JSE Top 40 Breaks Key Resistance Ahead of South Africa GDP Release

Investors are feeling more optimistic after the expected stronger second quarter GDP, with gains across all major sectors including...

Quick overview

- Investors are optimistic due to expected stronger second quarter GDP growth, particularly in mining and manufacturing sectors.

- The JSE Top 40 Index has broken above a key trendline, indicating renewed buying strength despite potential short-term fatigue.

- Analysts forecast 0.5% to 0.6% GDP growth, driven by mining recovery and manufacturing expansion, although structural challenges remain.

- The rand is slightly weaker, and while the outlook is positive, risks such as logistics bottlenecks and slow reforms could impact investor confidence.

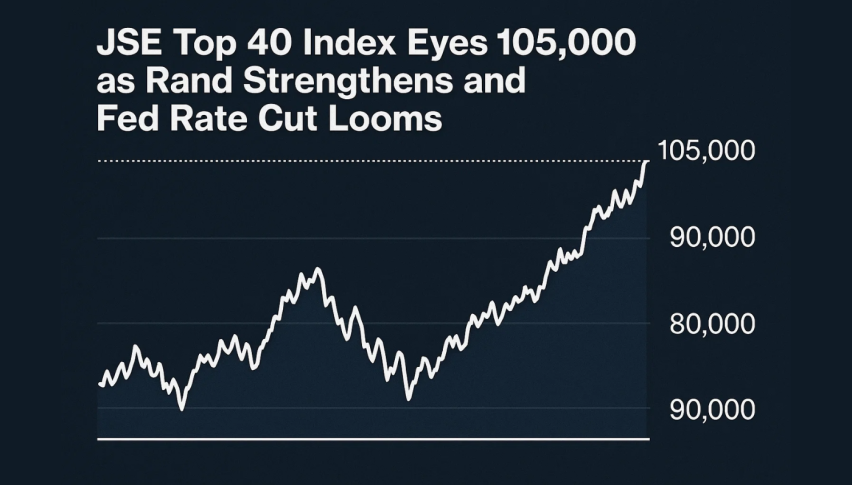

Investors are feeling more optimistic after the expected stronger second quarter GDP, with gains across all major sectors including mining and manufacturing. The JSE Top 40 Index (JALSH) has broken above the key descending trendline that has been capping price action since mid August.

The rand is softer at 17.4875 per US dollar, down 0.1% from Monday’s close. Analysts say this kind of volatility often precedes GDP releases as traders adjust positions before the official numbers.

GDP Outlook: Mining and Manufacturing to the Rescue

Stats SA will release second quarter GDP numbers at 0930 GMT with economists expecting 0.5% growth from 0.1% in the first quarter. Nedbank economists are forecasting 0.6% growth, citing:

- Mining recovery: Global demand and higher commodity prices.

- Manufacturing expansion: Stronger domestic consumption and improved conditions.

- Both will offset slower services and retail activity.

The coalition government’s reforms will help growth but structural challenges – from port congestion to freight rail inefficiencies – will continue to constrain productivity.

Technical Breakout Strengthens Outlook

The JSE Top 40 has broken out above 95,300 and turned that resistance into support. A series of green candles looked like a three white soldiers pattern, a sign of renewed buying strength.

Price tested 97,000 before retreating, leaving behind a potential shooting star, a warning of short term buying fatigue. But momentum is still positive: RSI at 64 is not overbought yet and the 50-SMA at 94,400 is still support. With the index above the 200-SMA at 88,000 the medium term trend is up.

For traders, it’s simple. Above 95,300 and bulls are in control, targets at 97,000 and 97,670. A stop below 95,000 will manage the risk. A bearish engulfing candle below that level could trigger a pullback to 93,700.Despite the positive view, there are risks. Logistics bottlenecks, high debt and cautious foreign investment will limit the upside. Analysts say slow reforms will erode investor confidence and the rand.

Mitchell, a local economist, says “strategic economic management is key to insulating South Africa from external shocks and financial stability”.

The 2035 benchmark government bond yield rose 1 basis point to 9.545%. Capital outflows could still pressure the rand. For now investors are weighing mining and manufacturing optimism against structural challenges and it’s a cautious but potentially profitable trading environment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account