Bitcoin Price Surges to $118K as ETFs Pull $2.72B in Just 5 Days

Bitcoin is making waves again—this time backed by an ETF-driven buying frenzy. U.S.-listed spot Bitcoin ETFs brought...

Quick overview

- Bitcoin has seen record inflows of $2.72 billion from U.S.-listed spot ETFs in the past week, marking the largest since their January 2024 launch.

- The surge in demand is driven by institutional investors, with eleven U.S.-based ETFs contributing to the inflows and a staggering 22:1 demand-to-supply ratio.

- BlackRock's IBIT ETF has crossed $80 billion in assets under management, becoming more profitable than their S&P 500 ETF.

- Bitcoin's price momentum suggests potential resistance levels at $122,880 and $126,224, with strong technical indicators supporting further gains.

Bitcoin is making waves again—this time backed by an ETF-driven buying frenzy. U.S.-listed spot Bitcoin ETFs brought in a record $2.72 billion in inflows last week alone, the biggest on record since their January 2024 launch. Even more impressive: back-to-back billion-dollar days. According to Farside Investors, inflows hit $1.17 billion on Thursday and $1.03 billion Friday—marking the second and third largest single-day entries ever.

For context, the only bigger day was November 7, 2024, when Bitcoin jumped following Donald Trump’s re-election, pulling in $1.37 billion. These inflows are supporting Bitcoin (BTC/USD) break through $112K midweek before touching a new all-time high of $118,780.

Behind the surge is an accelerating institutional shift. Eleven U.S.-based ETFs contributed to last week’s haul, signaling unprecedented demand for Bitcoin exposure among professional investors.

Key inflow facts:

- $2.72 billion total inflows last week

- Two billion-dollar inflow days: July 10 & 11

- 11 U.S. ETFs contributed to the surge

ETF Demand Is Crushing Bitcoin Supply

The numbers are staggering. On July 11, ETF products acquired over 10,000 BTC, while only 450 new BTC were mined that day. That’s a 22:1 demand-to-supply ratio.

Samson Mow, CEO of Jan3, didn’t mince words: “This demand is not sustainable at these price levels.” But for now, the imbalance is feeding a bullish feedback loop, pushing prices higher as supply struggles to keep up.

Much of the current inflow is being funneled into BlackRock’s IBIT. It just crossed $80 billion in AUM, setting the record for the fastest ETF to hit that milestone—doing it in just 374 days. It’s now more profitable for BlackRock than their S&P 500 ETF.

ETF market highlights:

- Bitcoin ETF AUM exceeds $140 billion

- IBIT now out-earns iShares S&P 500 Core ETF

- ETFs now drive major crypto sentiment shifts

Bitcoin Technicals: Momentum Points to $122K+

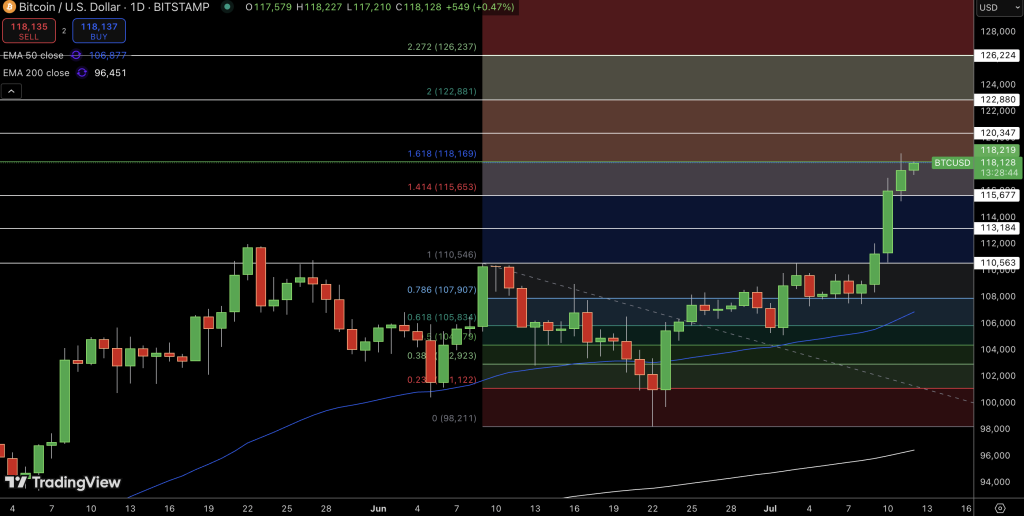

Bitcoin is holding firm near $118,100, riding a parabolic uptrend confirmed by a breakout above the 1.618 Fibonacci level at $118,169. The move above $110,546 signals strength, with the next resistance at the 2.0 Fib near $122,880. Above that, $126,224 becomes a critical extension target.

The technicals show six consecutive green daily candles with no signs of immediate exhaustion. RSI is elevated, suggesting momentum remains hot—though a brief consolidation could form before the next leg up. If BTC holds above $115,653, the rally may extend further.

- 50-day EMA rising fast at $106,877

- 200-day EMA confirms long-term trend at $96,451

- Immediate resistance: $122,880, then $126,224

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account