A Great Month for S&P 500 and Stocks, Despite Today’s Retreat

S&P 500 ended the day and week slightly lower, but it was a great month nonetheless, despite all the tariffs fuss and the global economy.

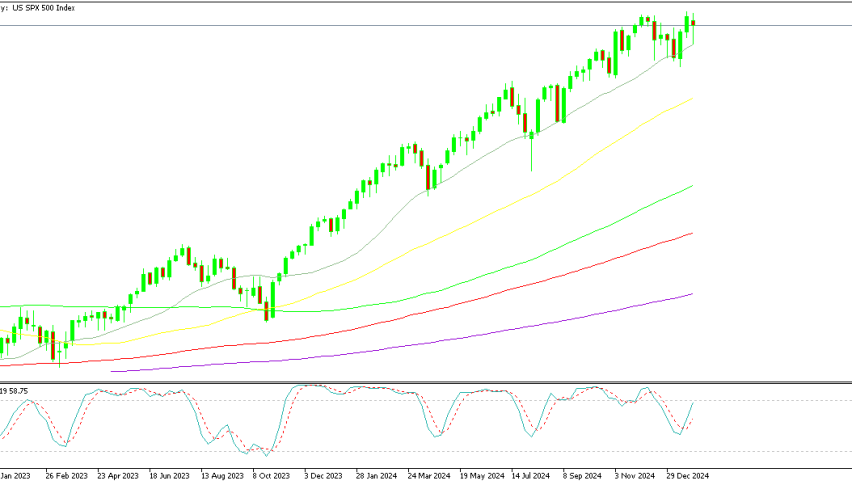

Live SPX/USD Chart

[[SPX/USD-graph]]S&P 500 ended the day and week slightly lower, but it was a great month nonetheless, printing a new all-time high, despite all the fuss regarding tariffs and the global economy.

The end of January brought significant market turbulence, largely driven by developments surrounding the incoming U.S. president. While the PCE report provided insights into inflation, it only stood out when looking at second-decimal rounding. The data reaffirmed that the Federal Reserve is unlikely to consider rate hikes in the near future, though the pace of rate cuts could slow or pause. The U.S. dollar initially took the data in stride, with early market movements largely reflecting month-end rebalancing. However, this led to erratic swings that were difficult to rationalize—until a new catalyst emerged.

Tariff Confusion Sparks Market Reactions

The turning point came when Reuters reported that while President Trump would announce tariffs on Canada and Mexico, they wouldn’t take effect until March 1 to allow for negotiations and potential exclusions. The market initially welcomed this news, sending stocks higher and pushing the U.S. dollar lower. However, just an hour later, the White House denied the report, reaffirming that tariffs would be implemented on Saturday as originally planned. This abrupt reversal caused significant market whiplash, with stocks quickly giving up gains and the U.S. dollar rebounding.

Stock Sell-Off Before February Tariffs and Uncertain Weekend Ahead

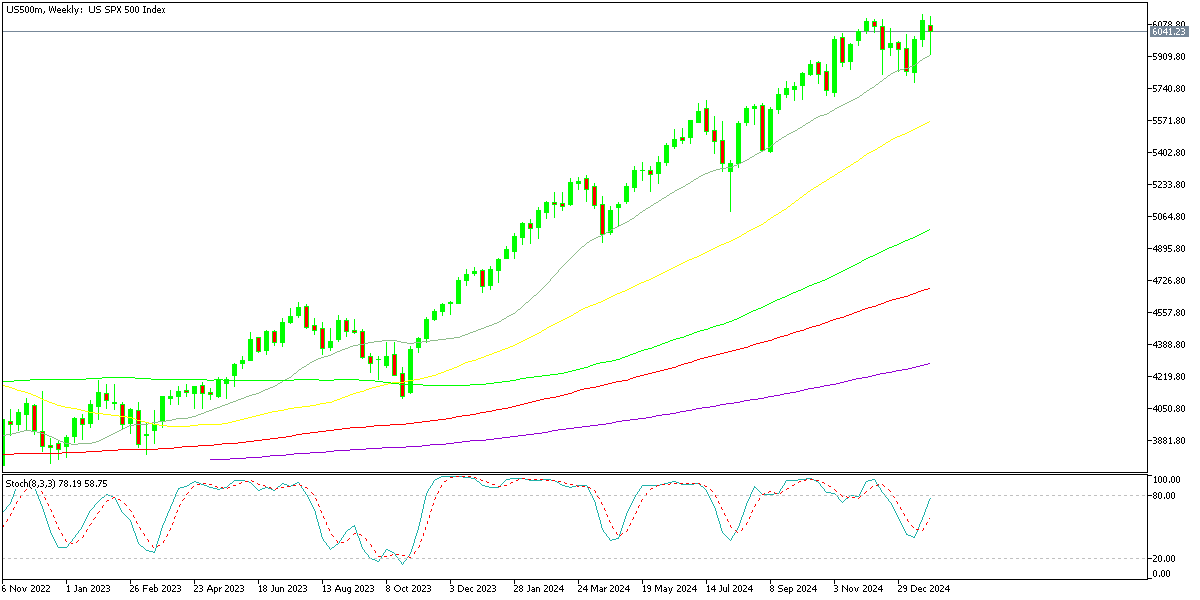

The S&P 500, which had climbed 40 points at its peak, reversed sharply to close 40 points lower—a swing of about 0.5%. Apple, which started the day strong, suffered a severe reversal, ending nearly 5% lower. The sudden shift in sentiment suggests that volatility will persist when markets reopen, and further surprises over the weekend could lead to more dramatic moves. For now, investors brace for what could be an eventful start to February.

S&P 500 Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account