MSTR Stock Starts to Rebound Off Support as Saylor’s BTC Crusade Charges On

Even as investors are alarmed by global volatility and tariff shocks, MicroStrategy is not backing down, tripling its Bitcoin holdings and..

Quick overview

- MicroStrategy has doubled its Bitcoin holdings to 640,250 BTC, valued at over $77 billion, despite recent market volatility.

- The company's stock, MSTR, faced pressure due to Bitcoin's decline and broader market selloffs triggered by tariff announcements.

- Executive Chairman Michael Saylor defended the company's strategy to integrate Bitcoin into corporate finance, emphasizing its transformation into a digital asset holding firm.

- MicroStrategy's recent earnings report showed significant growth, driven by innovative financial products, which has attracted institutional investors.

Live BTC/USD Chart

Even as investors are alarmed by global volatility and tariff shocks, MicroStrategy is not backing down, tripling its Bitcoin holdings and strengthening its position in the market.

Market Setback: Bitcoin Drag Pulls MSTR Lower

MicroStrategy (NASDAQ: MSTR) ended the week under pressure, sliding nearly 5% after Bitcoin’s $20,000 plunge dragged the stock below $300. Although shares briefly rebounded on Friday as BTC regained ground, the episode underscored how deeply the company’s fate is tied to cryptocurrency sentiment.

MSTR opened near $305, fell as low as $279 midweek, and recovered to close above $285 — hinting at fragile optimism heading into this week’s trading.

Tariff Shock Deepens Market Pain

Global risk appetite soured after China expanded export controls on rare earth minerals vital to EVs and semiconductors, sending shockwaves through industrial and tech sectors.

The situation worsened when President Trump announced 100% tariffs on Chinese goods, sparking a broad selloff in equities and crypto.

For MicroStrategy, this double blow hit especially hard — with Bitcoin’s collapse amplifying its downside volatility. Still, BTC’s rebound toward $110,000 over the weekend could spark a short-term recovery in MSTR.

Technical Picture: Resistance Caps Recovery

MSTR’s weekly chart shows critical support at the 200-day Simple Moving Average (SMA), which is where the decline stalled on Friday last week.

MSTR Chart Daily – The 200 SMA Held in the First Test

We saw a rebound to $289 and the upside momentum continued in after hours trading, taking MSTR to $291. A decisive break above the $300 level could restore bullish sentiment and open the door for a push back above $320 — but failure to do so risks a retest of $270 support.

S&P 500 Exclusion: A Symbolic Blow, Not a Fatal One

MicroStrategy’s exclusion from the S&P 500 in September dealt a symbolic setback, but not a fatal one.

The move reinforced perceptions of MSTR as a Bitcoin proxy stock, more volatile than mainstream tech peers — yet it also highlighted enduring investor confidence in its unorthodox strategy.

Saylor Defends the Vision

Executive Chairman Michael Saylor hit back at critics last week, accusing short sellers of running “bot-driven smear campaigns.” He reiterated that MicroStrategy’s mission is to integrate Bitcoin into corporate finance as a core treasury reserve, effectively transforming the company from a software developer into a digital asset holding firm.

Expanding Bitcoin Holdings and Institutional Backing

MicroStrategy recently added another 219 BTC worth roughly $24 million, raising its total stash to 640,250 BTC — valued at more than $77 billion.

Despite extreme volatility, the company’s Bitcoin bet has delivered an annualized return of 91%, far surpassing most technology peers.

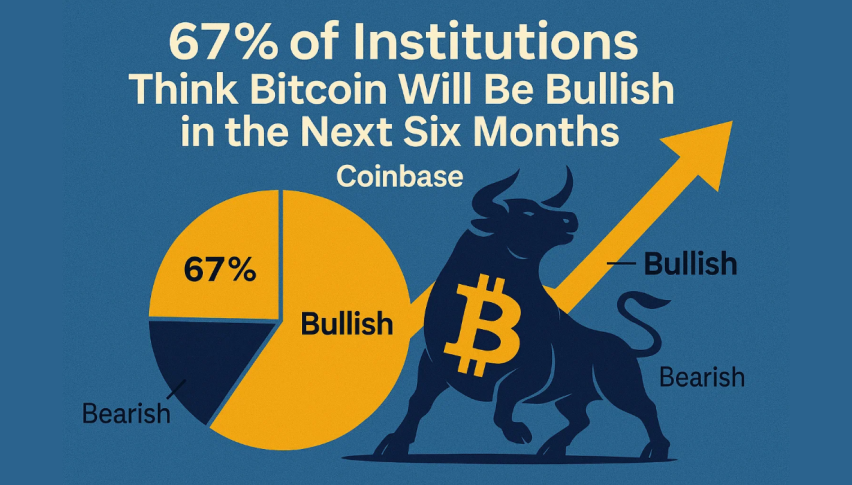

Institutional investors are taking notice. The California State Teachers’ Retirement System (CalSTRS) disclosed a $133 million stake in MSTR, marking one of the largest pension-backed exposures to a Bitcoin-linked stock.

Earnings and Product Innovation Drive Optimism

MicroStrategy’s Q2 2025 earnings reinforced confidence in its hybrid model:

- Net income: $10.02 billion

- EPS: $32.60 (massive beat)

- Revenue: $114.5 million

- Operating income: up 7,100% year-over-year

Much of this came from the launch of Perpetual Stretch Preferred Stock (STRC) — a Bitcoin-backed, yield-generating instrument that raised $2.5 billion in days. The success signals institutional appetite for regulated Bitcoin yield products, strengthening MicroStrategy’s position as a financial innovator.

Outlook: Volatility as the Price of Vision

MicroStrategy’s near-term fate remains tethered to Bitcoin’s recovery. If BTC holds above $110,000 and breaks higher, MSTR could quickly rebound. But persistent trade tensions and Fed uncertainty mean volatility will stay elevated.

Saylor’s conviction has transformed the firm into a symbol of institutional Bitcoin adoption — but also left it exposed to the full force of crypto’s unpredictable waves.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account