Tesla Stock Rebounds, Nvidia Stock Ends 1% Down

Today roles reversed, with Nvidia shares losing more than 1%, while the Tesla stock price made a decent bonce after declining for 2 months.

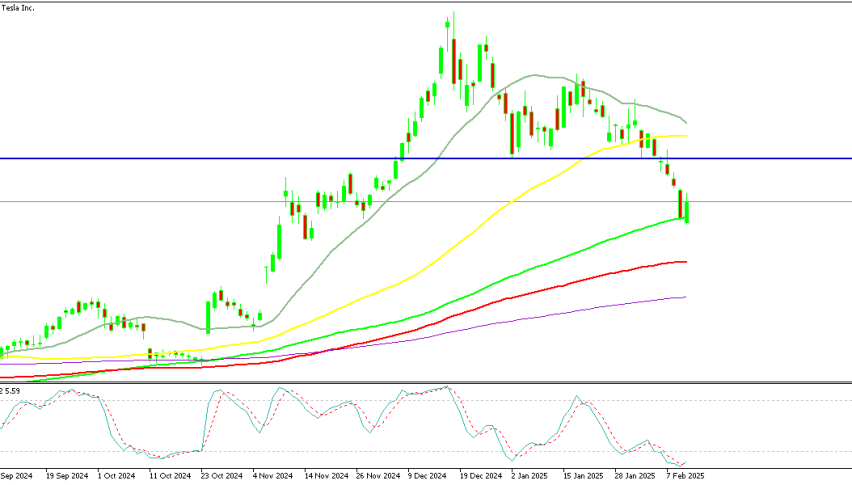

Live TSLA/USD Chart

Today roles reversed, with Nvidia shares losing more than 1%, while the Tesla stock price made a decent bounce after declining for 2 months.

Most major tech stocks, including Nvidia and Meta, continued their upward momentum, closing higher. However, Tesla struggled, closing 7% lower yesterday and dragging the Nasdaq down. The stock has now lost over 33% of its value since peaking at $388 in December. Today, Tesla rebounded following the introduction of new legislation proposed by Republican senators, though it surrendered some gains in the final hour of trading.

Tesla’s Recovery and Musk’s Bold Statements

Tesla’s stock saw a strong recovery, ending the day 5.5% higher. After a rough start to the week—falling 3.5% on Monday, followed by another 7% drop on Tuesday—Tesla showed resilience. CEO Elon Musk reportedly stated in a media interview that he plans to focus on Dogecoin (DOGE) for the next four months, aiming to cut the budget by $2 trillion and bring inflation down to 2%. He even claimed to be working so hard on DOGE that he sleeps in his White House office.

Broader Market Trends and Nvidia’s Fluctuations

The broader market remained mixed amid sector rotations driven by higher-than-expected U.S. CPI inflation numbers, Federal Reserve Chair Jerome Powell’s comments, and ongoing trade tariff concerns. The Nasdaq managed to close higher, while the S&P 500 ended slightly lower. Nvidia, which initially dropped following the DeepSeek launch, rebounded last week after finding support at the 100-day SMA (red). Despite a strong start to the week, gaining 5% over two days, Nvidia’s stock fell 1.5% today after facing resistance at the 50-day moving average.

Market Sentiment and Political Uncertainty

Investors remain on edge as White House policies, trade tariffs, and potential tax cuts continue to shape market sentiment. As political developments unfold, traders are closely monitoring their impact on tech stocks and broader market trends.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account