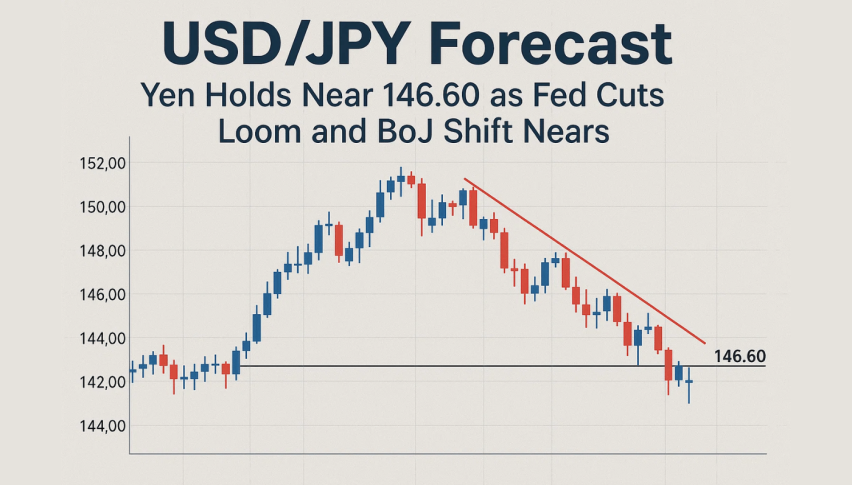

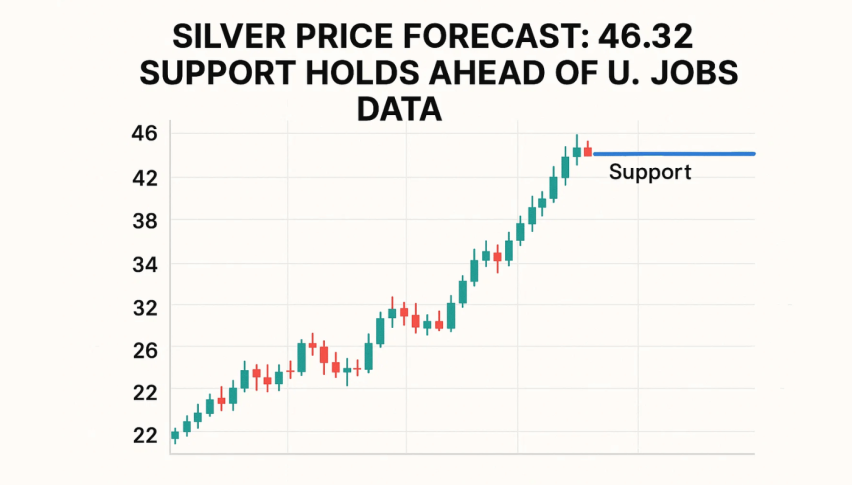

Silver Price Forecast: $46.32 Support Holds Ahead of U.S. Jobs Data

Silver traded sideways on Thursday, holding near $46.90 as investors wait for the US Nonfarm Payrolls (NFP) report.

Quick overview

- Silver traded sideways around $46.90 as investors await the US Nonfarm Payrolls report, with expectations for 52,000 new jobs in September.

- Recent data shows a significant private sector job loss and ongoing contraction in manufacturing, supporting safe-haven demand for precious metals.

- Silver is facing technical breakdown risks, having tested key support levels and showing bearish momentum indicators.

- The short-term direction for silver hinges on US labor market signals, with weak numbers likely to support prices and strong numbers potentially pushing them lower.

Silver traded sideways on Thursday, holding near $46.90 as investors wait for the US Nonfarm Payrolls (NFP) report. Expectations are for 52,000 new jobs in September vs 22,000 previously but the data may be delayed due to the US government shutdown. A weak number would reinforce bets on more Fed rate cuts this year and keep demand for non-yielding assets like silver and gold.

The bigger picture is fragile: ADP showed a 32,000 private sector job loss in September, the largest since March 2023 and ISM manufacturing PMI stayed in contraction at 49.1. Together this supports safe-haven demand for precious metals even as the US dollar tries to stabilize.

Silver Faces Technical Breakdown Risk

Silver is struggling with loss of momentum after breaking out of its ascending channel. The metal tested $46.32 support which is the 50-SMA. A cluster of long upper wicks at $47.84 showed exhaustion and back-to-back red candles formed a “three black crows” pattern – a bearish continuation signal.

Momentum indicators agree: RSI cooled down to 49 from overbought levels without going oversold. This leaves the market vulnerable to further downside if buyers can’t take control.

Key Levels and Trade Setup

- Immediate Resistance: $46.98 (50-SMA), then $47.84 and $48.52

- Support Zones: $46.32, $45.84 and deeper at $45.19

- RSI: Neutral at 49, bearish

Trade Idea (Bearish Bias):

- Entry: Sell on a confirmed break below $46.32 with volume

- Stop-Loss: Above $46.98 to protect against a fake breakout

- Target: First at $45.84, then $45.19 if bearish momentum builds

Counterpoint (Bullish Case): A bullish engulfing candle above $46.98 would flip the script and open up $47.84 and $49.05.

Silver Outlook

With everyone focused on Friday’s NFP and shutdown related data delays, silver’s short term direction is all about US labor market signals. Weak numbers will reinforce the case for Fed easing and will support silver, while strong numbers will push it below $46.32.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account