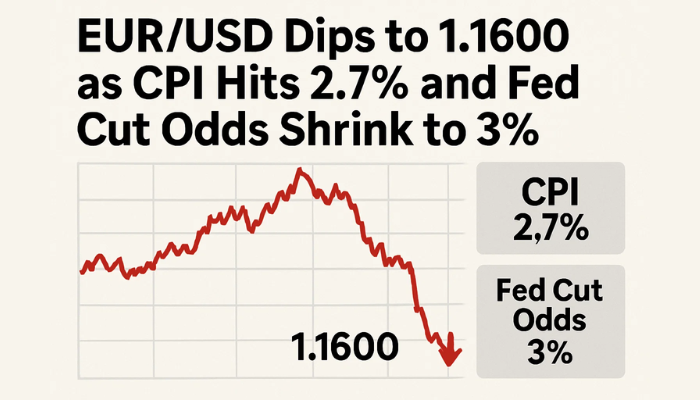

EUR/USD Dips to 1.1600 as CPI Hits 2.7% and Fed Cut Odds Shrink to 3%

The euro tried to bounce during Wednesday’s European session but failed to break above 1.1630. Traders were reluctant...

Quick overview

- The euro attempted to recover but failed to surpass 1.1630 due to strong US inflation data dampening rate cut expectations from the Fed.

- Currently, EUR/USD is trading around 1.1600, with the dollar gaining strength amid geopolitical tensions and rising Treasury yields.

- Technical indicators show a bearish channel for EUR/USD, with key resistance at 1.1658 and supports at 1.1581 and 1.1535.

- The upcoming US PPI report is anticipated to further impact the euro's performance, with a lack of support expected unless inflation trends change.

The euro tried to bounce during Wednesday’s European session but failed to break above 1.1630. Traders were reluctant to go long after hotter than expected US inflation data killed hopes of a near term rate cut from the Fed.

At the moment EUR/USD is trading near 1.1600 with sellers in control as the dollar is strengthening across the board. This is a broader repricing of interest rate expectations after the US June CPI report showed headline inflation up 0.3% m/m and 2.7% y/y.

Core CPI was 2.9% which was just shy of the 3.0% forecast but still sticky enough to keep the Fed cautious. As a result Treasury yields are up and the odds of a July rate cut have plunged from over 6% to 3% according to CME’s FedWatch tool. Even the September cut expectations have slipped with the market now pricing in just 43 basis points of easing for 2025 down from over 50 earlier this week.

Trade Risks and Eurozone Data Offer Little Relief

Beyond inflation, geopolitical and trade tensions are adding to the dollar’s strength. While Trump announced a trade deal with Indonesia, his comments about slapping “slightly above 10%” tariffs on smaller nations have kept traders on edge.

This uncertainty has revived safe haven demand for the dollar and is putting more pressure on the euro. Meanwhile eurozone data has done little to change the narrative:

- Italy’s CPI rose 1.8% y/y in June

- Eurozone trade surplus was €16.2 billion in May

Despite these numbers inflation is still below the ECB target so policymakers will wait and see. The ECB won’t move until they see a clear trend in inflation.

Bearish Channel Signals More Downside for EUR/USD

From a technical perspective the EUR/USD is in a bearish channel with lower highs and lower lows.

- Current price: 1.1600

- Immediate resistance: 1.1658 (previous support now resistance)

- Key supports: 1.1581, 1.1535, 1.1497

- SMA 50: 1.1699

- RSI (14): 32.90 — oversold but still bearish

Momentum is down unless the pair can break above 1.1658 with volume and RSI confirmation. Until then watch for a break below 1.1581 which would open 1.1535 and 1.1497.

Technical Takeaways:

- Price is below the 50-period SMA

- RSI is bearish without divergence

- A clean break above 1.1658 would be short term bullish

Final Word: PPI Will Be the Next Driver

As markets wait for the US PPI report any rise in producer prices will further weaken the euro and boost the dollar. Until then EUR/USD will be under pressure with technicals and fundamentals against a sustained bounce.

Unless the Fed changes its tone or inflation cools the euro may struggle to find support in the coming weeks.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account