USD/CAD Heads Towards our TP Target After the Inflation Report

On Monday we opened a sell forex signal in USD/CAD , as this pair was retracing higher. The trend has been bearish since the beginning of this month, after OPEC+ decided to cut Crude Oil production again, by an additional 50k barrels/day, which helped Oil price climb higher, as well as the CAD, since this currency is closely correlated to Crude Oil.

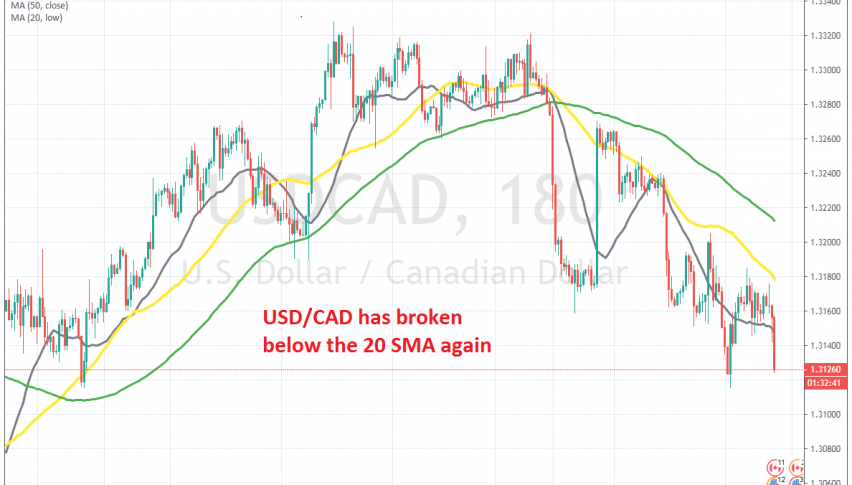

We decided to go short on this pair , although we should have waited a bit longer, since the pullback continued further to the upside. Now, the price has reversed and USD/CAD is heading towards our take profit target after the inflation report was released.

Inflation declined by 0.1% in November as expected, but the annualized numbers were better. YoY CPI moved higher to +2.2% vs +2.2% expected, up from 1.9% in October. Common CPI remained unchanged at 1.9% against 1.9% expected, as previously. Trimmed mean CPI YoY ticked higher to 2.2% as expected, up from 2.1% previously, while median CPI also increased to 2.4%, against 2.2% expected.

In October,median CPI stood at 2.2% but was revised higher to +2.3%. So, CPI declined in November by 0.1%, but median core CPI number is the highest since 2009. The CAD is climbing higher, which means that USD/CAD continues to slide lower.