USD/CAD Forecast: Will 1.3830 Hold or Break Amid Oil Rebound and Key Data?

Friday’s European session saw USD/CAD pull back from recent highs, trading near 1.3815 as the U.S. Dollar gave back some of the gains..

Quick overview

- USD/CAD pulled back to 1.3815 as the U.S. Dollar softened after recent gains.

- U.S. Q1 GDP showed a preliminary decline of -0.2%, indicating economic uncertainty.

- The Canadian Dollar gained support from rising oil prices and a narrowing current account deficit.

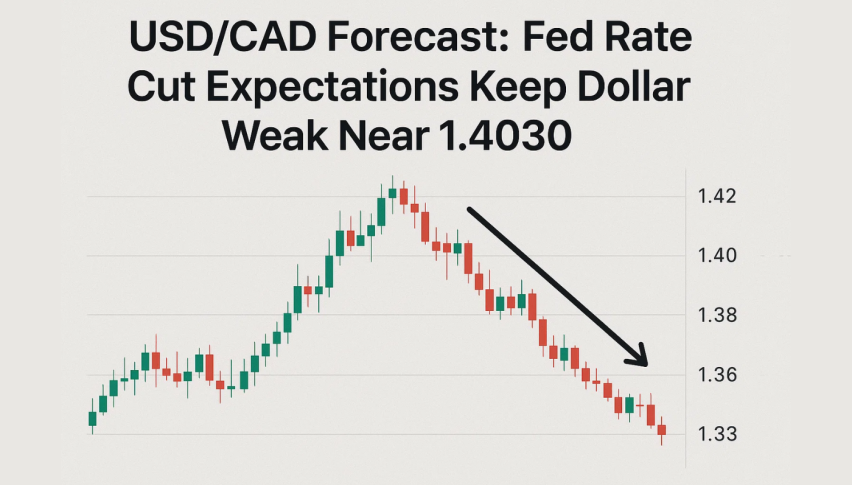

- USD/CAD is currently trapped in a descending triangle, with key resistance at 1.3830 and support at 1.3811.

Friday’s European session saw USD/CAD pull back from recent highs, trading near 1.3815 as the U.S. Dollar gave back some of the gains from the court ruling that reversed tariffs. After spiking above 100.00 on the Dollar Index (DXY) the greenback has softened as traders look ahead to data.

U.S. preliminary Q1 GDP came in at -0.2% as expected, missing and showing economic uncertainty. Jobless claims rose to 240,000, labor market is cooling. Pending home sales fell 6.3%, sentiment is further dampened. But Fed speakers, Barkin and Goolsbee, were cautious, data dependent.

Oil Prices and Canadian GDP Help CAD

The Canadian Dollar got support from oil prices, WTI crude rebounded from $60 to $63 as OPEC+ said supply is stable. Canada’s Q1 current account deficit narrowed to -2.1B from -3.6B. Expectations of 0.1% GDP growth on Friday also helped.

But Bank of Canada rate cut speculation is still alive, labor market softness keeps the door open. If GDP surprises to the upside CAD may strengthen.

Technical: Coiling Under Resistance

USD/CAD is trapped in a descending triangle, below 1.3830–1.3850.

-

Resistance: 1.3830, 1.3868, 1.3930

-

Support: 1.3811 (50-EMA), 1.3785, 1.3740, 1.3687

MACD is flat, momentum is waning, candlesticks are making lower highs, selling is persistent. Long wicks at 1.3811 show buyer defense but price is still indecisive.

Scenarios:

-

Bullish: Break above 1.3850 with volume could trigger 1.3930.

-

Bearish: Break below 1.3785 with follow through could be 1.3740–1.3687.

-

Neutral: Wait for a breakout to confirm direction.

Watch U.S. Core PCE and Canada GDP.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account