JSE Top 40 Forecast: Can $100K Level Hold as B4SA Fuels Momentum?

The JSE Top 40 closed at 100,426 on Friday, up despite a weaker rand and a stronger US dollar. The greenback rallied after strong US data...

Quick overview

- The JSE Top 40 closed at 100,426, showing resilience despite a weaker rand and a stronger US dollar.

- The Business for South Africa initiative has contributed to improved economic fundamentals, including significant gains in electricity capacity and reduced port handling times.

- Experts believe 2024 could mark a turning point for South Africa as reforms in key sectors reduce risks and attract private investment.

- The JSE Top 40 remains in an uptrend, with bullish momentum expected as long as it stays within the established trading channel.

The JSE Top 40 closed at 100,426 on Friday, up despite a weaker rand and a stronger US dollar. The greenback rallied after strong US data on GDP, jobless claims, durable goods orders and inventories lifted the dollar index 0.6% and put pressure on the rand and overshadowed local releases such as higher producer inflation and improved business cycle indicators.

Bond markets were quiet with the 2035 yield up 1 basis point to 9.15% and the Top 40 flat for the week. But investors seem cautiously optimistic as global headwinds meet domestic reform progress.

Reform Partnership Boosts Confidence

Much of that confidence comes from the Business for South Africa (B4SA) initiative, a public-private partnership now in its third year. Business leaders highlight key achievements that have improved the economic fundamentals:

- 6,000 MW of new electricity capacity added to the grid.

- Port handling times cut by 90% since mid-2023.

- Rail freight volumes turning around, up 15% to 171 million tons for 2024.

- All 40 FATF criteria met, South Africa to exit the grey list.

Adrian Gore (Discovery CEO) and Adrian Enthoven (Yellowwoods chairman) argue 2024 is the turning point after years of decline as reforms in electricity, transport and state owned enterprises reduce systemic risks and open up for more private investment.

JSE Top 40 Technical Outlook for the Week Ahead

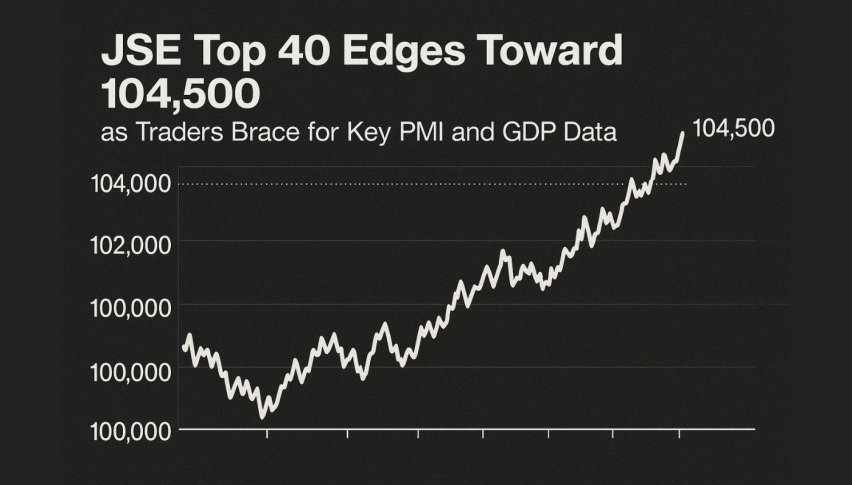

Technically the JSE Top 40 is still in an uptrend. After rebounding from 97,700 support the index broke the 50 period moving average at 98,623 and accelerated into the weekend. A long white candle capped the move, similar to the early stage of a “three white soldiers” formation.

The RSI is 71, overbought, so minor pullbacks are possible. But the channel is still intact and momentum is with the buyers. Resistance is at 100,978 and 101,647 and 102,356.

Support is at 99,560 and 98,400 and 97,027 near the base of the channel.For the traders a continuation long is still on if price holds above 99,560 with targets at 101,600-102,300. Stops can be set at 98,900. More cautious traders can re-enter on dips to 98,500-99,000 for better risk reward.

In summary:

Global currency strength and Fed policy temper the enthusiasm but B4SA reforms are boosting confidence. As long as the index stays in the channel the bias into next week is bullish and investors are pricing in gradual gains on the back of the improving fundamentals.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account