Dow Jones to Extend Run on FED Rate Cut, Positive U.S.-China Talks and Tech Earnings

U.S. stocks ended the week on a high note, with the Dow Jones breaking through the 47,200 mark for the first time ever as optimism ahead of

Quick overview

- U.S. stocks closed the week positively, with the Dow Jones surpassing 47,200 for the first time, driven by optimism around tech earnings and U.S.-China trade talks.

- The Dow Jones Industrial Average rose 1.93% for the week, while the Nasdaq Composite and S&P 500 also reached record highs.

- Investor confidence was bolstered by productive trade discussions between the U.S. and China, with a meeting scheduled between President Trump and Xi Jinping.

- Looking ahead, major tech earnings from companies like Meta, Microsoft, and Apple are anticipated to provide insights into corporate resilience amid inflation concerns.

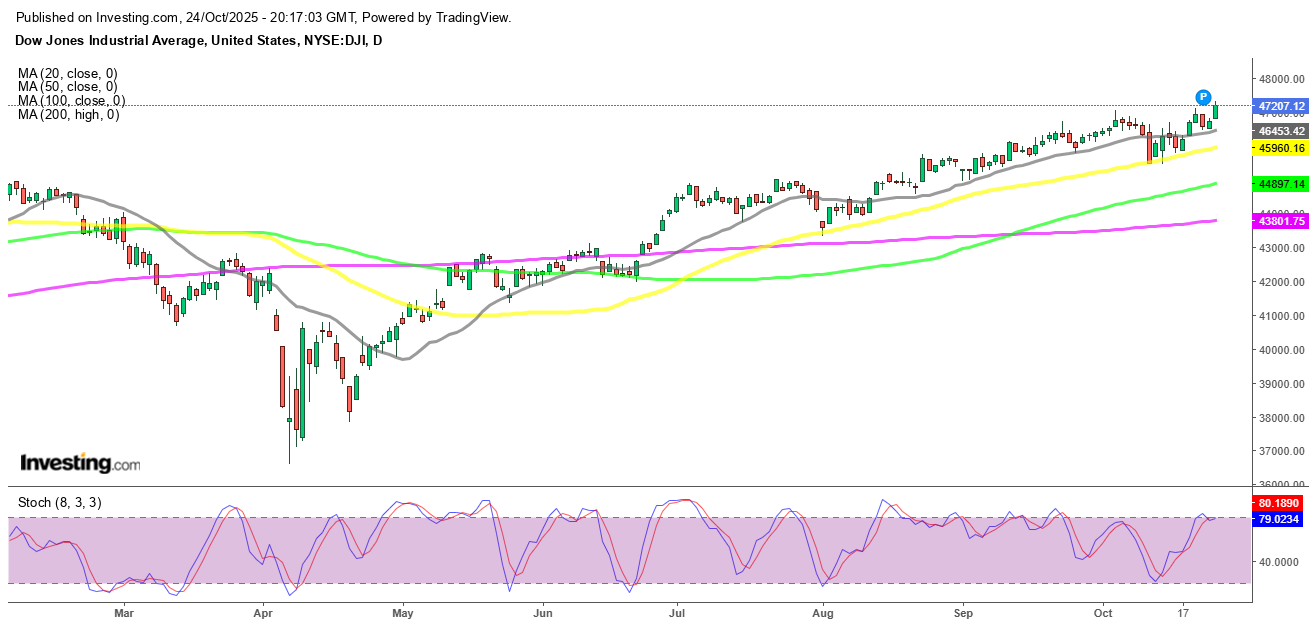

Live DOW Chart

U.S. stocks ended the week on a high note, with the Dow Jones breaking through the 47,200 mark for the first time ever as optimism ahead of major tech earnings and improving U.S.-China trade signals fueled investor confidence.

Dow Jones Breaks Historic Barrier

The Dow Jones Industrial Average made history on Friday, closing above 47,200 for the first time ever. The benchmark surged 550 points, or 1.93% for the week, driven by renewed buying in blue-chip and cyclical sectors. The rally capped a strong week for Wall Street as investors positioned themselves ahead of key earnings from major technology firms and improving signals on U.S.-China trade relations.

Dow Jones Chart Daily – The Upside Momentum Continues

The Nasdaq Composite advanced 1.58% for the week, while the S&P 500 rose 1.52%, both notching record highs of their own. Market breadth improved across all sectors, with energy, financials, and industrials showing notable strength.

Momentum Remains Firmly Bullish

From a technical standpoint, the major U.S. indices continue to find support at their key moving averages, indicating sustained institutional demand. The latest upswing was also bolstered by optimism following confirmation that President Donald Trump and Chinese leader Xi Jinping will meet on October 30 during the APEC Summit in South Korea.

Both governments described recent trade discussions as “productive,” with Treasury Secretary Scott Bessent saying, “We have a very successful framework for the leaders to discuss on Thursday.” China’s top negotiator Li Chenggang added that a “preliminary consensus” had been reached, potentially paving the way for delayed export restrictions on rare earth minerals — a move seen as positive for global supply chains.

Major Index Recap: A Record-Breaking Week

Dow Jones Industrial Average

- Closed at 47,207.12, up 1.93% for the week. Blue-chip and industrial stocks led gains, as investors rotated back into value names amid improved growth expectations.

NASDAQ Composite

- Ended at 23,204.87, up 1.58%. Semiconductor and AI-related stocks continued to fuel the tech-led momentum, as investor enthusiasm surrounding innovation sectors remained high.

S&P 500 Index

- Finished at 6,791.69, gaining 1.52% for the week. Broad strength across technology, energy, and finance pushed the benchmark closer to a key breakout level near 6,800.

Russell 2000 Index

- Closed at 2,513.47, rising 1.71% for the week — its strongest weekly performance in a month. Smaller-cap names benefited from easing Treasury yields and growing speculation of earlier Fed rate cuts.

Earnings Season Takes Center Stage

Looking ahead, all eyes turn to the upcoming wave of tech earnings. Meta Platforms, Microsoft, and Alphabet are set to report on Wednesday, followed by Apple and Amazon on Thursday. These results are expected to provide critical clues about corporate resilience and sector growth potential amid an evolving macroeconomic backdrop.

Meanwhile, Nvidia — a key player in the AI and semiconductor boom — will report later in November, keeping investors anticipating further clarity on the next phase of tech-led market momentum.

Outlook: Optimism Tempered by Inflation Watch

Despite the record highs, market sentiment remains mixed as traders await a crucial U.S. inflation report expected later this week. The outcome could shape the Federal Reserve’s policy direction, with futures markets now pricing in a 98% chance of a rate cut in October and a 92% probability of another in December.

For now, Wall Street’s record-breaking close underscores the market’s resilience — and its continued faith in both corporate earnings power and policy support to extend the current rally into year-end.

Dow Jones Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account