Forex Signals October 14: JP Morgan, Domino’s, Black Rock, City Group Earnings Today

U.S. stocks started the week with renewed strength as optimism over corporate earnings and easing global tensions lifted investor sentiment

Quick overview

- U.S. stocks opened the week positively, driven by optimism over corporate earnings and reduced global tensions.

- The Q3 2025 earnings season is underway, with major companies like JPMorgan Chase and Goldman Sachs set to report results that could influence market sentiment.

- The Dow Jones Industrial Average rebounded 1.3% as investor confidence grew following a more measured approach to tariffs from President Trump.

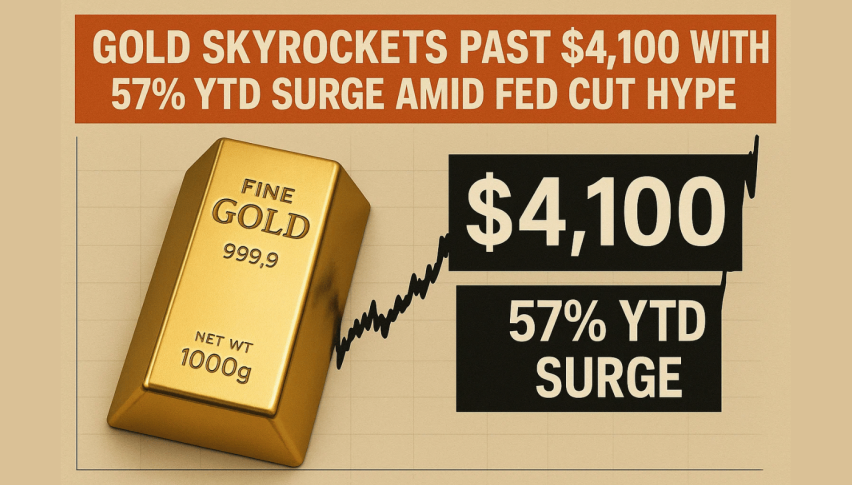

- Gold prices reached new monthly highs, surpassing $4,100 per ounce, amid safe-haven demand and a weaker U.S. dollar.

Live BTC/USD Chart

U.S. stocks started the week with renewed strength as optimism over corporate earnings and easing global tensions lifted investor sentiment across major indices.

Earnings Season Takes Center Stage

This week marks one of the busiest periods of the Q3 2025 earnings season, with some of the world’s largest financial and corporate names reporting results.

Investors are paying close attention to figures from JPMorgan Chase, Goldman Sachs, Johnson & Johnson, and BlackRock, among others, as their performances will likely set the tone for broader market sentiment in the weeks ahead.

Expectations are running high for solid bank results amid rising credit activity and resilient consumer spending, while corporate heavyweights are expected to provide insight into cost pressures, demand trends, and outlooks for 2026.

Dow Recovers as Investors Return to Risk Assets

After last week’s steep declines, the Dow Jones Industrial Average rebounded 1.3% on Monday, marking a strong start to the week. Financials and industrials led the charge, benefiting from renewed optimism in trade relations between the U.S. and China.

Investor confidence strengthened after President Donald Trump adopted a more measured tone on tariffs, suggesting that the proposed 100% import hike on Chinese goods may be delayed or scaled back. The shift in tone calmed fears of an immediate escalation and prompted investors to re-enter equity markets.

Geopolitical Relief Adds to Market Strength

Global markets found additional support from the signing of a peace accord between Israel and Palestine, a development that eased regional tensions and bolstered hopes for greater stability in energy and commodity markets.

The news provided a lift to global risk sentiment, while also driving oil prices slightly lower on expectations of improved Middle East stability and supply security.

Gold Extends Its Advance

Amid the risk-on sentiment, gold prices continued to climb, breaking above $4,100 per ounce and closing at new highs for the month.

Analysts attributed the move to a combination of safe-haven demand, a weaker U.S. dollar, and expectations that global central banks will maintain accommodative policies amid geopolitical uncertainty.

Key Forex Events to Watch Today: Major Financials and Consumer Giants Kick Off Q3 Season

The upcoming wave of corporate results will serve as a barometer for both consumer resilience and financial sector health. Strong performances from major banks could reaffirm confidence in credit conditions and economic stability, while softer numbers might revive recession concerns.

JPMorgan Chase & Co. (JPM)

- Earnings per share (EPS): $4.87 expected

- As the largest U.S. bank, JPMorgan’s results will offer an early look into credit quality, lending activity, and the impact of moderating interest rates on margins. Analysts will also watch for updates on capital return plans and consumer loan demand.

Johnson & Johnson (JNJ)

- EPS: $2.76 expected

- The healthcare giant’s report will highlight trends in pharmaceutical growth and medical devices. Investors are watching closely for commentary on new drug launches, legal settlements, and the company’s progress following its consumer health spinoff.

The Goldman Sachs Group, Inc. (GS)

- EPS: $11.09 expected

- Goldman’s performance will reveal the health of investment banking, trading, and asset management divisions. M&A and IPO activity have shown early signs of revival, which could boost revenue.

Wells Fargo & Company (WFC)

- EPS: $1.55 expected

- Focus remains on loan growth, cost control, and net interest margins. Markets will also watch management’s outlook on mortgage and commercial lending demand as economic growth cools.

Citigroup Inc. (C)

- EPS: $1.72 expected

- Citi’s restructuring progress and international exposure will be under the spotlight. Investors expect clarity on expense management and capital deployment as the bank continues to streamline its operations.

BlackRock, Inc. (BLK)

- EPS: $11.33 expected

- The world’s largest asset manager is likely to benefit from the rebound in global markets and inflows into ETFs. Analysts will assess its fee structure, margins, and institutional investment trends.

Domino’s Pizza, Inc. (DPZ)

- EPS: $3.96 expected

- The fast-food leader’s results will gauge the strength of U.S. consumer spending and international sales momentum. Price increases, delivery trends, and store expansion plans are key focal points.

Beyond the financials, earnings from Johnson & Johnson and Domino’s will provide insight into consumer health and discretionary spending, helping investors shape expectations for Q4. As Q3 earnings season unfolds, markets will look for confirmation that profit growth remains sustainable amid easing inflation, moderating rate expectations, and persistent geopolitical uncertainty.

Last week, markets were quite volatile again, with gold soaring above $3,900. EUR/USD continued the pullback move toward 1.15 while main indices closed higher on Monday. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold Makes It Above $4,100

Although demand for safe haven assets is still high, gold fell precipitously from record highs following the Fed’s most recent rate decrease as profit-taking was prompted by Powell’s cautious tone. Earlier this week, gold jumped beyond $3,700 and reached $3,707.42 following the Federal Reserve’s announcement of a 25 basis point rate decrease to 4.25%. But the impetus soon waned, and prices dropped back to $3,627, a $80 decline from the new all-time high. As traders locked in profits after the rally driven by dovish predictions, there was a sudden fall but buyers returned on Friday pushing the price $60 higher. Yesterday buyers continued to push and XAU reached another record high at $4,117.

USD/JPY Breaks Above the Range After the New BOJ Governor

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. However, the new BOJ governor the JPY has weakened and USD/JPY soared to 152.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Rebounds Off Support

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down below $105,000 before finding support at the 200 daily SMA (purple) and recovering above $115,000.

BTC/USD – Weekly chart

Ethereum Returns Above $4,000 After the Flash Crash

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. ON Friday we saw a dive below $3.500 however buying resumed on Sunday and ETH/USD climbed above $4,000.

ETH/USD – Weekly Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account