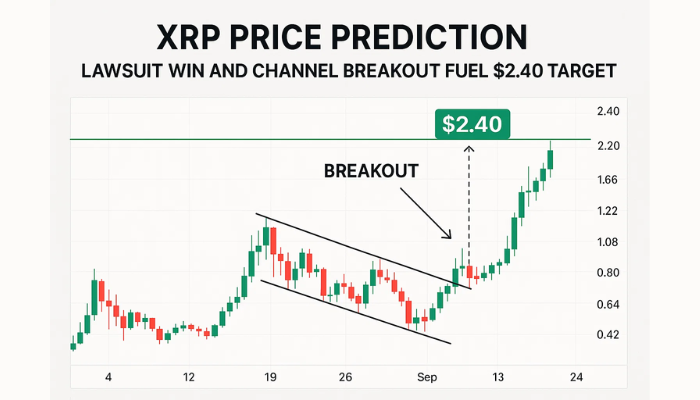

XRP Price Prediction: Lawsuit Win and Channel Breakout Fuel $2.40 Target

XRP is holding steady near $2.33 on Wednesday, with price up nearly 3% in the past 24 hours. The legal clarity around Ripple’s...

Quick overview

- XRP is currently priced at $2.33, showing a nearly 3% increase in the last 24 hours due to positive sentiment from Ripple's SEC victory.

- The broader crypto market is recovering, but XRP stands out with its legal clarity and potential for further growth towards $2.40.

- Technical indicators suggest XRP is in a bullish trend, with key resistance at $2.3531 and potential breakout strategies being considered.

- Traders have two options: a bullish breakout trade above $2.3531 or a dip entry near $2.30 if the price rejects the resistance.

XRP is holding steady near $2.33 on Wednesday, with price up nearly 3% in the past 24 hours. The legal clarity around Ripple’s long-standing SEC battle and renewed interest in U.S. crypto legislation are driving sentiment higher. On the charts, XRP is showing early signs of a potential breakout that could carry it toward $2.40 if current levels give way.

The broader crypto market remains in recovery mode following a series of macro headwinds earlier this year. XRP, however, is standing out thanks to Ripple’s decisive win against the SEC. After four years of legal uncertainty, the court ruled that XRP is not a security, giving the asset room to grow without the threat of regulatory overhang.

CEO Brad Garlinghouse is now at the center of crypto policy discussions, including his role in shaping the Senate’s CLARITY Act, a bill aimed at defining digital asset regulations. With Ripple applying for a U.S. banking license, the company is firmly stepping into the next phase, one marked by institutional integration and regulatory legitimacy.

Technical Outlook: XRP Builds Momentum Inside Rising Channel

XRP/USD is currently respecting a well-formed ascending channel on the 1-hour chart. After reclaiming both the 50 EMA ($2.29) and 200 EMA ($2.25) with a clean crossover, XRP’s structure has shifted from neutral to bullish.

Price is printing higher highs and higher lows, and recent candles are hugging the midline of the channel.

The next key resistance is at $2.3531. If bulls manage a confirmed close above that level, XRP could quickly test $2.38 and potentially push toward the psychological $2.40 level.

No major reversal candles have emerged yet, though RSI is nearing overbought territory, so a minor consolidation may come first.

Trade Setup: Breakout or Pullback Re-Entry (250 Words)

Here’s how I’m viewing the XRP setup as of today:

We’re looking at a classic channel breakout trade. The price is coiling just below resistance, supported by a strong structure, bullish EMAs, and volume slowly increasing. This gives us two potential strategies—either trade the breakout or buy the dip.

Option 1: Bullish Breakout Trade

- Entry: Break and 1-hour close above $2.3531

- Stop-loss: Below $2.30 (channel support + 50 EMA)

- Target 1: $2.38

- Target 2: $2.40+ if momentum holds

The 50 EMA continues to act as dynamic support, and RSI is climbing near 68, suggesting the trend still has gas left, even if a short pullback occurs.

Option 2: Dip Entry Play

If XRP rejects $2.35 with a clear bearish signal—like a shooting star, bearish engulfing, or long upper wick—then short-term traders could look to enter long on a retest of $2.30.

- Entry: Buy near $2.30 if support holds

- Stop-loss: Below $2.27

- Target 1: $2.35

- Target 2: $2.38

In my experience, these clean EMA-supported channels don’t need to be overtraded. Just wait for price to confirm, follow the trend, and manage risk.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account