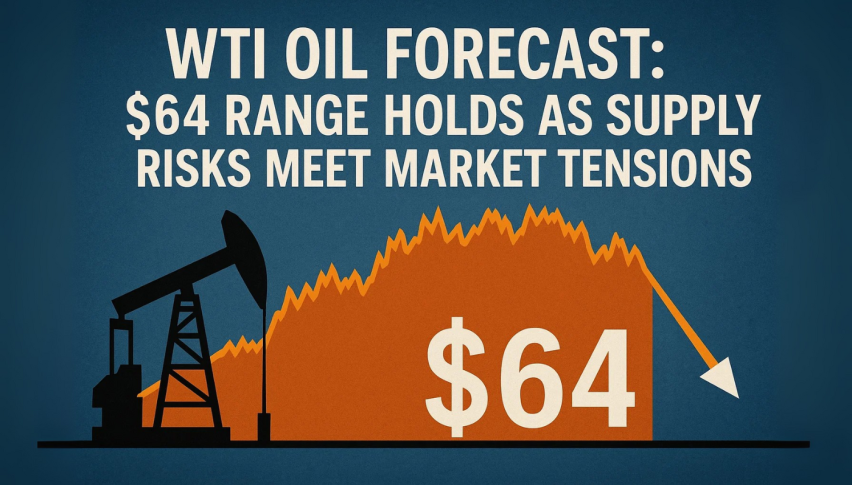

Oil Price Slips to $66.36 as Trump’s 50-Day Warning Shifts Market Momentum

WTI crude oil prices dropped on Friday, closing at $66.36 after breaking below a key ascending channel. The sudden move came as markets...

Quick overview

- WTI crude oil prices fell to $66.36 after breaking below a key ascending channel amid geopolitical tensions and tariff concerns.

- President Trump's 50-day deadline for Russia to end the war in Ukraine has eased immediate supply fears, leading to profit-taking in the market.

- Technical indicators show a bearish outlook for WTI, with $65.54 as the next major support level and selling pressure potentially intensifying.

- Macro factors, including slowing growth in China and escalating trade tensions, are contributing to uncertainty in oil demand.

WTI crude oil prices dropped on Friday, closing at $66.36 after breaking below a key ascending channel. The sudden move came as markets digested US President Donald Trump’s 50-day deadline for Russia to end the war in Ukraine or face new sanctions. While the initial threat had lifted oil on supply fears, the delayed enforcement timeline gave traders some breathing room—triggering profit taking across the board.

“The 50-day window eased immediate supply concerns,” said Priyanka Sachdeva, senior analyst at Phillip Nova. Meanwhile Trump’s 30% tariffs on imports from EU and Mexico starting August 1 has added new worries on global demand. Analysts warn that tariffs will slow growth and weigh on fuel consumption especially if China, India and Turkey—the top buyers of Russian crude—scale back trade under US pressure.

Geopolitics aside, traders are now in wait and see mode. ING said if Trump follows through with sanctions “it would change the entire outlook for the oil market”. Until then, markets will wait.

WTI Technical Breakdown: $65.54 Support in Focus

From a technical standpoint WTI is bearish. After failing to hold $66.95—previously a mid-range level—prices broke below the 50-period Simple Moving Average (SMA) now at $67.42. This breakdown opens the door to more losses, $65.54 is the next major support.

If selling intensifies the next target is $64.43, then $63.43. To change sentiment bulls need to get prices back above the 50-SMA and reclaim $66.95. That could lead to a retest of the upper resistance range $68.18-$69.39.

Adding to the bearish view the Relative Strength Index (RSI) is at 39.80—well below the 50 mark. Sellers are in control of the short term trend and there is no sign of bullish divergence.

Macro Headwinds as China Slows

The bearish technicals come at a time of macro weakness. China’s Q2 growth slowed, exports are weakening and consumer sentiment is softening. “Chinese data is directly impacting commodity sentiment” said Tony Sycamore at IG who also pointed out that front loading of exports to beat tariffs is a temporary buffer.

OPEC is still cautiously optimistic. Its Secretary General said demand is “very strong” for Q3 but traders are skeptical as trade tensions escalate.

In short oil markets are in a tug of war between supply risk and demand uncertainty. With geopolitics, tariff headlines and weakening technicals WTI may struggle to find direction until either buyers step in or global data surprises.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account