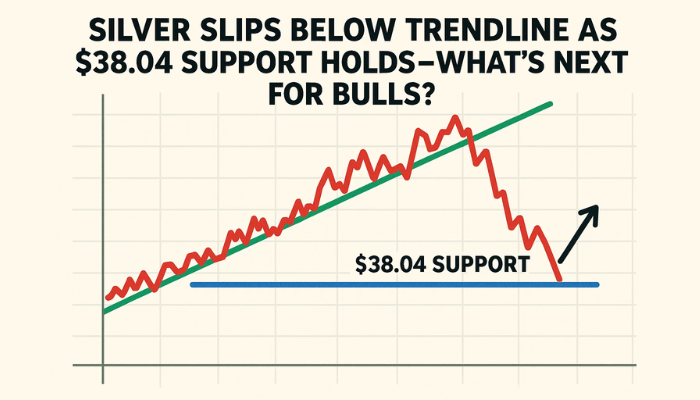

Silver Slips Below Trendline as $38.04 Support Holds—What’s Next for Bulls?

Silver (XAG/USD) is under the spotlight this week after breaking its ascending trendline on the 4-hour chart.

Quick overview

- Silver (XAG/USD) has broken its ascending trendline and is currently near a key support zone at $38.04, raising concerns among bulls about a potential bearish continuation.

- The failure to reclaim the 50-period Simple Moving Average at $38.62 indicates a weakening bullish structure amid rising real yields and a hawkish Fed stance.

- Investor sentiment is shifting towards USD-denominated assets due to stronger economic data, which has pressured silver and other precious metals.

- To regain bullish momentum, silver must reclaim the 50-SMA, break above $38.74, and hold above trendline support; otherwise, it may decline to $37.56 and $37.13.

Silver (XAG/USD) is under the spotlight this week after breaking its ascending trendline on the 4-hour chart. Prices are now hovering near a key support zone around $38.04 and bulls are getting nervous about a bearish continuation. This area coincides with the lower boundary of a recent demand zone that has repeatedly absorbed the downside.

Also, silver has failed to get back above the 50-period Simple Moving Average (SMA) which is currently at $38.62. This technical rejection shows a weakening bullish structure especially as real yields rise and demand for safe-haven assets wanes as the Fed becomes more hawkish.

Gold, often used as a sentiment proxy for silver, has also dropped below its 200-SMA and lost key trendline support – adding to the weakness across the precious metals space.

Fed Policy and Rising Yields Shift Sentiment

Investor focus is now on the Federal Reserve’s upcoming policy guidance. While the Fed has paused rate hikes recently, markets are waiting for any signal of higher for longer policy due to strong economic data. This has pushed real yields higher and put pressure on non-yielding assets like silver.

Recent economic reports – stronger than expected US jobless claims and consumer confidence – have boosted the dollar and weighed on metals. Unless silver gains technical momentum, traders may continue to favor USD-denominated assets over commodities.

Key points:

- RSI is below 40, no bullish divergence

- $38.04 is the level to beat, $37.56 and $37.13 are next supports

- A move above $38.74 would confirm the reversal

Silver Technical Setup: Watch These Levels

The current consolidation above $38.04 may be temporary unless buyers step in big. RSI at 39.21 is oversold but without divergence or volume backed break out, the case for a bounce is weak.

To regain control, bulls must:

- Reclaim the 50-SMA at $38.62

- Break and close above $38.74

- Hold above trendline support to regain confidence

If not, silver may slide to $37.56 and $37.13. Price action around the Fed announcement will set the tone for the rest of the week.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account