Why Did The Buck Cross The Road On The ADP Employment Report? – Hint: NFP

The US ADP employment jumped from around 180k expected to above 260k. That´s a decent jump and although last month´s number was revised considerably lower, the Buck moved 30 pips higher after the ADP labour report.

By the way, last month´s numbers are history now, so the present is much more important to predict the future. That´s right, the forex market always tries to anticipate the next move, or the next economic data release, or the next political event.

The next forex event, in this case, is the NFP (non-farm employment) on Friday. This report is the real deal when it comes to jobs, but today´s ADP report gives us a rough idea of what the NFP report will be.

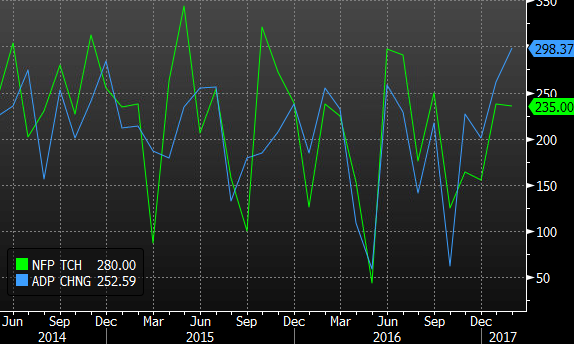

The correlation between ADP and NFP has been getting closer since 2016

Today´s jobs numbers came about 80k higher, so the market is anticipating a positive NFP report on Friday, hence the jump/decline in USD pairs.

At the moment, all the attention is on the wages though, which is published as average hourly earnings. That´s because the unemployment is pretty low, but the wages haven´t moved up as much as you´d expect.

Still, the NFP report is still a big market mover when the numbers are too far off market´s consensus. Following this logic, the USD jump on the ADP report is a sign that the market might lean on the USD until Friday. So, stay long USD until then?

I´m upset I missed EUR/USD when it was above 1.0685 a few hours ago, but if we get up there again, I´m pretty confident I´ll open another sell forex signal in this pair.