Gold Price Prediction: XAU Supported at $4,000, Eyes $4,500 on Dovish FED

Gold’s wild price swings highlight a renewed appetite for safe-haven assets, as shifting Fed policy and U.S.-China trade uncertainty...

Quick overview

- Gold's price volatility reflects a growing demand for safe-haven assets amid U.S.-China trade tensions and uncertain Federal Reserve policies.

- The recent surge to an all-time high of $4,381 was followed by a brief pullback, but buyers quickly defended the $4,000 support level.

- Institutional investment in gold has surged, with record inflows into gold-backed ETFs and central banks increasing their gold reserves significantly.

- Analysts predict that if current trends continue, gold could reach $5,000 by the end of 2025, supported by strong technical momentum and a dovish monetary environment.

Live GOLD Chart

Gold’s wild price swings highlight a renewed appetite for safe-haven assets, as shifting Fed policy and U.S.-China trade uncertainty continue to anchor market sentiment.

A Flight to Safety Amid Uncertainty

Gold’s surge to an all-time high of $4,381 early last week underscored a global rush toward safety. Investors, rattled by U.S.-China trade frictions and mixed policy signals from the Federal Reserve, poured into the yellow metal. However, when optimism briefly returned after conciliatory remarks from both President Trump and Chinese officials hinting at progress toward a trade deal, gold prices pulled back toward $4,000.

XAU Chart Daily – The Upside Momentum Has Exploded Since August

That retreat proved short-lived. Buyers swiftly reentered the market, defending the $4,000 support zone, aided by key technical indicators. The 20-day moving average (SMA) held firm as a support level twice last week, forming hammer candlestick patterns, often seen as bullish reversal signals. This suggests the correction was merely a healthy pause within a broader uptrend.

Policy Easing and Global Risks Fuel the Rally

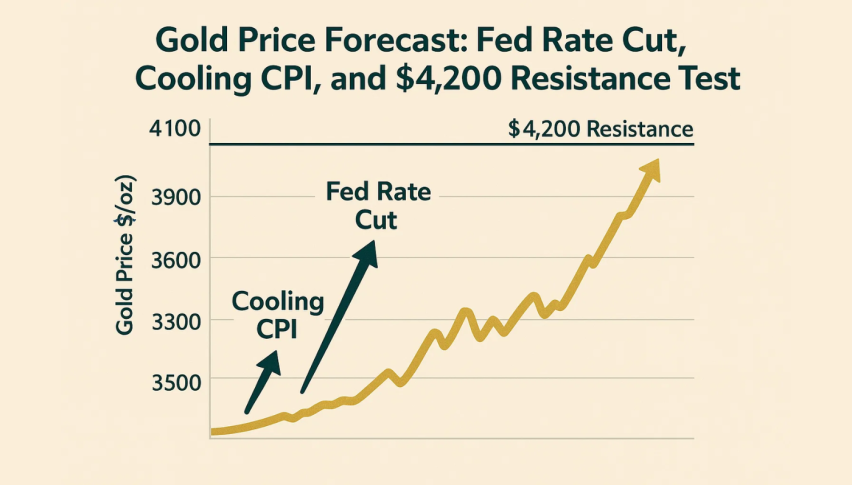

The Federal Reserve’s dovish tilt remains the key driver behind gold’s explosive momentum since late August, when prices were hovering around $3,300. Markets now expect an October rate cut with a 98% probability, and another in December, which would further weaken the dollar and enhance gold’s appeal.

Geopolitical tensions and persistent inflation fears continue to amplify gold’s safe-haven demand. Analysts forecast that if the Fed maintains its accommodative stance and global risks persist, gold could test $5,000 by the end of 2025.

Institutional and Central Bank Buying Reinforces Strength

The rally isn’t just retail-driven. Institutional flows have intensified — gold-backed ETFs attracted a record $26 billion in inflows during the third quarter, pushing total assets under management to $472 billion, their highest level ever.

At the sovereign level, central banks are now holding more gold than U.S. Treasuries for the first time since 1996, marking a historic reallocation in global reserves.

China, for instance, increased gold holdings to 8.5% of total reserves, still below the global average near 20%, suggesting further accumulation potential. Steady buying from Asia and the Middle East continues to reinforce gold’s role as a long-term hedge against both inflation and dollar volatility.

Outlook: Gold Poised for Higher Highs

With technical momentum, strong institutional participation, and a dovish monetary backdrop, gold’s long-term trajectory remains firmly upward. The $4,000 mark now serves as a critical support base, and any sustained break above $4,400 could open the path toward $4,500 and beyond.

In a world navigating trade negotiations, policy shifts, and shifting reserve strategies, gold remains the asset of conviction.

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account