crypto executive directives; the next government already names important candidates including pro-crypto David Sacks is top crypto advisor; Paul Atkins will lead the SEC.

- institutional adoption: Particularly if more established financial companies embrace crypto assets, experts estimate 2025 might witness even more robust institutional inflows than 2024.

- Regulatory Environment: The transition to a more crypto-friendly administration could catalyze further mainstream adoption, though market participants should remain mindful of potential volatility during this transition period

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account