JSE Top 40 Posts 3-White-Soldiers Rally as Reserves Hit $67.9B

JSE Top 40 Index (J200) is still in an uptrend, trading at ZAR 103,744 just above the lower boundary of the channel. Since mid-September...

Quick overview

- The JSE Top 40 Index (J200) is in an uptrend, currently trading at ZAR 103,744, showing signs of sustained momentum with higher highs and lows.

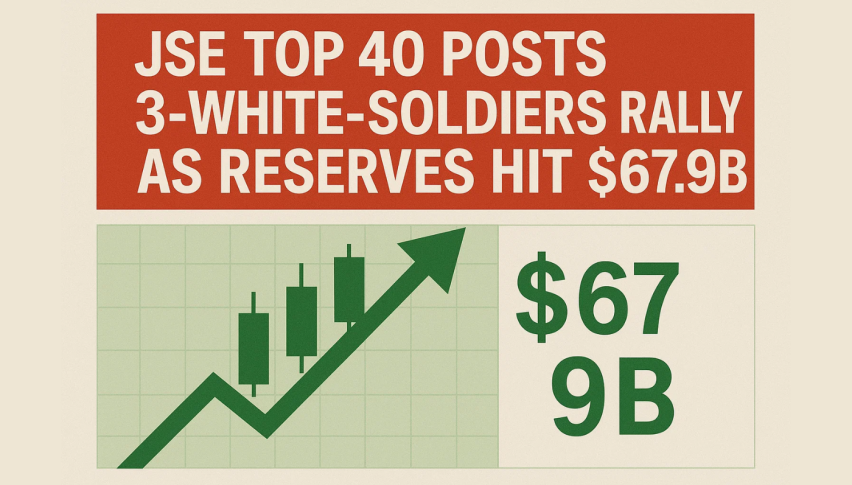

- A three white soldiers candlestick pattern indicates strong buying interest, but a long upper wick on the latest candle suggests potential resistance at ZAR 104,200.

- South Africa's net foreign reserves increased to $67.865 billion in September, boosting confidence in the rand amid global volatility.

- The bond market remains resilient, with steady demand and easing yields, although external risks may limit gains in the equity market.

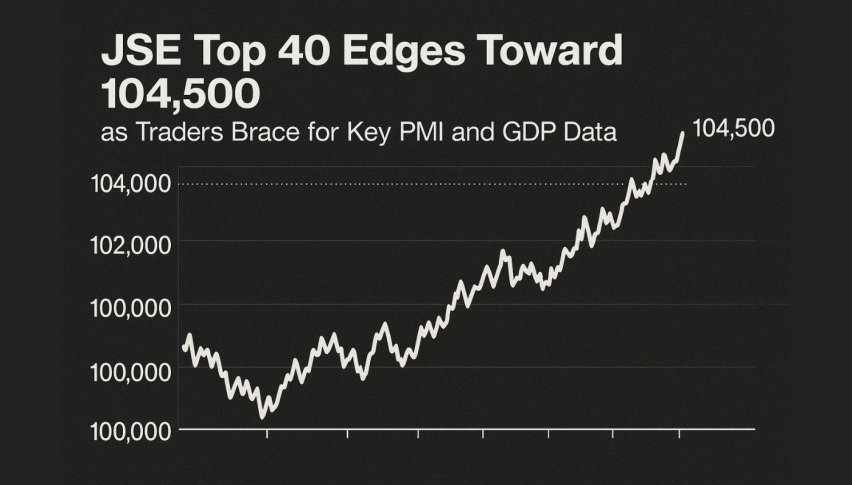

JSE Top 40 Index (J200) is still in an uptrend, trading at ZAR 103,744 just above the lower boundary of the channel. Since mid-September it has been making higher highs and higher lows, clear signs of sustained momentum. It bounced off the lower boundary of the channel at ZAR 101,800 which also coincides with the 50-SMA acting as a pivot for corrections.

A three white soldiers candlestick pattern across three sessions confirmed buying interest. But the latest candle has a long upper wick suggesting the market might be hitting resistance at the channel midpoint at ZAR 104,200. The RSI is at 69.8, the market is getting overbought and might need a short pause or a small pull back before the next leg higher.

Rand Reserves Boosts Confidence

South Africa’s currency gets a boost from improving external liquidity. Net foreign reserves rose to $67.865 billion in September from $65.899 billion in August, beating expectations of $67.5 billion. Reuters

Economists praised the upswing as support for the rand, helping it to weather global volatility. The reserve buffer and stable capital flows calm the local markets even as external pressures mount.

Bonds, Yield & Market Balance

Debt markets also showed resilience. The 2035 bond saw yields ease by 6 basis points to 9.16%, demand is steady. In this environment equity losses can be partly offset by fixed income strength and a stable currency backdrop.

But external policy risk – especially US volatility and global risk aversion – might cap gains for now. If the channel holds and the 50-SMA support, the trend is to buy dips. If the index breaks above ZAR 104,200 expect targets to ZAR 105,000 – 105,930. If it retraces to ZAR 102,900 – 103,000 it’s a lower risk re-entry with stops below ZAR 101,800.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account