Ripple Buyers Return as XRP Bounces, S&P Recuperates

Today stock markets crashed earlier, which pulled down cryptocurrencies such as Ripple, but XRP has bounced back to unchanged, while S&P...

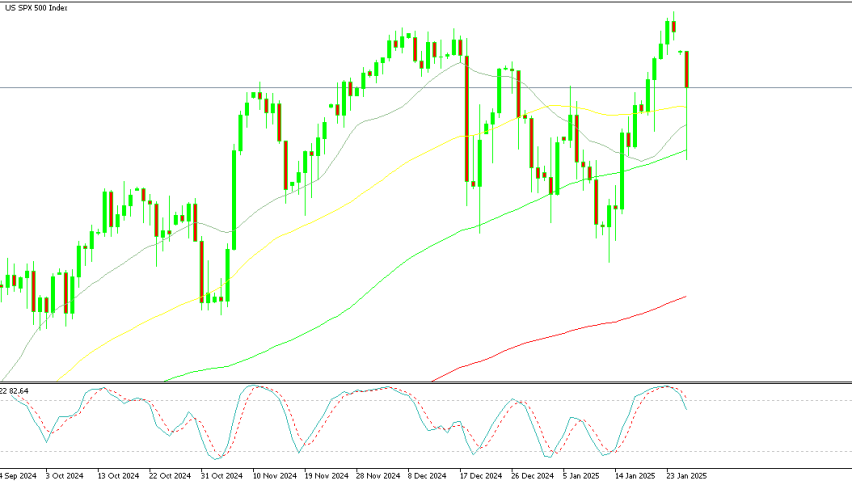

Live SPX/USD Chart

[[SPX/USD-graph]]Today stock markets crashed earlier, which pulled down cryptocurrencies such as Ripple, but XRP has bounced back to unchanged, while S&P 500 also recuperated most of the losses, so it wasn’t such a bad day after all, apart from Nvidia and other AI/tech companies.

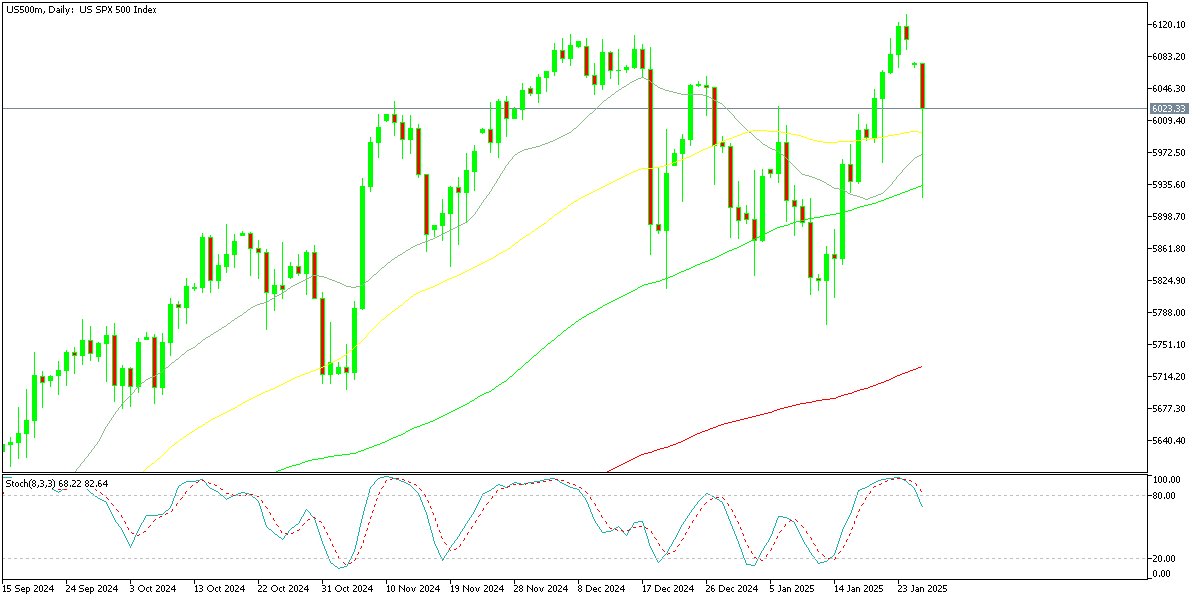

Ripple coin made another new record high earlier this month, reaching $3.3942 after the strong bullish rally in November and the retreat in December. The 50 SMA (yellow) acted as support on the daily chart, and we saw a bounce off that moving average. However, the price started retreating lower again last week and today we saw a quick dip to 2.64, which means falling around 15% in value.

But, the decline stopped right at the 50 daily SMA and buyers returned, sending the price above $3 again, where XRP/USD is closing the day. This shows that the buying pressure is strong as buyers continue to jump on every opportunity such as today’s retreat. Therefore, Ripple is still a good asset to buy.

Ripple Chart Daily – The 50 SMA Held As Support

Nvidia’s 17% Decline Marks a Historic Market Cap Wipeout

Nvidia’s dramatic 17% drop in stock price has set a new record for the largest single-day market capitalization loss in history, wiping out an astonishing $600 billion in value—twice the size of the previous record. Despite this staggering milestone, the headlines fail to fully capture the magnitude of the event and its ripple effects across the market.

The sell-off wasn’t confined to Nvidia alone. Other semiconductor and chip manufacturers also faced significant pressure as concerns over competition in artificial intelligence (AI) technology mounted. High-flying Vistra, a key player in the sector, suffered an even sharper decline, plunging 28% by the end of the trading session.

While the broader tech sector experienced significant pain, there were silver linings elsewhere. Some companies benefitted from the vision of a future where AI becomes more accessible and affordable. This optimism drove gains in certain equities, leading to a larger number of stocks closing higher than lower for the day. However, the dominance of Nvidia and other giants within the so-called “Mag7″—a group of mega-cap tech stocks—meant their sharp declines had an outsized impact on indices like the Nasdaq.

In essence, Nvidia’s slump underscores both the risks and the shifting dynamics in the AI and tech sectors, as the market adjusts to evolving competition and changing expectations.

Closing Changes for Main US Stock Indices

- S&P 500: Declined by 1.45%, reflecting broader market weakness driven by negative sentiment across risk assets. Concerns over global economic uncertainty and disappointing earnings reports contributed to the downturn.

- Nasdaq Composite: Dropped significantly by 3.1%, underperforming other indices due to heavy losses in technology stocks. This steep decline was fueled by increased competition in the AI sector and a broader sell-off in high-growth, tech-heavy names.

- Russell 2000: Fell by 1.2%, indicating reduced investor appetite for small-cap stocks, which are often seen as more sensitive to economic uncertainty. The index’s performance highlights caution among investors in riskier market segments.

- Dow Jones Industrial Average (DJIA): Managed to edge up by 0.6%, bucking the broader market trend. The DJIA’s resilience was supported by gains in defensive sectors like healthcare and consumer staples, which helped offset losses in other areas.

- Toronto Stock Exchange (TSX): Declined by 0.7%, as weakness in the energy and financial sectors weighed on Canada’s main equity index. Fluctuating oil prices and concerns over global demand dampened investor sentiment in Canadian markets.

S&P 500 Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account