Forex Signals Sept 17: Fed Meeting BoC Rate Cut Amid Diverging Economic Signals

Markets await pivotal rate decisions from the Federal Reserve and Bank of Canada as strong U.S. retail sales data and weakening Canadian gro

Quick overview

- Markets are anticipating key rate decisions from the Federal Reserve and Bank of Canada amid mixed economic signals.

- U.S. retail sales exceeded expectations, rising 0.6% in August, while Canadian growth shows signs of weakness with an increasing unemployment rate.

- The Fed is expected to cut rates by 25 basis points, but some members may advocate for a larger cut due to labor market concerns.

- Gold prices reached a new record high, while Bitcoin and Ethereum experienced significant volatility but showed signs of recovery.

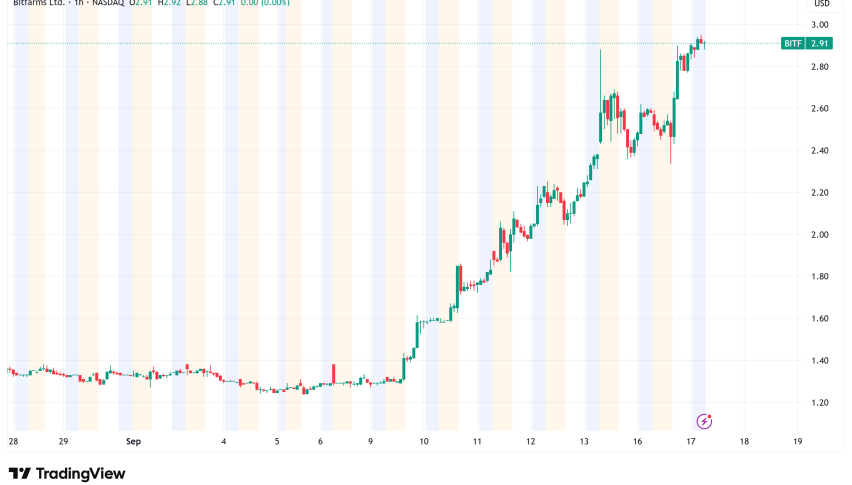

Live BTC/USD Chart

Markets await pivotal rate decisions from the Federal Reserve and Bank of Canada as strong U.S. retail sales data and weakening Canadian growth complicate the policy outlook.

U.S. Retail Sales Upside Surprises Policymakers

August retail sales surged 0.6%, triple the expected 0.2% gain, while July’s reading was revised higher to 0.6%. Excluding autos, sales climbed 0.7%, above forecasts, with broad-based category gains in clothing (+1.0%), sporting goods (+0.8%), and motor vehicles (+0.5%).

The GDPNow tracker from the Atlanta Fed rose from 3.1% to 3.4% on the back of the strong data, reinforcing consumer resilience despite inflation pressures. While part of the rise reflects higher import prices, the breadth of spending shows households remain a key driver of growth.

Key Market Events to Watch Today

Fed Rate Decision in Focus

Despite strong consumer spending, labor market softness remains the Fed’s main concern. Recent job growth has slowed, and prior employment data has been revised lower, shifting focus toward easing financial conditions.

According to a Reuters poll, 105 of 107 economists expect the Fed to deliver a 25bp rate cut this week, bringing the target range to 4.00–4.25%. However, some members, including new Governor Miran alongside Waller and Bowman, could argue for a larger 50bp cut. Dissent is likely, reflecting divisions within the FOMC.

Markets will pay close attention to the dot plot: Will policymakers signal one or two more cuts by year-end? And how steeply will the rate path fall into 2026? Fed Chair Powell is expected to strike a careful balance, avoiding pre-commitments while acknowledging inflation remains above the 2% target.

BoC Outlook: Growth and Jobs Point to More Easing

In contrast, Canada faces weakening fundamentals. The unemployment rate has risen from 6.9% to 7.1%, and growth data continues to underperform, with tariffs adding further strain.

The Bank of Canada is widely expected to cut its policy rate by 25bp, with markets already pricing another move before year-end. Money markets currently assign a 68% chance of two cuts by end-2025, reflecting ongoing downside risks to growth and employment.

The BoC’s own guidance leaves room for further easing, noting that “if a weakening economy puts downward pressure on inflation and trade-related price shocks are contained, additional rate reductions may be required.”

Last week, markets were quite volatile again, with gold soaring to $3,6065. EUR/USD continued the upward move toward 1.17.80, while main indices closed higher again. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold Reaches Yet Another Milestone

Gold continues to attract strong safe-haven flows although we saw a slight pullback yesterday. Prices surged above $3,703 early yesterday, hitting a new record high, so buyers are in total control, while China has resumed buying bullion. Technical charts now highlight the $3,800 level as the next major resistance, which will be broken soon as the upside accelerates, however an upside-down daily candlestick is a bearish signal, which could indicate a deeper pullback after such a rally.

USD/JPY Continues Trading in the Range

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. The move underscored persistent volatility as traders weighed Japan’s intervention risks against evolving Fed expectations.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Continues the Rebound Off the 20 SMA

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down to $113,000 before recovering above $116,000 last week, however sellers returned and sent BTC below $110,000, however we saw a rebound off the 20 weekly SMA (gray) yesterday.

BTC/USD – Weekly chart

Ethereum Climbs Above $4,500

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. However buying resumed and on Sunday ETH/USD printed another record at $4,941. However we saw a retreat to $,000 lows over the weekend, but yesterday buyers returned.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account