Ethereum Bulls Position for $5K Breakthrough as $5 Billion Options Expiry Looms

Ethereum (ETH) is at a turning point right now. This Friday, $5 billion worth of options contracts will expire, which could be the push the

Quick overview

- Ethereum is currently trading above $4,500 and is approaching a critical options expiration that could help it break the $5,000 mark.

- There is a bullish sentiment in the options market, with call options significantly outpacing put options, indicating trader confidence in Ethereum's momentum.

- Despite some recent selling pressure, Ethereum has shown a 22% increase over the last month and has key support levels at $4,460 and $4,310.

- Institutional demand and a decrease in circulating Ether supply are contributing to a positive outlook for Ethereum's price in the near future.

Ethereum ETH/USD is at a turning point right now. This Friday, $5 billion worth of options contracts will expire, which could be the push the cryptocurrency needs to break through the psychologically important $5,000 mark. Ethereum is now trading above $4,500, but its price has dropped nearly 2% in the past week. Both institutional and retail traders are keeping a careful eye on its price activity as they prepare for what could be a major breakout.

There is a big difference between optimistic and bearish positions in the approaching options expiration. Call options have $2.75 billion in open interest, while put options only have $2.25 billion. This 22% edge for bulls shows that traders are very sure that Ethereum’s recent momentum will continue, even though there may be some short-term turbulence.

ETH/USD Technical Analysis: Bullish Bias Despite Short-Term Headwinds

From a technical point of view, Ethereum’s recent price movements are both good and bad. The cryptocurrency has gone up an amazing 22% in the last 30 days. It found support at $4,310 and is now stronger than before. However, in recent sessions, there has been some selling pressure near the $4,630 resistance zone. Right now, the price is having trouble keeping up its pace above important technical levels.

The hourly chart shows some worrying signs, as Ethereum is trading below both the $4,580 barrier and the 100-hour Simple Moving Average. There has been a collapse below a rising channel with support at $4,600, and both the MACD and RSI indicators are displaying bearish divergence. The most important support level is currently at $4,460, and the most important support zones are at $4,420 and $4,310.

But the overall technical picture is still good. If Ethereum goes back over the $4,630 resistance mark, it might go up to $4,710 and then $4,820, which could lead to a test of the $5,000 psychological barrier.

Options Positioning Reveals Trader Confidence

The way the options market is set up going into Friday’s expiration significantly favors optimistic outcomes in a number of pricing scenarios. Deribit’s options data, which makes up 65% of the market, shows that bearish tactics aren’t well-suited for the present price levels, with only 6% of put options placed at $4,600 or above.

On the other hand, bulls are ready for a range of pricing situations. Even if Ethereum goes back down to $4,400, call options would still have a $560 million edge. This advantage gets more and bigger as prices go up. For example, if Ethereum trades between $4,850 and $5,200, it will be worth $1.8 billion more than calls.

Institutional Demand and Supply Dynamics Fuel Optimism

In addition to the technical setup, basic components are coming together to promote rising costs. Geoffrey Kendrick, who is in charge of Standard Chartered’s digital assets research, still thinks Ethereum is undervalued and has a target price of $7,500 by the end of the year, which would be around 60% higher than where it is now.

The way supply and demand work together is very interesting. Since June, corporate digital asset treasury businesses have collected about 2.5% of all ETH in circulation. Spot ETH exchange-traded funds, on the other hand, have collected over 5% of all ETH in circulation. This is a big drop in the amount of Ether available, down 7.5% in just a few months. Kendrick thinks that institutional holdings might eventually make up 10% of all circulating Ether.

Exchange outflows add to the positive story, as more than 74,000 ETH (about $340 million) were taken out of exchanges in one day, mostly from Binance. When investors relocate their securities to cold storage for longer-term holding, it usually means that there is less selling pressure in the near term.

Market Correlation and External Factors

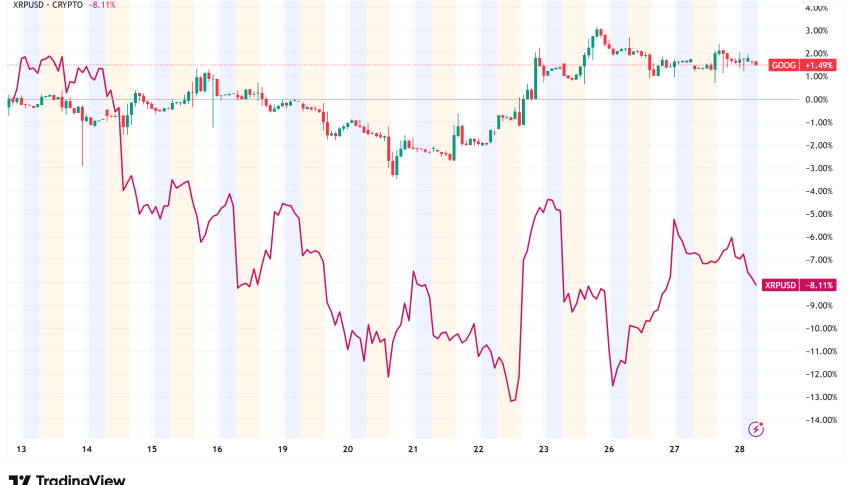

Ethereum’s 80% correlation with the S&P 500 over the past few months indicates that the overall mood of the market, especially when it comes to tech results, will be quite important. Nvidia’s earnings release on Wednesday could offer the stock market a boost if the results are better than expected, since the AI industry affects how people feel about the market.

Ethereum’s market worth of $557 billion makes it one of the 30 largest traded assets in the world. This has drawn more interest from institutions, putting it ahead of well-known companies like Mastercard and Exxon Mobil.

Ethereum Price Prediction and Outlook

Ethereum looks like it could break through $5,000 in the next few weeks because of the way technical indications, options positions, and basic supply and demand are all coming together. The first thing to do is go back to the $4,630 resistance level and keep the momentum going above $4,710.

If the options expiration gives the expected boost and the overall market stays strong, it looks more and more likely that the price will rise toward $5,000. If the price doesn’t stay above the $4,460 support level, though, it could go down to $4,310 before the next rally attempt.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account