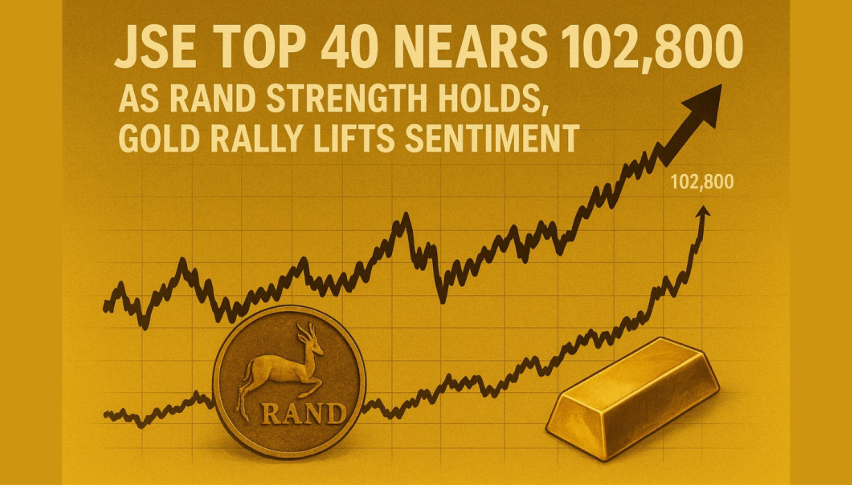

JSE Top 40 Nears 102,800 as Rand Strength Holds, Gold Rally Lifts Sentiment

On Thursday, the South Africa JSE Top 40 Index extended its rally, trading at 102,293 as it pressed against the upper boundary...

Quick overview

- The South Africa JSE Top 40 Index continued its rally, reaching 102,293, supported by strong mining and metals stocks amid global uncertainties.

- The rand remained stable near 17.3 per US dollar, benefiting from a weaker dollar and attractive South African yields for foreign investors.

- The South African Reserve Bank maintained the repo rate at 7%, balancing inflation concerns with fragile growth, while trade risks loom over export-focused industries.

- Technically, the JSE Top 40 is testing resistance at 102,803, with potential for further gains if it breaks above this level.

On Thursday, the South Africa JSE Top 40 Index extended its rally, trading at 102,293 as it pressed against the upper boundary of its rising channel. The advance reflects steady investor confidence, even as global uncertainties remain. Mining and metals stocks, buoyed by a firm gold rally, continued to provide strong support for the index.

The rand also held firm near 17.3 per US dollar, its strongest level since September 2024. A weaker dollar, driven by slowing US growth and expectations of Federal Reserve rate cuts, has made South Africa’s higher yields more appealing to foreign investors. This resilience underscores the role of commodities and yield differentials in shaping local markets.

Key drivers include:

- Slowing US growth weighing on the dollar

- Fed signals pointing toward rate cuts

- South Africa’s high yields drawing capital inflows

Trade Risks and Domestic Policy

The South African Reserve Bank (SARB) recently kept the repo rate unchanged at 7%, balancing inflation concerns within the 3%–6% target range against fragile growth. Meanwhile, trade risks persist. The potential expiration of the African Growth and Opportunity Act (AGOA) and the threat of higher US tariffs add uncertainty to export-focused industries.

Investors are closely watching:

- SARB’s interest rate trajectory

- US-South Africa trade negotiations

- Global commodity demand, particularly gold and platinum

Despite these challenges, the JSE Top 40 has shown resilience, with commodity-linked sectors acting as a buffer against global headwinds.

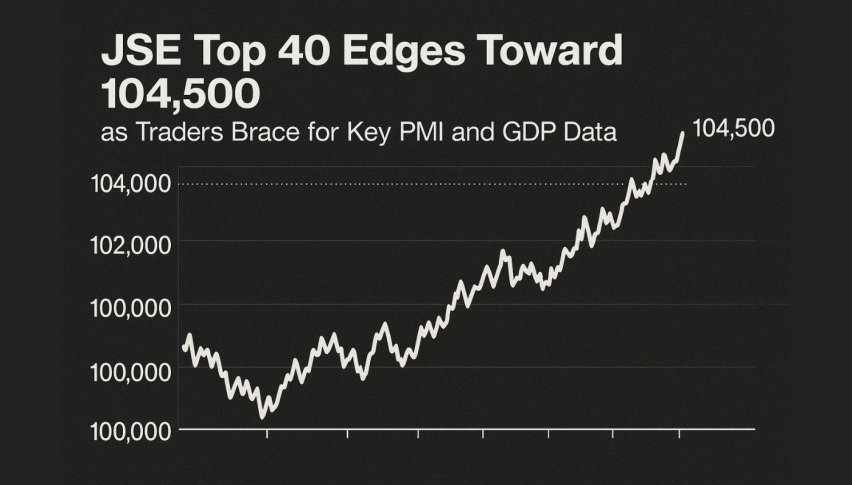

JSE Top 40 Technical Levels to Watch

Technically, the JSE Top 40 is testing resistance at 102,803 after a powerful multi-week rally marked by higher highs and higher lows. On the 4-hour chart, candlestick formations reveal hesitation, with small-bodied candles near the highs signaling buyer fatigue. The RSI sits at 74, in overbought territory, hinting at the risk of short-term consolidation.

Should the index break decisively above 102,803, momentum could target 103,562 and 104,342. Conversely, a rejection could trigger a pullback toward 101,330, with stronger support at 100,334. The 50-SMA at 99,902 and 100-SMA at 96,652 remain key anchors for the broader uptrend.

For traders, a pullback-buy strategy offers the most balanced entry. Waiting for a dip toward 101,300–100,300 with confirmation from a bullish hammer or engulfing candle provides cleaner risk-reward. Upside targets sit at 102,800 and 103,560, with stops below 99,900 to safeguard against reversals.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account