Newegg NEGG Stock Explodes 2000% as Gaming Platform Launch Fuels Fresh Buying

After weeks of base-building and a volatile July, Newegg Commerce has ignited one of the most dramatic rallies of the summer, powered by...

Quick overview

- Newegg Commerce has experienced a dramatic rally, surging 56% this week after a 60% increase last week.

- The stock has broken through key resistance levels, reaching a peak of $84.60 and marking a 2,000% rise since mid-July.

- The launch of the Newegg Gamer Community and a $65 million equity offering are seen as positive catalysts for growth.

- The company's future momentum will depend on user adoption of the new platform and effective use of the raised capital.

After weeks of base-building and a volatile July, Newegg Commerce has ignited one of the most dramatic rallies of the summer, powered by bullish technical signals and the launch of a new digital community for gaming enthusiasts.

Price Action: NEGG Blasts Through July Highs

Newegg Commerce (NASDAQ: NEGG) continued its extraordinary rise this week, climbing another 56% following a 60% surge last week. On Friday alone, the stock jumped 40%, cracking above the late-July resistance level of $70 and peaking at $84.60 during intraday trade. This rebound marks a spectacular reversal from the mid-July low of $25, when shares had plunged over 50%.

NEGG Chart Daily – Leaving Behind the 20 SMA

At the current pace, Newegg’s summer rally has now exceeded 2,000%, putting it on its strongest upward run since the speculative surge of 2021. With its market cap now sitting at $1.65 billion, the company’s stock is once again commanding serious attention.

Technical Picture: Bullish Breakout Confirmed

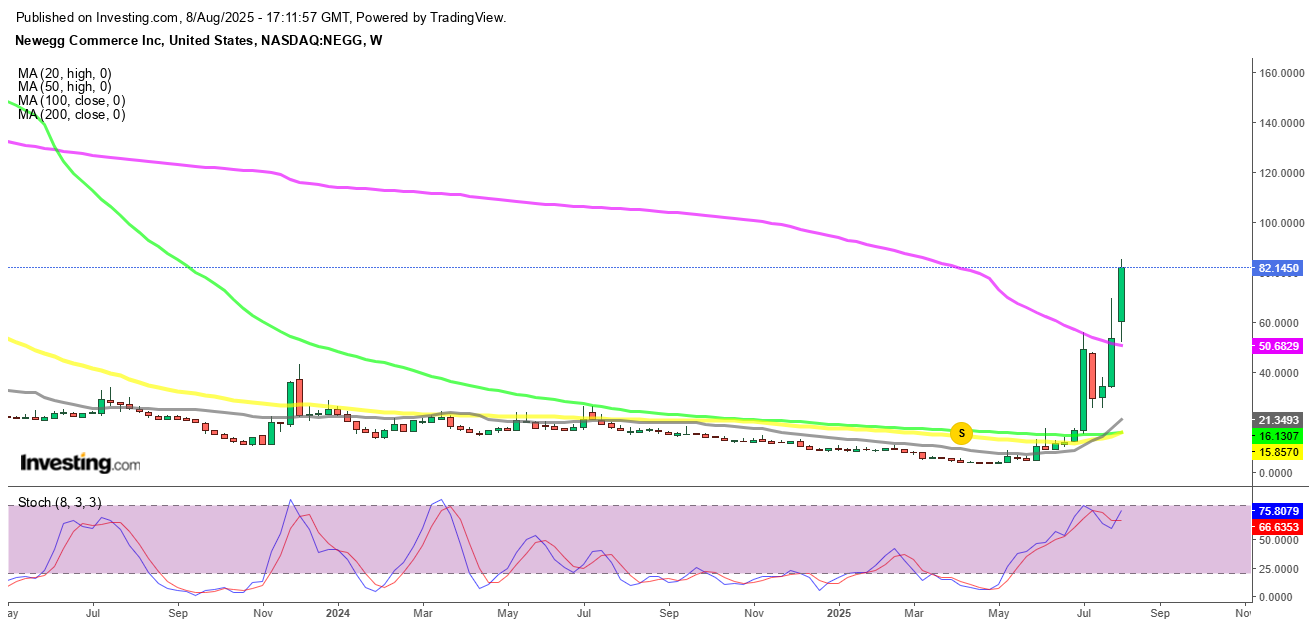

On the weekly chart, NEGG has convincingly broken above the 200-day simple moving average (SMA), a key technical barrier that had capped gains throughout much of the summer. That level, once strong resistance, now appears to be flipping into solid support—a sign of deep accumulation and sustained demand.

NEGG Chart Weekly – 200 SMA Turns into Support

Adding to the bullish case, this week’s surge followed a textbook bounce from the 20-day SMA (gray), a level that often signals reversal potential for traders watching momentum shifts. The technical setup now favors continued upside, with buying pressure clearly outpacing any lingering concerns over recent volatility.

Fundamental Fuel: Gamer Community Launch & New Capital Raise

Newegg’s breakout aligns with the official debut of the Newegg Gamer Community, a new feature on Newegg.com and its mobile app designed to bring together PC gamers, tech enthusiasts, and custom build hobbyists. The company, known for its e-commerce dominance in the tech sector, sees the platform as a strategic move to deepen user engagement and capture more share in the growing gaming hardware market.

At the same time, Newegg entered into a $65 million at-the-market (ATM) equity offering agreement with Needham & Company. While such offerings often cool investor sentiment due to dilution fears, the market responded positively. The proceeds are expected to fund operations and growth initiatives, and investors appear to view the move as a proactive strategy rather than a red flag. As part of the deal, Needham will collect a 3% fee on each share sold.

Outlook: Bullish Momentum Faces the Next Test

With a new bullish base, breakout confirmation, and a fan-focused digital expansion underway, Newegg appears to be riding a wave of renewed institutional and retail enthusiasm. Whether the rally sustains beyond these highs may depend on user adoption of the gamer platform and how quickly the company puts the ATM proceeds to productive use.

Still, for now, NEGG has reclaimed its spot among the market’s hottest tickers—and with 2021-like gains already logged, the story may not be over yet.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account