Tesla Stock Looks Cheaper to Buy after Closing Below $300 on 10% Fall As EV Hype Cools Off

Stock markets recovered most of the losses from the decline early today, but Tesla stock closed near the lows below $300, almost 10% down.

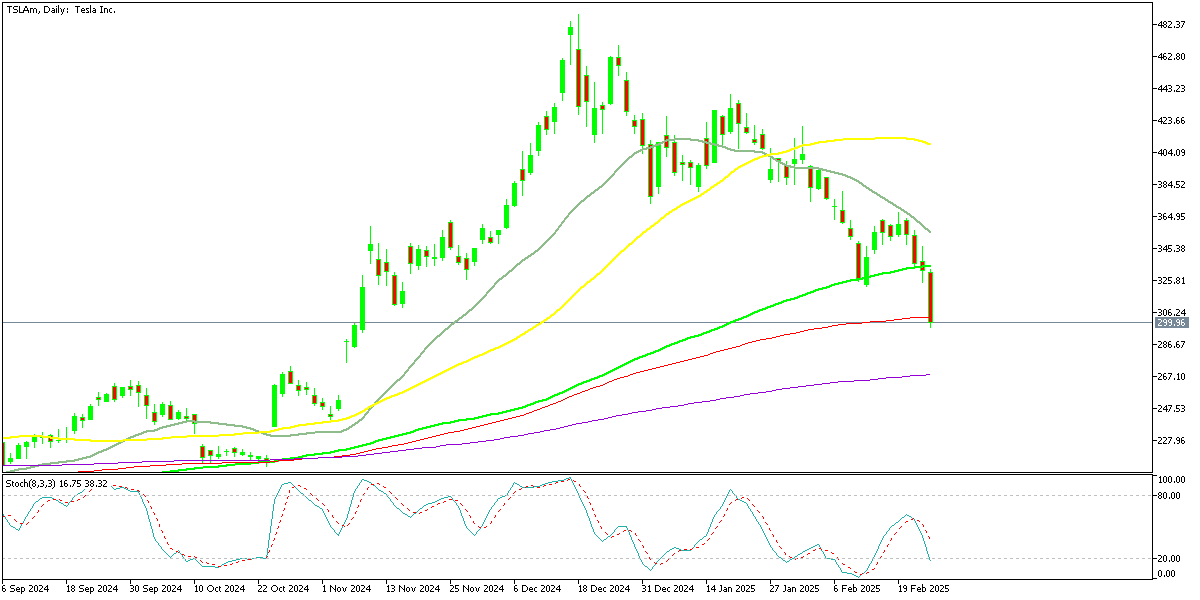

Live TSLA Chart

[[TSLA-graph]]Stock markets recovered most of the losses from the decline early today, but Tesla stock closed near the lows below $300, almost 10% down on the day.

Tesla’s Sharp Decline Continues

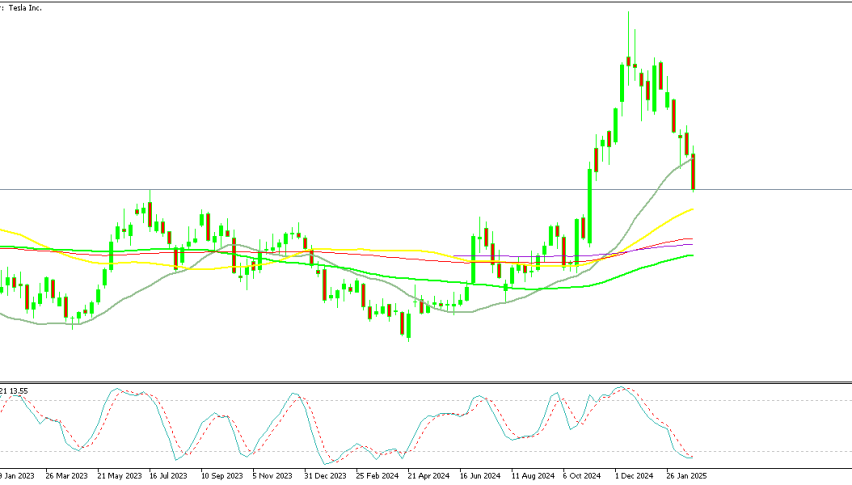

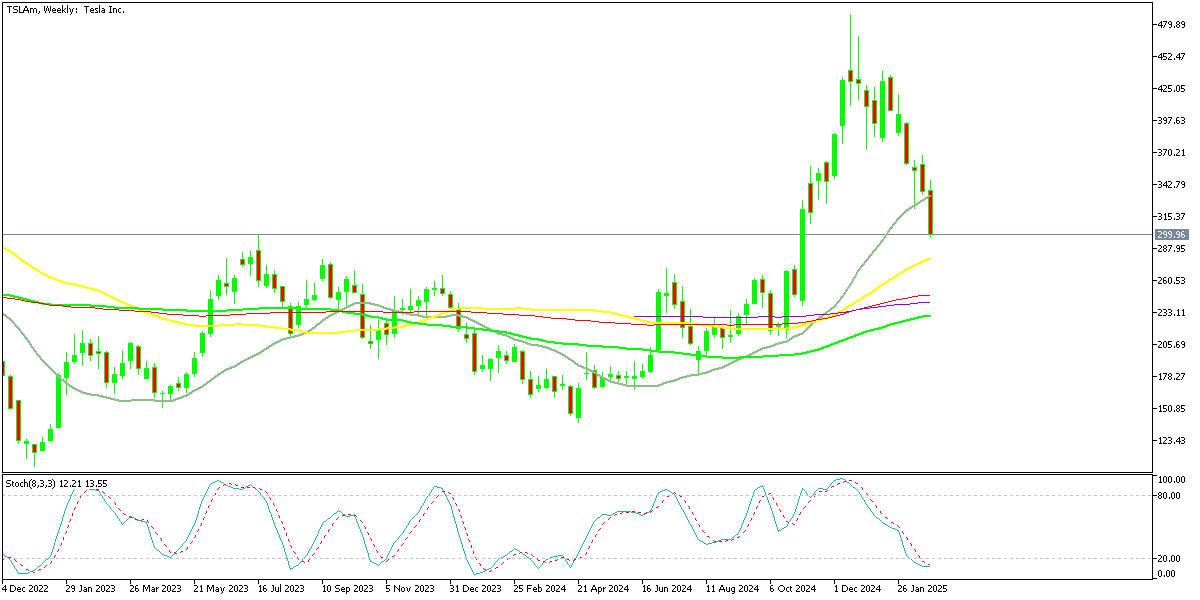

Tesla shares extended their losing streak today, falling below the $300 mark for the first time since their post-election rally in early November. This marks a significant downturn for the EV giant, which saw an extraordinary 250% surge last year, fueled by optimism around new technologies, strong sales, and AI-driven innovations. However, since peaking at $488 in mid-December, Tesla’s stock has tumbled more than 40%, breaking key moving averages and signaling a shift in market sentiment. The once-unshakable hype around EVs appears to be cooling off, putting additional pressure on Tesla’s valuation.

European EV Sales Slump Hits Tesla Hard

One of the primary reasons behind Tesla’s stock decline is the noticeable slowdown in EV sales across Europe. The European Automobile Manufacturers’ Association reported that only 9,945 Teslas were registered in January—an alarming drop of nearly 50% compared to over 18,000 registrations in the same period last year. Overall, European EV registrations fell by 45% last month, reflecting weakening demand in a market that was once a major growth driver for Tesla. Higher interest rates, reduced government subsidies, and increasing competition from Chinese automakers have all contributed to this downward trend, raising concerns about Tesla’s ability to maintain its aggressive growth trajectory.

Challenges Beyond Europe

Tesla is also facing challenges beyond the European market. In the U.S., increasing competition from traditional automakers like Ford and General Motors, as well as emerging EV players like Rivian and Lucid, has intensified price wars, pressuring Tesla’s margins. Additionally, supply chain constraints and rising material costs continue to impact production efficiency. While Tesla remains a dominant player in the EV industry, the landscape is becoming increasingly competitive, forcing the company to adapt quickly.

A Potential Buying Opportunity or More Decline Ahead?

With Tesla’s stock plunging nearly 10% today alone and down 26% in 2025 so far, investors are debating whether this presents a buying opportunity or a warning sign of further declines. While some believe Tesla’s valuation remains inflated given the cooling EV demand, others argue that Elon Musk’s vision extends well beyond electric vehicles. With advancements in AI, robotics, energy storage, and autonomous driving, Tesla’s long-term growth potential remains strong.

If Tesla’s stock stabilizes around these levels in the coming weeks, this dip could provide an attractive entry point for investors looking to capitalize on the company’s broader technological ambitions. However, if the downward trend continues and EV market challenges persist, the stock may face further pressure before finding a solid bottom.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account