Forex Signals Oct 23: Markets Spotlight on T-Mobile and Intel Earnings

Thursday’s earnings calendar will be dominated by two major players — T-Mobile US and Intel Corporation — both expected to deliver crucial..

Quick overview

- Thursday's earnings reports from T-Mobile US and Intel Corporation are anticipated to provide key insights into the telecom and semiconductor sectors amid market volatility.

- U.S. stocks experienced a sharp decline due to escalating geopolitical tensions and trade pressures, with all major indices closing lower.

- T-Mobile is expected to report steady growth in subscriber numbers, while Intel faces challenges from weakening PC demand and competition.

- Market sentiment remains cautious as investors await earnings results that could influence the broader tech sector's performance.

Live BTC/USD Chart

Thursday’s earnings calendar will be dominated by two major players — T-Mobile US and Intel Corporation — both expected to deliver crucial insights into the telecom and semiconductor sectors amid a volatile market backdrop.

Markets Retreat as Trade and Geopolitical Pressures Escalate

U.S. stocks fell sharply on Wednesday as renewed geopolitical and trade tensions rattled investor confidence, prompting another wave of risk aversion across equity markets.

Rising Global Strains Weigh on Sentiment

Markets were pressured by growing uncertainty surrounding the Russia–Ukraine conflict and escalating friction between Washington and Beijing. The U.S. administration is reportedly preparing additional sanctions on Russia, with new measures expected within the next 24 hours.

Meanwhile, President Trump signaled tougher trade action against China, threatening sweeping restrictions on U.S. software exports and new tariffs as high as 155% on Chinese goods — a move that could take effect as soon as November 1 and effectively act as a trade embargo.

Diplomatic Talks Offer Limited Relief

Treasury Secretary Bessent has traveled to Malaysia for early discussions with Chinese officials ahead of a scheduled meeting between President Trump and President Xi in South Korea. However, optimism remains muted as both nations appear to be tightening economic pressure in advance of the high-stakes negotiations.

Market Performance Snapshot

All major U.S. indices ended lower, reflecting the cautious mood:

- Dow Jones Industrial Average: −0.71%

- S&P 500: −0.53%

- NASDAQ Composite: −0.93%

- Russell 2000: −1.45%

Key Market Events to Watch Today:

With T-Mobile expected to deliver steady growth and Intel fighting to regain its competitive footing, Thursday’s earnings could highlight the diverging fortunes within the tech landscape. A strong showing from either firm might help restore some confidence in a market still searching for direction.

Earnings Expectations for Thursday

T-Mobile US, Inc. (TMUS)

- Report Time: Before Market Open (BMO)

- Quarter: Q3 2025

- Earnings per Share (EPS) Estimate: $2.40

Focus Points:

- Investors are looking for continued momentum in subscriber growth and 5G adoption.

- Profit margins and churn rates will be key metrics as competition intensifies in the U.S. wireless market.

- Analysts expect solid cash flow performance to offset higher network investment costs.

Intel Corporation (INTC)

- Report Time: After Market Close (AMC)

- Quarter: Q3 2025

- Earnings per Share (EPS) Estimate: $0.01

Focus Points:

- Intel faces pressure amid weakening PC demand and intensifying competition from AMD and Nvidia.

- The market will be watching for progress in Intel’s manufacturing turnaround and AI chip roadmap.

- Analysts are cautious, expecting another quarter of low profitability as restructuring efforts continue.

Market Context

- Tech stocks have seen mixed performance this week, with investor sentiment swinging between optimism over AI-driven growth and caution over slowing hardware demand.

- Thursday’s results from TMUS and INTC could set the tone for how the broader tech sector performs into year-end.

Last week, markets were quite volatile again, with gold soaring above $3,900. EUR/USD rebounded above 1.16 while main indices closed higher on Wednesday. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

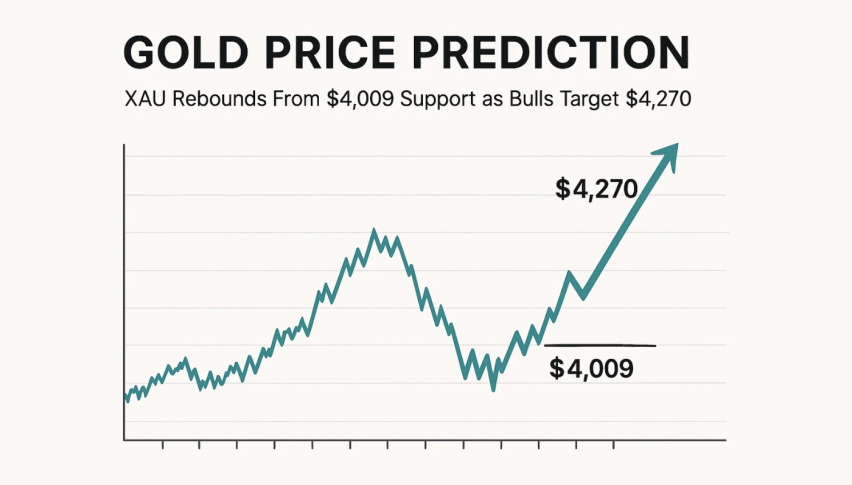

The 20 SMA Holds the Gold Dip

Although demand for safe haven assets is still high, gold fell precipitously from record highs following the Fed’s most recent rate decrease as profit-taking was prompted by Powell’s cautious tone. Earlier this week, gold jumped beyond $3,700 and reached $3,707.42 following the Federal Reserve’s announcement of a 25 basis point rate decrease to 4.25%. But the impetus soon waned, and prices dropped back to $3,627, a $80 decline from the new all-time high. As traders locked in profits after the rally driven by dovish predictions, there was a sudden fall but buyers returned on Friday pushing the price $60 higher. Yesterday buyers continued to push and XAU reached another record high at $4,381 but we saw a $375 crash to $4,004 yesterday, so the volatility is increasing. But the 20 daily SMA held as support.

USD/JPY Returns to 150

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. However, the new BOJ governor the JPY has weakened and USD/JPY soared to 153 but returned below 152 yesterday.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Retests the Support Indicator

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down below $105,000 before finding support at the 200 daily SMA (purple) and recovering above $115,000 but then fell toward $100K again. However this week BTC has turned higher again, climbing above $111K.

BTC/USD – Daily chart

Ethereum Falls Below $4,000

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. ON Friday we saw a dive below $3.500 however buying resumed on Sunday and ETH/USD climbed above $4,500 but returned back down below $4,000 again this week.

ETH/USD – Weekly Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account