Forex Signals Oct 21: Netflix, GM and Coca-Cola Earnings as US Govt Shutdown End Nears

Investors enter a pivotal week as earnings from Netflix, General Motors, and Coca-Cola coincide with signs of a U.S. government shutdown...

Quick overview

- Investors are anticipating a pivotal week with earnings reports from Netflix, General Motors, and Coca-Cola coinciding with potential U.S. government shutdown developments.

- Global markets rallied on optimism over U.S.-China diplomatic progress, leading to a surge in equities and a record high for the Nasdaq.

- Gold rebounded to a new all-time high, reflecting strong demand for safe-haven assets despite improving risk sentiment.

- Crude oil prices fell to their lowest since May due to concerns over rising global supply, while currency markets remained cautious ahead of U.S.-China discussions.

Live BTC/USD Chart

Investors enter a pivotal week as earnings from Netflix, General Motors, and Coca-Cola coincide with signs of a U.S. government shutdown deal, setting the stage for heightened volatility and cross-asset reactions.

Markets Rally on Hopes of U.S.–China Breakthrough

Optimism over potential diplomatic progress between the U.S. and China drove global markets higher on Monday, with investors embracing risk assets amid expectations of a deal taking shape later this week.

Equities Surge as Talks Raise Optimism

Weekend reports of a possible high-level meeting in Malaysia between U.S. and Chinese officials reignited confidence in global trade relations. The news fueled a strong rally in equities, with the Nasdaq surging to a fresh record high.

The rally was broad and steady throughout the session, gaining momentum from the opening bell as investors positioned for a potential breakthrough. Additional support came from comments by White House advisor Kevin Hassett, who expressed optimism that a government shutdown deal could also be reached this week, further lifting sentiment.

Gold Rebounds to Record Territory

The standout performer of the day was gold, which completely erased Friday’s sharp losses and touched a new all-time high before easing slightly late in the session.

Early buying was cautious, but demand accelerated once North American traders entered the market, suggesting that Friday’s dip was largely option-driven rather than a change in fundamentals. The move underscores persistent investor appetite for safe-haven assets despite improving risk sentiment.

Currency Markets Remain Cautious

The foreign exchange market was notably subdued as traders awaited concrete signals from the U.S.–China discussions. While the overall improvement in risk appetite offered mild support to several major currencies, the prospect of a diplomatic deal paradoxically lent strength to the U.S. dollar, seen as a beneficiary of a stable global environment.

Oil Slides, Then Stabilizes

Crude oil prices fell to their lowest level since May, weighed down by concerns over rising global supply. Benchmark prices briefly touched $56.35 per barrel before recovering to post a $1.15 rebound.

Market participants are watching for signs of an oversupply, as OPEC continues to increase output, while ongoing Ukrainian strikes on Russian energy infrastructure add a layer of uncertainty to the outlook.

Key Market Events to Watch Today: Earnings Calendar for the week

This week’s earnings lineup spans multiple sectors, offering a broad snapshot of corporate and consumer health.

Stronger-than-expected reports could support risk-on flows and lift the USD, while any major disappointments—especially from General Motors, Coca Cola, or Netflix—may trigger safe-haven demand for the JPY and gold.

Major Earnings This Week

Netflix (NFLX)

- Earnings: Q3 2025 – AMC

- EPS Expectation: $6.97

- Focus: Subscriber growth post-price increases and performance of ad-supported tiers.

- Impact: Tech momentum driver; strong results could lift Nasdaq-linked sentiment.

General Motors (GM)

- Earnings: Q3 2025 – BMO

- EPS Expectation: $2.33

- Focus: Electric vehicle profitability and strike-related cost impacts.

- Impact: Industrial and manufacturing-linked currencies (CAD, MXN) may react.

Coca-Cola (KO)

- Earnings: Q3 2025 – BMO

- EPS Expectation: $0.78

- Focus: Global demand recovery, input cost management, and emerging market exposure.

- Impact: Consumer sector sentiment gauge; may influence defensive asset flow.

Last week, markets were quite volatile again, with gold soaring above $3,900. EUR/USD rebounded above 1.16 while main indices closed higher on Wednesday. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold Resume Uptrend and Prints A New Record High

Although demand for safe haven assets is still high, gold fell precipitously from record highs following the Fed’s most recent rate decrease as profit-taking was prompted by Powell’s cautious tone. Earlier this week, gold jumped beyond $3,700 and reached $3,707.42 following the Federal Reserve’s announcement of a 25 basis point rate decrease to 4.25%. But the impetus soon waned, and prices dropped back to $3,627, a $80 decline from the new all-time high. As traders locked in profits after the rally driven by dovish predictions, there was a sudden fall but buyers returned on Friday pushing the price $60 higher. Yesterday buyers continued to push and XAU reached another record high at $4,379 but on Friday we saw a $200 crash. However buyers returned yesterday, pushing XAY to $4,381.

USD/JPY Returns to 150

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. However, the new BOJ governor the JPY has weakened and USD/JPY soared to 153 but returned below 152 yesterday.

USD/JPY – Weekly Chart

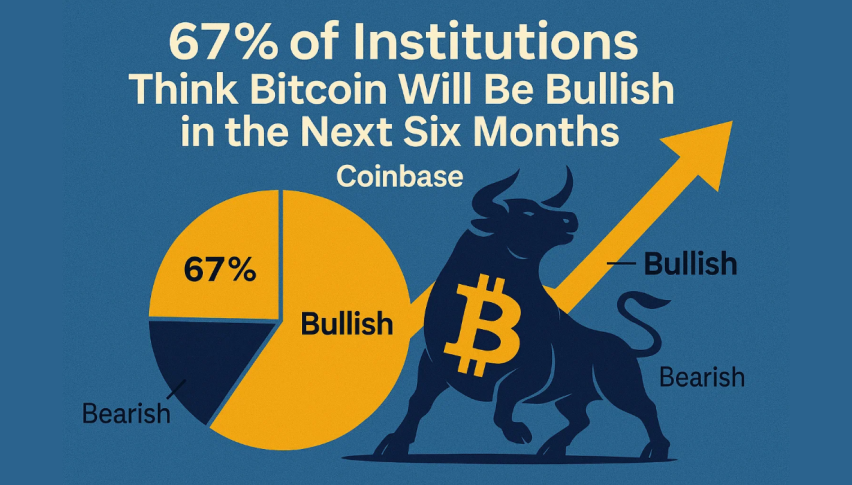

Cryptocurrency Update

Bitcoin Starts the Rebound Off Support

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down below $105,000 before finding support at the 200 daily SMA (purple) and recovering above $115,000 but then fell toward $100K again. However this week BTC has turned higher again, climbing above $111K.

BTC/USD – Daily chart

Ethereum Falls Below $4,000

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. ON Friday we saw a dive below $3.500 however buying resumed on Sunday and ETH/USD climbed above $4,500 but returned back down below $4,000 again this week.

ETH/USD – Weekly Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account