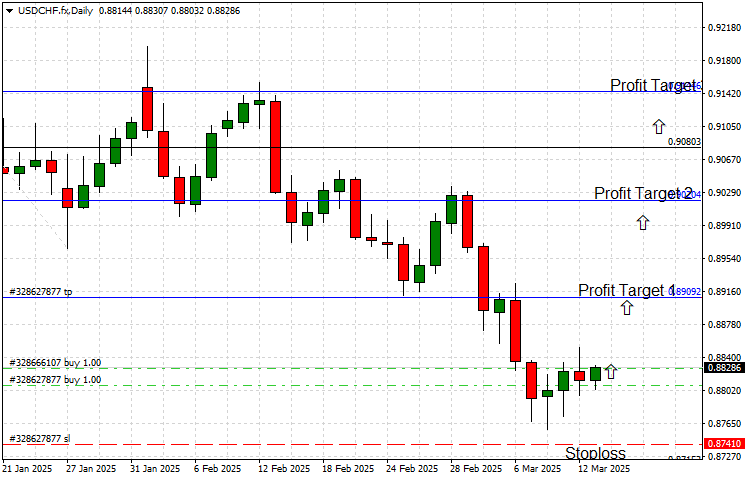

USD/CHF Poised for Upside Correction and Potential Reversal

After an extended downside move, USD/CHF is showing signs of an upside correction, with the potential for a full bullish reversal.

With key resistance levels in sight, traders should watch for a move toward the first profit target at 0.8910, followed by 0.9020 and 0.9144.

The USD/CHF pair has seen a significant overextension to the downside, suggesting a likely retracement or even a full-scale bullish reversal. After reaching a recent low near 0.8760, the pair is showing early signs of stabilization, with price action forming a potential base for a rebound. Given the prolonged selling pressure, a relief rally toward key resistance levels appears highly probable.

As of today [13.03.25], USD/CHF is trading at 0.8840, signaling the beginning stages of a corrective move. Our first upside target is set at 0.8910, followed by additional resistance levels ahead at 0.9020 and 0.9144, which align with prior structural highs.

The recent weakness in USD/CHF has been driven by broad dollar softness and market sentiment shifts. However, with oversold conditions now evident, a rebound is increasingly likely. The U.S. Federal Reserve’s stance, along with shifts in global risk appetite, could further catalyze a recovery in USD strength. Meanwhile, the Swiss franc’s role as a safe-haven asset may soften should risk sentiment improve.

Key Bullish Catalysts

- Oversold Market Conditions: The pair has been heavily sold, making an upside retracement highly probable.

- Support at 0.8910 breached: Price had overextended beyond and expected to retrace back and find stability above this level, confirming buying interest.

- Key Resistance Levels Ahead: A move past 0.8910 would reinforce bullish sentiment and open the door for further upside.

Key Price Levels

- Major Support (Temp’ Breached): 0.8910

- First Upside Target: 0.8910

- Second Upside Target: 0.9020

- Third Upside Target: 0.9144

Given the confluence of technical factors, USD/CHF is well-positioned for a bullish correction, with a potential move beyond 0.8910 in the following coming days. Should momentum sustain, traders could see extended gains toward 0.9020 and 0.9144. However, a failure to close in on 0.8910 would invalidate the bullish scenario and shift focus back to the downside.

Traders should monitor price action closely, looking for confirmation of bullish strength as the pair approaches key resistance zones.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account