JSE Top 40 Forecast: Index Tests Key Support as Rand Holds Near 17.70

The Johannesburg Stock Exchange FTSE All Share Index (JALSH) closed Thursday at 101,303.89 ZAR, down 210.98 points...

Quick overview

- The Johannesburg Stock Exchange FTSE All Share Index closed at 101,303.89 ZAR, reflecting cautious investor sentiment amid global economic uncertainty.

- The South African rand traded slightly weaker at 17.7025 ZAR/USD, influenced by global risk factors despite support from record gold prices.

- Global headlines, including a U.S. court ruling on tariffs, have impacted demand for the dollar, indirectly benefiting emerging market currencies like the rand.

- The JSE Top 40 Index is testing a critical support zone, with technical indicators suggesting bearish momentum and potential for tactical short positions.

The Johannesburg Stock Exchange FTSE All Share Index (JALSH) closed Thursday at 101,303.89 ZAR, down 210.98 points (-0.21%). This minor pullback reflects cautious investor sentiment, with trading still concentrated in large-cap South African firms. Analysts note that while the market remains relatively stable, the sideways movement highlights investor hesitation amid global economic uncertainty.

Rand Holds Steady Against Dollar

The South African rand traded near 17.7025 ZAR/USD, slightly weaker by 0.2% compared to Wednesday’s close. Analysts attribute the muted performance to global risk factors overshadowing domestic tailwinds, despite support from record gold prices.

“The rand remains resilient but limited by broader global factors,” noted ETM Analytics. Traders are awaiting Friday’s U.S. Non-Farm Payrolls report, which could shape near-term U.S. dollar moves and global interest rate expectations.

- Rand movement: minimal

- Focus: U.S. jobs report

- Commodity influence: gold supporting ZAR

Global Factors Shape Market Outlook

Global headlines continue to influence South African markets. A recent U.S. court ruling that struck down most of former President Donald Trump’s tariffs has dented demand for the dollar as a safe-haven asset, indirectly supporting emerging market currencies like the rand.

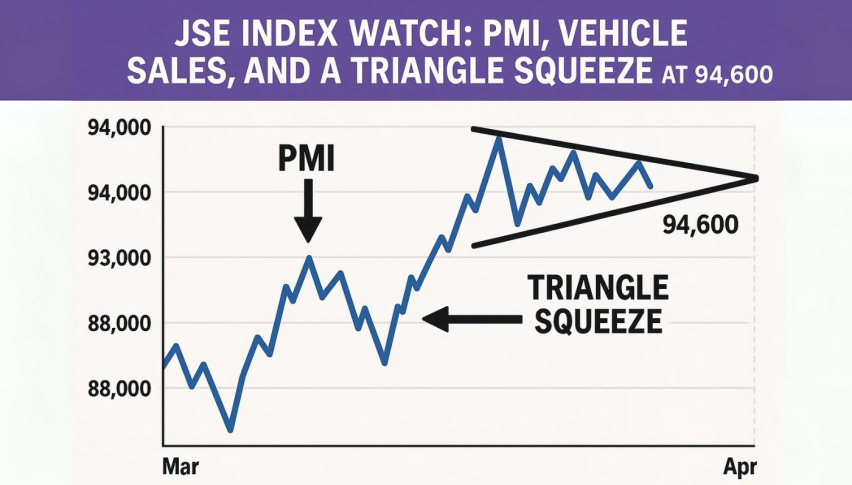

Meanwhile, South Africa’s 2035 government bond yield held steady at 9.645%, underscoring moderate investor confidence. Analysts expect the JALSH to remain range-bound, with steady bond yields and commodity strength cushioning against global trade-related risks.

- U.S. dollar: limited gains due to tariff ruling

- Bonds: 2035 yield steady at 9.645%

- Investor outlook: cautious but optimistic

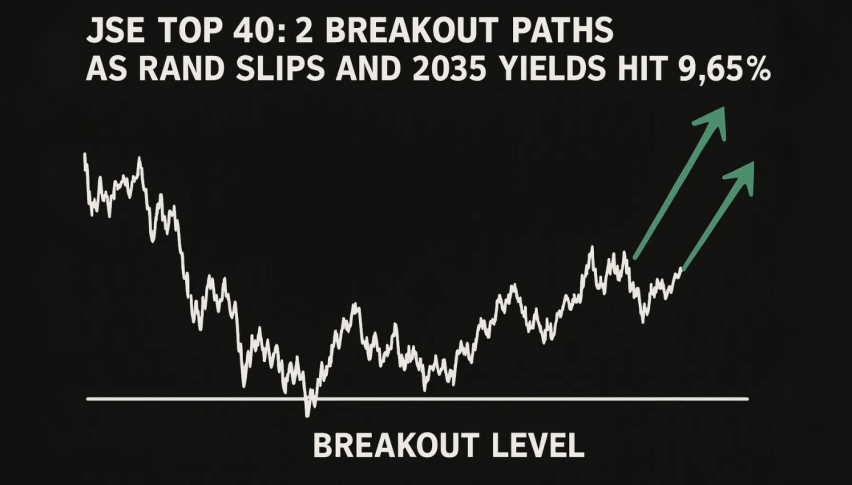

Technical Analysis: JSE Top 40 Pressures Support

The South Africa JSE Top 40 Index is pressing against a critical support zone after breaking down from a descending triangle pattern. This setup, formed by a series of lower highs since mid-August and a horizontal base near 93,000, often signals bearish continuation once support breaks

The index currently trades around 93,109, just below the 50-EMA at 94,247, which has shifted into resistance. The 200-EMA at 87,723 stands as the next long-term anchor.

Momentum indicators emphasize weakness. The RSI slipped to 39, showing bearish pressure without oversold signals, while a sequence of long-bodied red candles resembles a three black crows pattern, hinting at intensified selling.

For traders, the setup favors tactical shorts. A break below 92,347 could accelerate losses toward 91,647 and 90,916, with stops above 94,250 to avoid false breakouts. Unless buyers reclaim the 50-EMA with strength, momentum leans bearish, offering opportunities for short positions with structured risk.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account