EUR/USD Back to 1.05 as EZ Inflation Implies ECB Hawkish Cut Case

EUR/USD failed at 1.05 as the US went ahead with trade tariffs, but after the Eurozone CPI, markets expect a hawkish 25 bps ECB cut,

Live EUR/USD Chart

EUR/USD failed at 1.05 as the US went ahead with trade tariffs, but after the Eurozone CPI, markets expect a hawkish 25 bps ECB cut, which has sent this pair to toward 1.05 again.

Stronger USD and Trade Tariffs Keep Pressure on EUR/USD

The EUR/USD pair is under increasing downward pressure this week as traders anticipate the implementation of new U.S. trade tariffs, set to take effect tomorrow. These tariffs are expected to bolster USD strength, weighing further on the euro. Meanwhile, the European Central Bank (ECB) is widely expected to deliver another 25 basis point rate cut, lowering interest rates from 2.90% to 2.65%, marking its sixth cut in total since last year.

Since October 2023, the euro has been struggling against the dollar, primarily due to persistent USD strength. In January 2025, EUR/USD dropped below 1.02 before staging a brief recovery above 1.05. However, as expected, a bearish reversal occurred last week when buyers failed to sustain the pair above that key level.

Inflation Data and ECB Policy Outlook

Today’s release of the Eurozone CPI inflation report is a critical factor in shaping the ECB’s future policy stance. Given the ongoing decline in inflation, the central bank is likely to maintain its dovish trajectory, increasing the probability of further easing beyond this week’s cut. With lower inflation reinforcing expectations of a prolonged rate-cutting cycle, the euro is likely to remain under pressure.

Ahead of today’s CPI release, we initiated a EUR/USD sell position below the 100-day SMA (green), which had been acting as resistance. The trade played out as expected, and we booked profits when the price dropped below 1.04 last week.

Will EUR/USD Reach Parity?

With the combination of a strong U.S. dollar, rising trade tensions, and a dovish ECB, the bearish momentum in EUR/USD could intensify. If the pair continues its current downward trajectory, a test of the 1.00 parity level may not be far off. The key question now is whether the ECB’s policy will be dovish on Thursday and add to the impact of a resilient U.S. economy and tightening trade policies.

Eurozone Economic Data – March 3, 2025

Eurozone February Preliminary CPI (Released by Eurostat)

- Headline CPI (YoY): +2.4% (slightly above +2.3% expected, but lower than +2.5% prior)

- Core CPI (YoY): +2.6% (in line with expectations, down from +2.7% prior)

- Implications: Inflation remains on a gradual downward trend, reinforcing expectations of ECB rate cuts. However, the slight upside surprise in headline inflation may slow the pace of monetary easing.

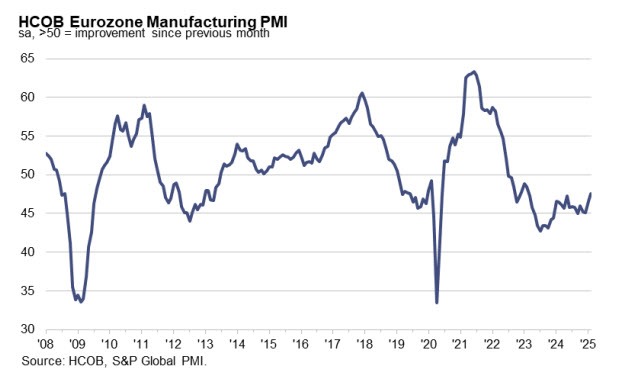

Eurozone February Final Manufacturing PMI (Released by HCOB)![EZPMI]()

- Final PMI: 47.6 (better than preliminary estimate of 47.3 and up from 46.6 in January)

- Implications: Despite the improvement, the PMI remains below 50, indicating continued contraction in the manufacturing sector. The slight rebound suggests some stabilization, but demand and production remain weak.

The Eurozone economy presents a mixed outlook, with inflation gradually declining, which supports the case for ECB rate cuts, while manufacturing remains in contraction, indicating sluggish growth. Although the headline CPI came in slightly higher than expected, both core inflation and the overall reading are marginally lower than in January.

This trend reinforces expectations for an ECB rate cut this week, but policymakers may hesitate if inflation remains stubbornly within the 2% to 3% range and fails to ease more significantly. Despite the euro’s slight gains today, the broader picture suggests continued downward pressure on the currency, particularly against a strong U.S. dollar, as trade tensions escalate. The ECB’s next steps will likely depend on whether inflation keeps falling or if persistent economic stagnation pushes policymakers toward a more aggressive easing cycle.

While EUR/USD has seen some support from a softer USD today, the pair remains vulnerable. If the ECB prioritizes economic growth over inflation concerns, the likelihood of further rate cuts increases, which could drive the euro lower in the coming months.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account