AMD Stock Holds Above $100 as Nasdaq Stabilizes – AI-Driven Rebound Ahead?

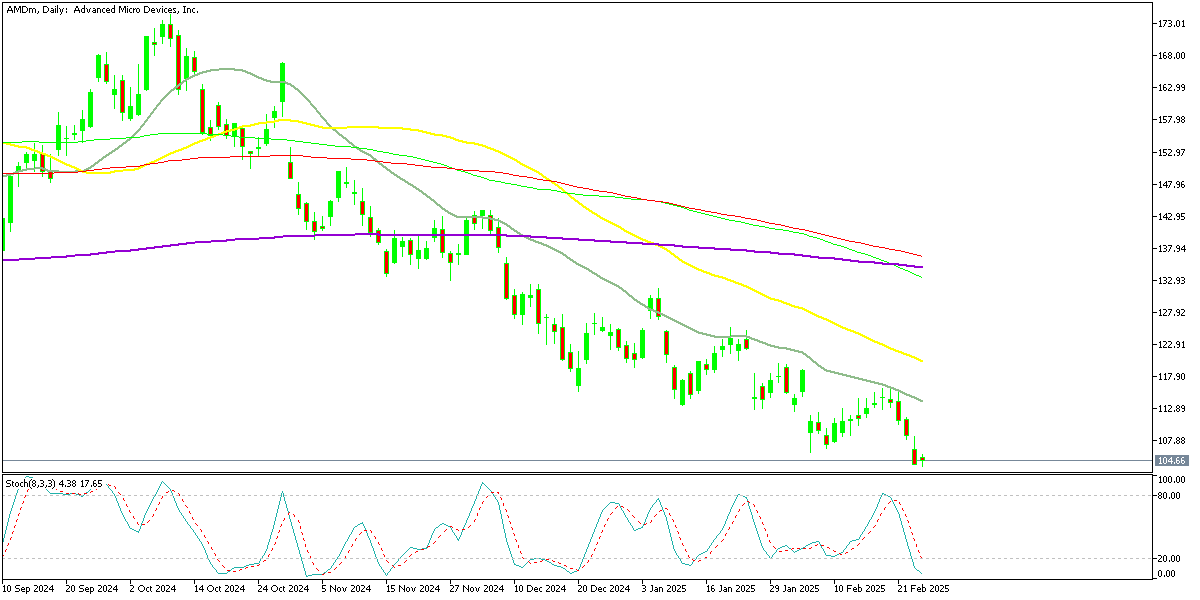

Today the decline in the AMD stock price stalled, which shows that there is buying interest ads we approach the $100 level, while Nasdaq...

Live NAS100 Chart

Today the decline in the AMD stock price stalled, which shows that there is buying interest ads we approach the $100 level, while Nasdaq also made a small gain.

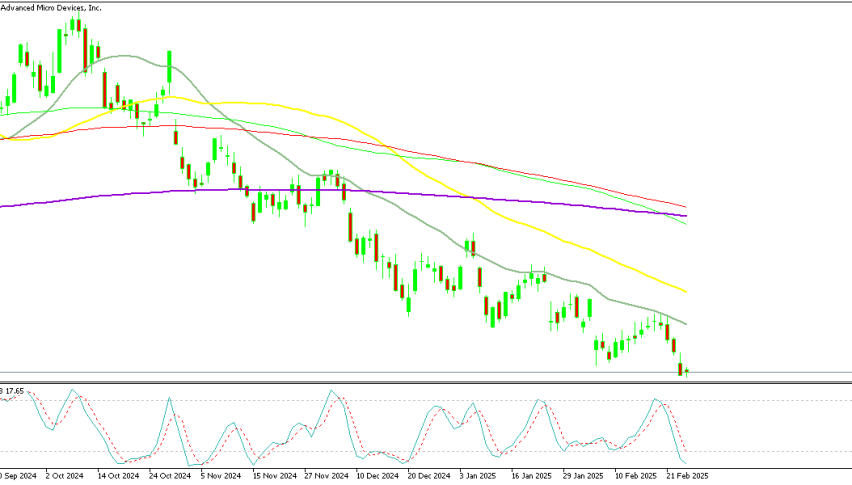

Since reaching a peak of $227 in March 2023, Advanced Micro Devices (AMD) has been on a nearly two-year decline. The stock remains under selling pressure, with the 20-day simple moving average (SMA) acting as a strong resistance level, limiting any short-term rebounds.

AMD Chart Weekly – Sellers Face the 200 SMA

Despite occasional recovery attempts, AMD has struggled to regain upward momentum. On the weekly chart, sellers are now testing the crucial 200 SMA, which hovers just above the $100 mark, a level that could act as a key support zone.

Can AMD Take Advantage of the AI’s Potential?

While AMD’s stock has been influenced by fluctuations in PC and gaming demand, the rapid growth of artificial intelligence presents a new opportunity. AI applications require immense processing power, an area where AMD’s GPUs and CPUs could prove invaluable. If the company successfully capitalizes on this AI-driven demand, it could reshape its position in the tech industry and potentially drive a turnaround in its stock performance. Investors and analysts remain focused on how AMD will leverage this trend to regain momentum.

U.S. Stock Market Closes Mixed – Key Takeaways

The U.S. stock market ended the day with a mixed performance, reflecting investor uncertainty. While the DOW Jones declined under pressure from industrial and financial stocks, the NASDAQ gained due to strength in the tech sector. The S&P500 remained stagnant, struggling for direction amid shifting market sentiment. Looking ahead, traders will closely monitor economic data, Federal Reserve signals, and corporate earnings for further market cues.

-

Dow Jones Industrial Average (DJIA)

- Declined 186 points (-0.43%), closing at 43,434.

- Pulled down by weakness in industrials and financials.

- Investors remain cautious due to ongoing economic uncertainties and mixed corporate earnings.

-

S&P 500

- Ended nearly flat, gaining 0.90 points (+0.02%) to close at 5,956.

- Struggled for direction amid sector rotation and volatility.

- Mixed performance across technology and consumer sectors.

-

NASDAQ Composite

- Led gains, rising 48.88 points (+0.25%) to 19,075.

- Tech stocks provided support, with select AI and semiconductor firms pushing higher.

- Continued momentum in the AI and cloud computing industries contributed to modest strength.

Nasdaq Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account