BAT Share Price Jumps 12% as Virgin Active Hits £119M EBITDA, Outlook Strong

BAT (JSE: BAT) has risen 12% in recent days on a series of positive updates across the portfolio. At the heart of the move is Virgin Active.

Quick overview

- BAT has seen a 12% increase recently, driven by positive updates from its portfolio, particularly Virgin Active.

- Virgin Active reported a 13% year-on-year revenue growth and an EBITDA of £119 million for March 2025, with strong performance in the UK and Italy.

- Premier Group is expected to achieve mid single-digit revenue growth and 20-30% headline EPS growth despite macroeconomic challenges.

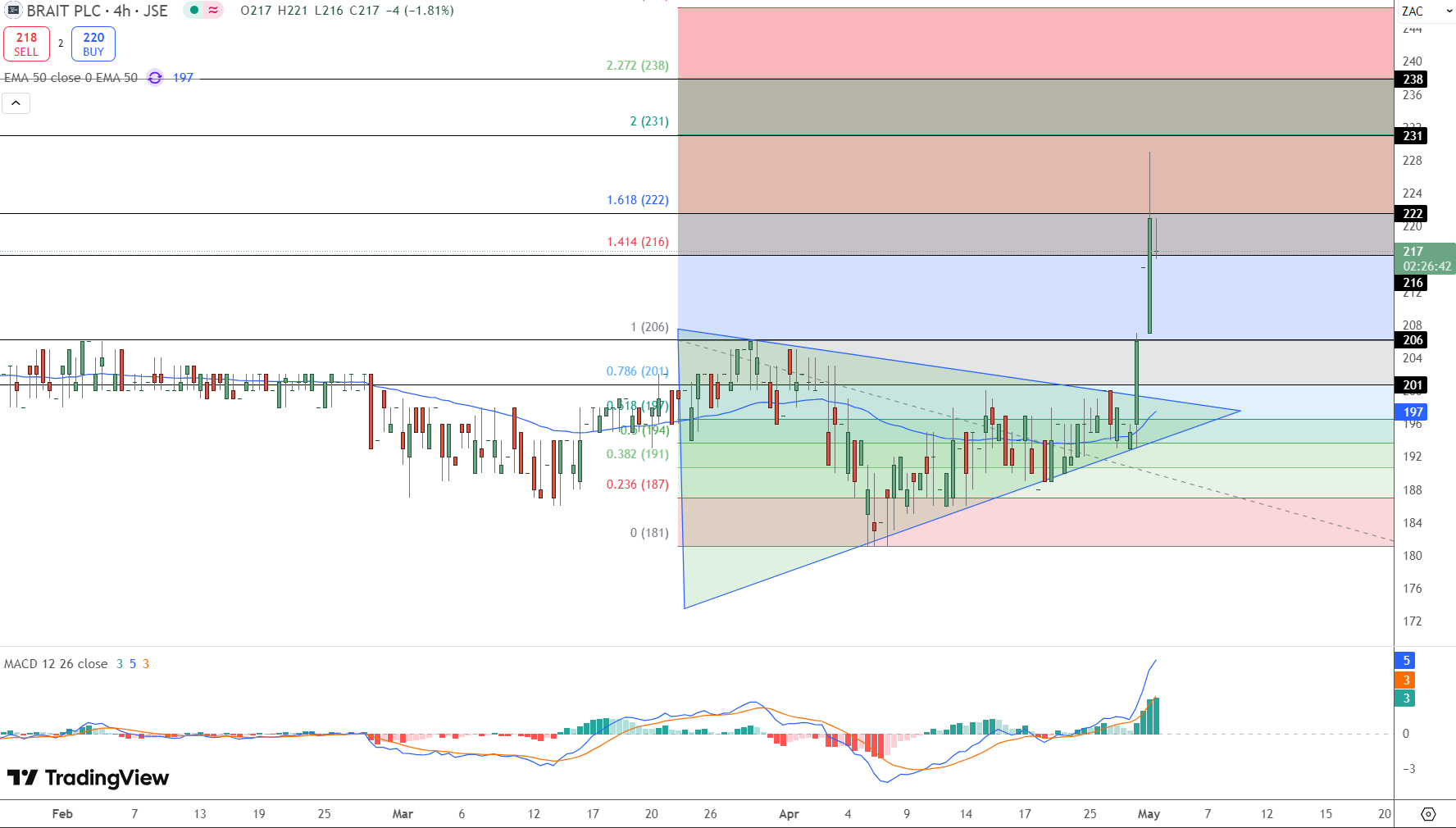

- BAT's stock has broken out of a symmetrical triangle pattern, indicating bullish momentum with potential price targets between ZAC 231 and ZAC 238.

BAT (JSE: BAT) has risen 12% in recent days on a series of positive updates across the portfolio. At the heart of the move is Virgin Active which reported 13% year on year revenue growth and £119m EBITDA for March 2025. UK and Italy outperformed, more than offsetting softer South Africa and Australia.

Management is focused on cost discipline and targeted reinvestment to sustain operating leverage. Virgin Active’s performance reflects steady demand recovery and the company’s ability to capture value in its key markets.

How Virgin Active Is Linked to JSE: BAT (Brait PLC)?

Virgin Active is one of the core portfolio companies owned by Brait PLC (share code: BAT on the JSE).

Brait is an investment holding company listed on the Johannesburg Stock Exchange (JSE) and Luxembourg Stock Exchange, and its share price performance is heavily influenced by how its portfolio companies are performing.

Brait’s Current Key Portfolio Includes:

-

Virgin Active (fitness club group, UK/Italy/South Africa/Australia)

-

Premier Group (consumer goods and food processing)

-

New Look (fashion retail, UK)

Key Points:

-

Virgin Active EBITDA run rate: £119M

-

Revenue up 13% year on year

-

UK and Italy outperform, South Africa and Australia softer

Premier Delivers Despite Macro Headwinds

Premier, another anchor in the portfolio, is expected to deliver mid single digit revenue growth and 20-30% headline EPS growth. Despite inflation, rising interest rates and commodity volatility, the company credits its resilience to better margin management and streamlined logistics.

Full year results due around June 10 could add to the upside if earnings come in at the top end of guidance. Investors are getting ahead of the curve and buying into the stock above key levels.

What’s Supporting the Outlook:

-

EPS growth guidance: 20-30%

-

Revenue growth despite consumer pressure

-

Operational efficiency is the key driver

Technical Breakout Signals Bullish Momentum

On the chart, BAT has broken out of a multi week symmetrical triangle and closed at ZAC 217 after taking out resistance at ZAC 206. Volume confirmed the breakout and MACD is turning up. Price has moved above the 50 EMA (ZAC 197) and the short term trend is now higher.

Fibonacci extensions point to targets between ZAC 231 and ZAC 238 if momentum holds. Watch for a pullback to the ZAC 206-201 zone for a low risk entry.

Trade Setup:

-

Entry Zone: Retest near ZAC 206

-

Targets: ZAC 231-238

-

Stop: Below ZAC 197And that’s all good.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account