Kumba Iron Ore Shares (JSE: KIO) Resume Downtrend on Flat Profit and Dividend Payout

Kumba Iron Ore’s recent earnings and dividend payout failed to halt its prolonged share price decline, weighed down by global trade tensions

Quick overview

- Kumba Iron Ore's recent interim dividend of R5.3 billion was overshadowed by a continued decline in share price due to global trade tensions and falling iron ore prices.

- Despite reporting strong half-year EBITDA of R16 billion and achieving cost savings of R661 million, the stock struggled to break above the 50-day moving average.

- Insider selling by Kumba executives has raised concerns among investors, prompting scrutiny of the company's outlook.

- While the company remains operationally strong, external pressures are likely to keep the stock under pressure in the near term.

Kumba Iron Ore’s recent earnings and dividend payout failed to halt its prolonged share price decline, weighed down by global trade tensions and iron ore price pressures.

Dividend and Share Price Reaction

Despite announcing a substantial interim dividend of R5.3 billion—derived from robust half-year free cash flow of R7.9 billion—Kumba Iron Ore’s share price has remained under pressure. The stock rose briefly on Tuesday after the results, but the bounce was short-lived as selling resumed, extending a downtrend that’s persisted since 2022.

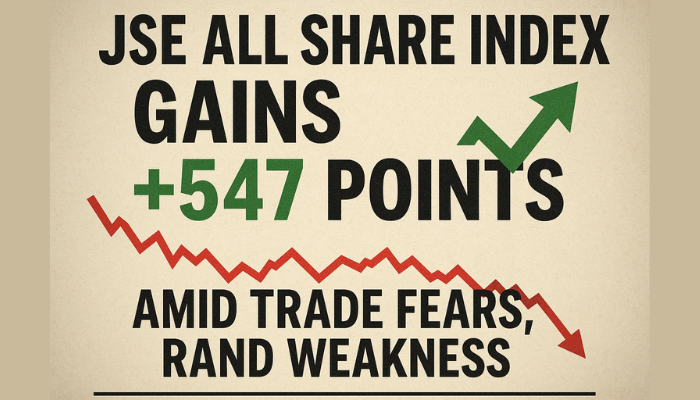

Earlier in the week, the share price dropped more than 4%, deepening losses that began Friday. In just two days, Kumba had shed over 10% of its market value. The decline reflects mounting concerns over falling iron ore prices and continued uncertainty in global trade flows.

Technical and Market Headwinds – The 50 SMA Acting As Resistance

Kumba’s stock has struggled to break above the 50-day simple moving average, which has acted as resistance since late last year. Despite strong financial results, including improvements in cost efficiencies and premium pricing strategies, the company’s valuation continues to suffer under the weight of broader market volatility and economic softness in key export markets.

The firm’s ability to secure a premium of $7 per wet metric ton above the benchmark price—and maintain cost discipline with savings of R661 million—underscores its operational strength. Yet macroeconomic forces have so far overwhelmed those positives in investors’ eyes.

Kumba Iron Ore Declares Lower Dividend as Iron Ore Prices Dip and Currency Gains Bite

Dividend and Cash Flow Update

- Kumba Iron Ore declared an interim dividend of R16.60 per share for the first half of 2025.

- This reflects a total shareholder payout of R5.3 billion, funded from attributable free cash flow of R7.9 billion.

- The dividend is lower than last year’s R18.77 per share, reflecting tighter margins and softer revenue performance.

Earnings and EBITDA

- The company reported half-year EBITDA of R16 billion, underscoring resilient operational performance despite market headwinds.

Price Pressures and Market Conditions

- Revenue decline was driven by a 6% drop in average realised FOB iron ore export prices to $91/wet metric ton, alongside a stronger South African rand.

- Despite these pressures, Kumba earned a $7/ton premium over benchmark pricing, significantly higher than the $1/ton premium achieved in H1 2024.

- This boosted the realised price to $91, or 8% above the market benchmark of $84/ton.

Cost Management and Efficiency

- The company is on track to meet its C1 unit cost target of $39/wet metric ton, achieving R661 million in cost savings over the first half.

Unit cost guidance remains:

- Sishen: R510–540 per dry metric ton

- Kolomela: R430–460 per dry metric ton

Strategic Context

- The earnings release follows BHP Billiton’s $38.9 billion unsolicited bid for Anglo American, Kumba’s parent company.

- The London-based miner rejected the offer and two subsequent proposals, citing undervaluation.

Kumba Insider Selling Prompts Investor Scrutiny

The notable share disposals by several Kumba Iron Ore Limited (JSE:KIO) insiders over the past year have not gone unnoticed and may have stirred concerns among investors. While insider selling can stem from a range of personal or financial reasons, consistent or widespread sales by multiple executives often warrant a closer look. In contrast, insider buying typically offers a clearer signal of confidence. Given the volume of sales, shareholders may be right to dig deeper into the company’s outlook and internal sentiment.

Outlook and Positioning

While the interim dividend was trimmed from the prior year’s R18.77 per share, the payout remains healthy and reflective of solid internal cash generation. Kumba appears well-positioned operationally, benefiting from premium pricing, productivity gains, and effective cost management.

However, until external pressures—such as trade disputes, currency volatility, and iron ore price compression—ease, the stock may continue facing downward pressure. The market’s reluctance to reprice Kumba’s improving fundamentals suggests sentiment will remain fragile in the near term.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account