Eightcap Review

Eightcap is a trusted broker that provides Contracts for Difference (CFDs) and low spreads on 1000+ financial instruments. It is regulated by one tier-1 regulator (highest trust) and one tier-3 regulator. Eightcap has a trust score of 96 out of 100.

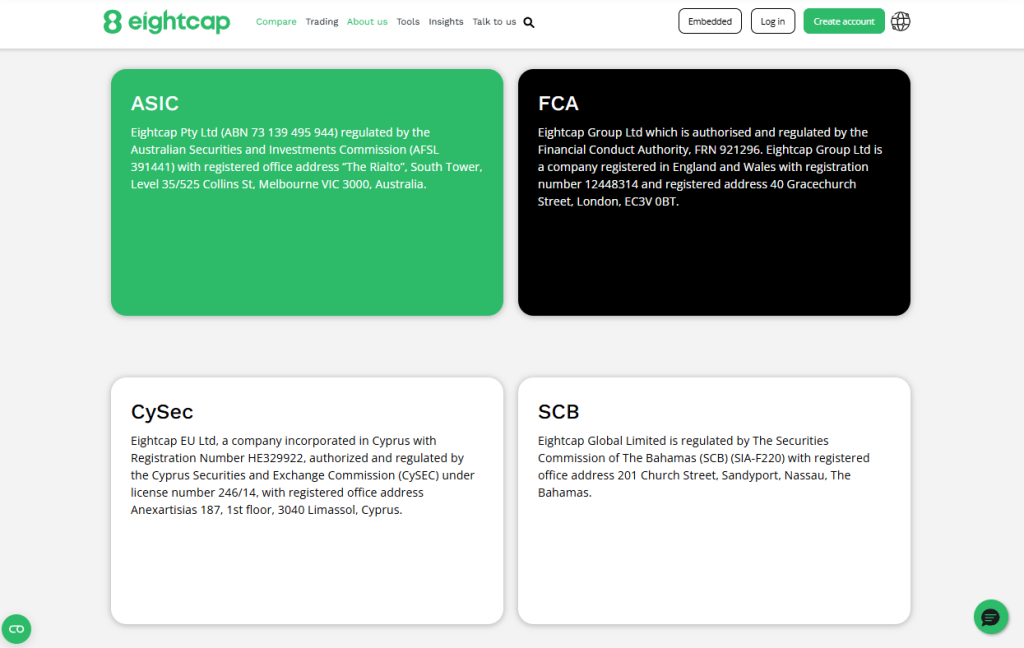

🛡️Regulated and trusted by the ASIC, FCA, CySEC, and the SCB.

🛡️2240 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| Broker Name | Eightcap |

| Regulation | 🇦🇺 ASIC 🇬🇧 FCA 🇨🇾 CySEC 🇧🇸 SCB |

| Country of Regulation | 🇦🇺 Australia 🇬🇧 UK 🇨🇾 Cyprus 🇧🇸 Bahamas |

| Minimum Deposit | 100 USD |

| Spreads From | 0.0 pips |

| Commissions | Yes |

| Swap Fees | Yes |

| Leverage | Up to 500:1 |

| Margin Requirements | Varies by instrument and account type |

| Account Segregation | Yes |

| Negative Balance Protection | Yes |

| Investor Protection Schemes | Yes |

| Fund Withdrawal Fee | Third Party Fees may Apply |

| Affiliate Program | Yes |

| IB Program | Yes |

| Rebate Program | Yes |

| Institutional Accounts | Yes |

| Managed Accounts | Yes |

| Minor Account Currencies | Yes |

| Average Deposit Processing Time | Instant (varies by method) |

| Average Withdrawal Processing Time | 1-3 business days |

| Islamic Account | Yes |

| Demo Account | Yes |

| Order Execution Time | 0.1 seconds |

| VPS Hosting | Yes |

| Total CFDs Offered | 1,000+ |

| Deposit Options | Bank Transfer Credit/Debit Card eWallets Bitcoin |

| Withdrawal Options | Bank Transfer Credit/Debit Card eWallets Bitcoin |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader |

| OS Compatibility | Windows MacOS iOS Android |

| Forex Trading Tools | Technical analysis tools Expert Advisors (EAs) VPS hosting |

| Live Chat | Yes |

| Support Email | [email protected] |

| Contact Number | +61 3 8592 2375 |

| Forex Course | Yes |

| Webinars | Yes |

| Education | Market analysis guides tutorials |

| Acts as Sponsor | Yes |

| Suited to Professionals | Yes |

| Suited to Active Traders | Yes |

| Suited to Beginners | Yes |

| Most Notable Benefit | Low spreads and access to a wide range of trading instruments |

| Most Notable Disadvantage | Limited regulatory coverage (only regulated in Australia and SVG) |

| Open an Account |

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Overview

Eightcap, founded in 2009, is a trusted Forex and CFD broker regulated by ASIC, FCA, CySEC, and SCB. It offers competitive spreads, MetaTrader platforms, strong support, and flexible accounts for traders of all experience levels.

Frequently Asked Questions

Is Eightcap a regulated broker?

Yes, Eightcap is regulated by reputable financial authorities, including ASIC (Australia), FCA (UK), CySEC (Cyprus), and SCB (Bahamas), offering traders a high level of security and compliance across several jurisdictions.

What trading platforms does Eightcap support?

Eightcap supports MetaTrader 4 and MetaTrader 5, two of the most widely used and powerful trading platforms globally. These platforms offer advanced tools, fast execution, and support for automated trading strategies like Expert Advisors (EAs).

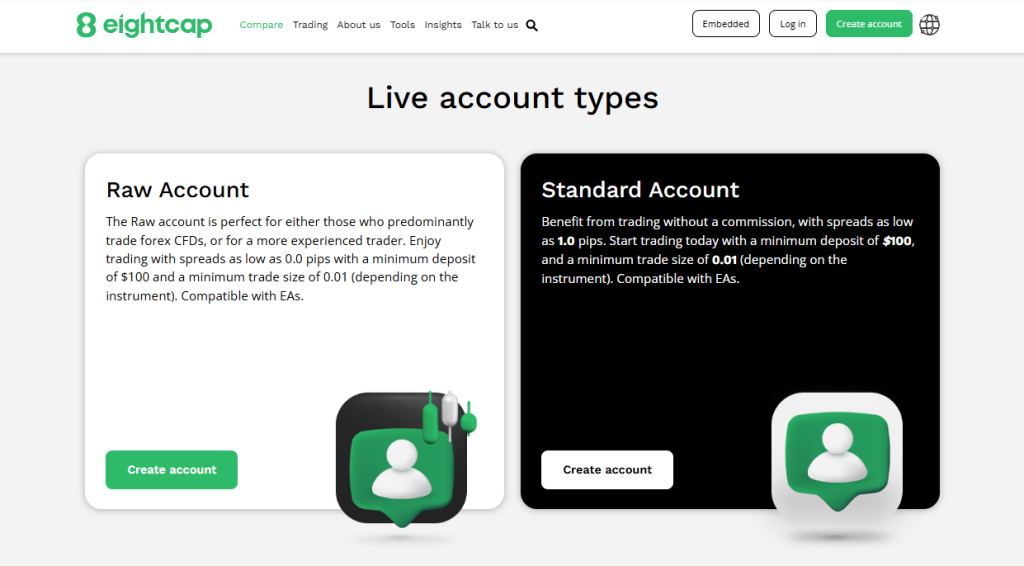

What account types does Eightcap offer?

Eightcap provides two main account types: Standard and Raw. The Standard account has no commission with slightly wider spreads, while the Raw account offers lower spreads with a commission fee, both catering to different trading styles.

Are there any downsides to trading with Eightcap?

While Eightcap is well-regulated in several regions, it may lack coverage in certain countries. Traders in those areas might face limitations or need to ensure compliance with their local financial regulations before opening an account.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap caters to active and professional traders with up to 500:1 leverage, ultra-low spreads from 0.0 pips, fast execution, VPS hosting, and access to 1,000+ CFDs—ideal for high-frequency and advanced trading strategies.

Built for Innovation, Backed by Trust

Eightcap stands out as a global fintech innovator, offering powerful trading infrastructure, advanced API solutions, and trusted brokerage services. Regulated across multiple jurisdictions, Eightcap merges deep market expertise with scalable tech for traders and businesses alike.

Fast Facts

Frequently Asked Questions

What is Eightcap’s Embedded API, and who is it for?

Eightcap’s Embedded API is a Trading-as-a-Service (TaaS) solution that allows businesses to offer derivatives trading directly through their own platforms, enabling custom, scalable trading experiences without complex infrastructure or licensing requirements.

Who are the key leaders behind Eightcap’s success?

Eightcap’s leadership includes fintech visionaries like Founder Joel Murphy and CEO Tim Brady, supported by experts in tech, compliance, and market expansion, each with extensive experience from top financial institutions and fintech firms globally.

Is Eightcap a regulated and trustworthy broker?

Yes, Eightcap is regulated in multiple major jurisdictions, including by ASIC (Australia), FCA (UK), CySEC (Cyprus), and SCB (Bahamas), ensuring transparency, security, and compliance for global clients and enterprise partners alike.

What makes Eightcap attractive for enterprise clients and developers?

Beyond retail brokerage, Eightcap offers enterprise-grade API and trading infrastructure. It enables seamless integration, fast execution, and broad asset access—ideal for fintech platforms, brokers, or businesses seeking scalable trading capabilities.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap goes beyond traditional brokerage by combining robust regulation with cutting-edge trading technology. Ideal for traders and fintech innovators alike, its tailored solutions, leadership expertise, and infrastructure make it a standout choice in the modern trading space.

Global Footprint – Trading Without Borders

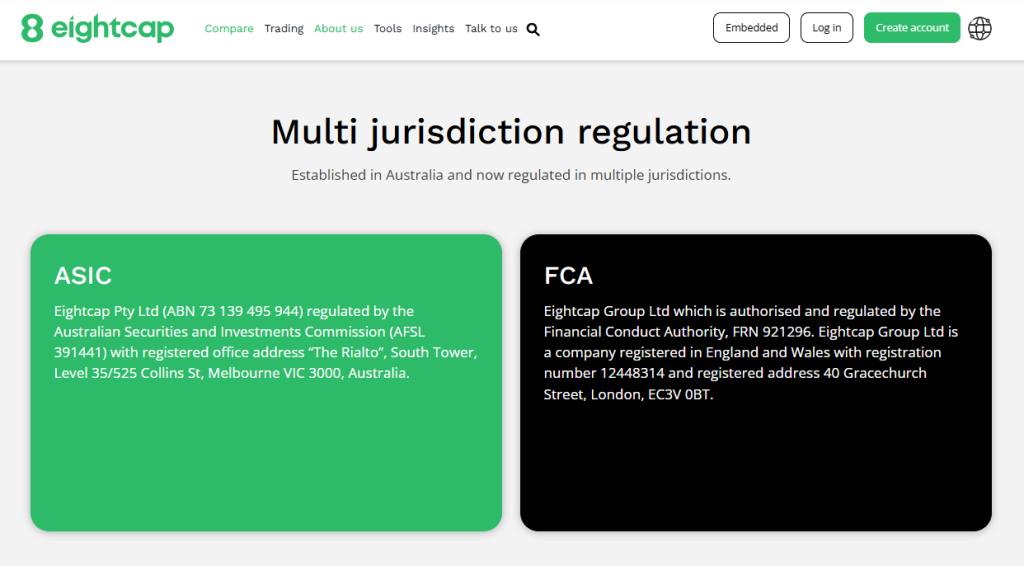

Eightcap’s global reach is anchored by top-tier regulation in multiple jurisdictions, including Australia, the UK, Cyprus, and the Bahamas. This widespread regulatory footprint ensures trader protection, compliance, and secure access to markets around the world.

Frequently Asked Questions

Is Eightcap regulated in Australia?

Yes, Eightcap Pty Ltd is fully regulated by the Australian Securities and Investments Commission (ASIC), under AFSL 391441. This provides Australian clients with strong consumer protection and oversight from one of the world’s most respected financial regulators.

Can UK residents trade with Eightcap?

Absolutely. Eightcap Group Ltd is authorised and regulated by the UK’s Financial Conduct Authority (FCA), one of the most stringent regulatory bodies in the financial industry, ensuring client safety and compliance with high operational standards.

What is Eightcap’s regulatory status in Europe?

In Europe, Eightcap EU Ltd is authorised and regulated by CySEC (Cyprus Securities and Exchange Commission), allowing it to provide trading services across the European Economic Area (EEA) under MiFID II passporting rights.

Is Eightcap available to international clients?

Yes, international traders can access Eightcap’s services via Eightcap Global Limited, which is regulated by the Securities Commission of the Bahamas (SCB). This entity extends Eightcap’s secure and compliant offerings to a global client base.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

With regulation from ASIC, FCA, CySEC, and SCB, Eightcap offers traders worldwide a safe and reliable environment. This multi-jurisdictional compliance not only builds trust but also supports secure and scalable access to global financial markets.

Safety and Security

Eightcap’s global regulatory presence ensures it operates with transparency and integrity. From Australia to the UK, Cyprus, and the Bahamas, traders benefit from trusted oversight and a commitment to compliance across major financial markets.

Frequently Asked Questions

Why is multi-jurisdictional regulation important for traders?

Multi-jurisdiction regulation means Eightcap meets the compliance standards of several top-tier financial authorities, which provides increased security, better transparency, and added confidence for traders operating in different regions around the world.

What does ASIC regulation mean for Australian traders?

ASIC regulation ensures that Eightcap Pty Ltd adheres to strict Australian financial laws. This includes investor protections, transparent pricing practices, and responsible operations under license AFSL 391441, making it a trusted broker for Australian residents.

Can UK clients trade safely with Eightcap?

Yes, Eightcap Group Ltd is authorised by the UK’s Financial Conduct Authority (FCA), which enforces high standards of operational integrity, safeguards client funds, and ensures responsible trading practices for all UK-based customers.

What is Eightcap’s European regulatory status?

Eightcap EU Ltd is regulated by CySEC, enabling compliant services throughout the European Economic Area (EEA). This regulation supports transparency, financial protection, and cross-border market access for European traders under MiFID II rules.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap’s regulation in Australia, the UK, Cyprus, and the Bahamas provides traders with assurance of security and legal compliance. Its global licensing ensures a trusted trading experience, whether you’re a retail trader or institutional partner.

Partnership Options

Eightcap Partners delivers a high-converting affiliate program backed by 20+ years of experience. Partners gain access to expert support, flexible payouts, and strong marketing tools, partnering with a trusted global broker known for low spreads and reliable trading platforms.

| Feature | Details | Benefits | Support |

| Experience | 20+ years in affiliate marketing | Trusted expertise and proven growth strategies | Dedicated account management |

| Program Structure | Commission-based with flexible payouts | High-converting funnels and scalable earnings | Transparent reporting and tracking tools |

| Trading Platform | Reliable infrastructure with low spreads | Better retention through strong trader experience | Technical integration support |

| Marketing Tools | Custom creatives, EAs, competitions | Engaging campaigns and enhanced client acquisition | Ready-to-use marketing materials |

| Global Reputation | Regulated in multiple jurisdictions | Partners with a credible and secure brand | Multi-language resources and compliance support |

Frequently Asked Questions

What is Eightcap Partners?

Eightcap Partners is an affiliate program where marketers and businesses earn commissions by referring clients to Eightcap—a globally trusted CFD broker known for its strong reputation, low spreads, and dependable trading infrastructure.

What support does Eightcap Partners provide?

Eightcap Partners offers robust affiliate support, including tailored marketing materials, detailed reporting tools, technical resources, and dedicated account management—all designed to help partners drive traffic, improve conversions, and grow their business effectively.

What makes Eightcap a trusted partner?

Eightcap has over two decades of industry experience, multi-jurisdictional regulation, and a global client base. With competitive spreads, excellent service, and reliable platforms, it’s a proven and secure choice for partners and traders alike.

How does the Eightcap partnership program work?

The affiliate program provides flexible payouts, high-converting funnels, and access to tools like trading indicators, EAs, and competitions, empowering partners to attract and retain clients while building long-term revenue streams.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap Partners is ideal for affiliates looking to build a thriving business. With over 20 years of marketing experience and dedicated support, it provides powerful tools and resources to help partners succeed in today’s competitive online trading landscape.

Minimum Deposit and Account Types

Eightcap offers traders a selection of account types tailored to different strategies and experience levels. Whether you seek commission-free simplicity or raw spreads for tighter control, every option comes with competitive conditions and a low $100 minimum deposit.

Pick the Right Fit for Your Trading Style

| Feature | Raw Account | Standard Account | TradingView Account |

| Spreads From | 0.0 pips | 1.0 pips | 1.0 pips |

| Commission | From $3.50/lot | Shares Only | Shares Only |

| Minimum Deposit | 100 USD | 100 USD | 100 USD |

| Platform Integration | MT4/MT5 | MT4/MT5 | TradingView |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

Frequently Asked Questions

What are the main account types available at Eightcap?

Eightcap provides three core account types: Raw, Standard, and TradingView. Each offers unique benefits—whether it’s commission-free trading, raw spreads from 0.0 pips, or advanced tools via TradingView integration—all starting from just $100.

What is the minimum deposit required for Eightcap accounts?

All live Eightcap accounts require a minimum deposit of just $100. This low barrier makes it accessible for both beginner and experienced traders to enter the markets with flexible conditions and robust trading platforms.

Are there commissions on Eightcap accounts?

The Standard and TradingView accounts are commission-free (except for share CFDs). The Raw account charges a commission per standard lot traded: 3.5 (AUD, USD, etc.) or 2.25 GBP / 2.75 EUR, offering spreads from 0.0 pips.

Can I try Eightcap before opening a live account?

Yes. Eightcap offers a free demo account with full platform access in a risk-free environment. While demos expire after 30 days or 5,000 trades, active live account holders can access non-expiring versions with up to six demos at once.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap offers great flexibility with a low minimum deposit of $100 for all account types, making it accessible for traders of all experience levels. Whether you’re a beginner or a professional, Eightcap’s diverse account options allow you to tailor your trading experience to your needs.

How to Open an Eightcap Account

1. Step 1: Visit the Eightcap Website

Go to the official Eightcap website: https://www.eightcap.com.

2. Step 2: Click on “Open Account”

On the homepage, click the “Open Account” button to begin the registration process.

3. Step 3: Fill in Your Details

You’ll be asked to provide your personal information, including:

- Full name

- Email address

- Phone number

- Residential address

- Date of birth (to confirm you are over 18)

4. Step 4: Choose Your Account Type

Select the account type that best suits your trading preferences:

- Raw Account (for tight spreads and commissions)

- Standard Account (commission-free, straightforward pricing)

- TradingView Account (for advanced charting and analysis)

5. Step 5: Upload Verification Documents

To meet regulatory requirements, you’ll need to upload the following documents:

- Proof of identity (passport, driver’s license, or national ID card)

- Proof of address (utility bill, bank statement, or government-issued letter)

6. Step 6: Fund Your Account

Once your account is verified, you can deposit funds. The minimum deposit is $100, and you can use several payment methods:

- Bank transfer

- Credit/Debit card

- eWallets (Skrill, Neteller, etc.)

- Bitcoin

After funding your account, you can start trading. Download MetaTrader 4 (MT4) or MetaTrader 5 (MT5), use the WebTrader, or try a demo account before going live.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Three Powerful Trading Platforms and Tools

Eightcap offers traders an excellent platform lineup – TradingView, MT5, and MT4 – each catering to different levels of expertise. Whether you’re a beginner or a pro, you’ll find the tools, features, and flexibility needed to execute your trading strategy effectively.

| Feature | TradingView | MT5 | MT4 |

| Best For | Advanced charting and analysis | Multi-asset trading and tools | Beginners and ease of use |

| Indicators | 100+ | 38 | 30 |

| Timeframes | Customizable | 21 | 9 |

| Symbol Access | 1,000+ | Unlimited | 1,024 |

| Strategy Tester | Yes | Yes | Yes |

| Device Compatibility | Windows macOS iOS Android Web | Windows macOS iOS Android, Web | Windows macOS iOS Android Web |

Frequently Asked Questions

Which platform is best for advanced charting and strategy development?

TradingView stands out for advanced charting and strategy building. With over 100 indicators, a customizable scripting language, and a strategy tester, it’s ideal for traders focused on in-depth technical analysis.

Is MetaTrader available for mobile use?

Yes, both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are fully functional on iOS and Android devices. This allows traders to monitor positions and execute trades anytime, anywhere.

Does TradingView include a strategy tester?

Yes. TradingView offers a built-in strategy tester that allows users to backtest their custom trading strategies using historical data, helping refine techniques before live trading.

Are all platforms compatible with different devices?

All three platforms – TradingView, MT4, and MT5 – are compatible with Windows, macOS, iOS, Android, and web browsers, offering flexibility across desktop and mobile trading environments.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap delivers robust platform choices for every trading style. From TradingView’s visual power to MT4 and MT5’s trading depth, these platforms support traders with the speed, features, and cross-device compatibility to trade efficiently.

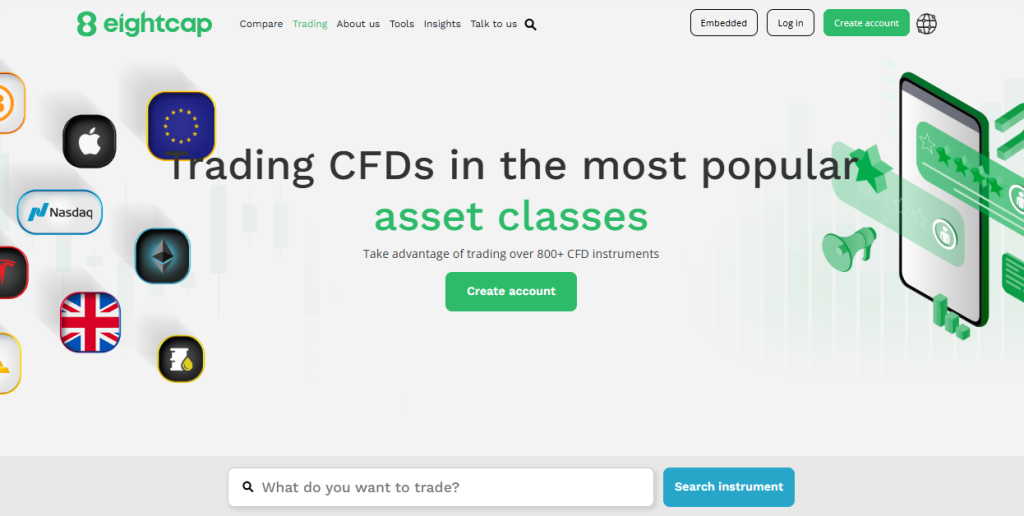

Explore 800+ Markets with Eightcap

Eightcap gives traders access to 800+ instruments across major global markets, including forex, commodities, indices, and cryptocurrencies. With tight spreads from 0 pips, it’s a powerful platform for anyone looking to diversify and trade efficiently.

| Asset Class | Examples | Spread From | Key Highlights |

| Forex | EUR/USD GBP/USD USD/JPY | 0 pips | Tight spreads on major pairs |

| Commodities | Gold (XAU/USD) WTI Oil (USOUSD) | 1.2 pips (Gold) 3 pips (Oil) | Strong liquidity and diversification |

| Indices | US30 Nasdaq 100 UK100 | 12 pips | Global index access with competitive pricing |

| Crypto | Bitcoin Ethereum more | Variable | Trade popular digital assets with flexibility |

Frequently Asked Questions

What forex pairs can I trade on Eightcap?

Eightcap offers a wide selection of forex pairs, including popular majors like EUR/USD, GBP/USD, and USD/JPY. Traders can benefit from ultra-tight spreads that start from 0 pips, providing cost-effective access to the forex market.

What commodities are available for trading?

You can trade key commodities such as Gold (XAU/USD) and WTI Crude Oil (USOUSD). Gold trades with a spread of 1.2 pips, while oil starts from 3 pips, giving traders a straightforward way to diversify their portfolios.

Which indices can I trade on Eightcap?

Eightcap offers major global indices like Wall Street 30 (US30), Nasdaq (NDX100), and UK 100 (UK100). Spreads start from as low as 12 pips, enabling cost-efficient exposure to global economic movements and trends.

Are there other markets available besides forex, commodities, and indices?

Yes, Eightcap also provides cryptocurrency trading. You can access popular digital assets alongside traditional instruments, giving you the flexibility to tailor your trading strategy across multiple asset classes.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

With access to over 800 instruments, Eightcap is a top-tier choice for traders looking to diversify. The broker combines low spreads with a wide range of markets—ideal for both beginners and experienced traders seeking global exposure.

Transparent Trading Costs at Eightcap

Eightcap delivers clear and competitive pricing across multiple account types. Traders can select between tight spreads with commissions or commission-free trading with slightly wider spreads, offering flexibility, cost control, and full support for advanced strategies like scalping and EAs.

| Account Type | Spreads From | Commission (per lot) | Scalping and EAs |

| Raw Account | 0.0 pips | 3.5 AUD/USD /NZD/SGD /CAD or 2.25 GBP / 2.75 EUR | Allowed |

| Standard Account | 1.0 pips | None (Shares incur commission) | Allowed |

| TradingView Account | 1.0 pips | None (Shares incur commission) | Allowed |

Eightcap Pricing Uncovered: Is It as Competitive as It Seems?

Eightcap is a competitive broker offering low spreads from 0.0 pips, flexible commission options, and access to over 800 instruments. With powerful trading platforms and support for all strategies, it suits both beginners and experienced traders.

Frequently Asked Questions

What are the spreads on each account type at Eightcap?

The Raw Account offers ultra-tight spreads starting at 0.0 pips. Meanwhile, both the Standard Account and TradingView Account feature slightly wider spreads, beginning at 1.0 pips, suitable for traders who prefer zero commission structures.

Are there any commissions on the Standard Account or TradingView Account?

No, both the Standard and TradingView Accounts are commission-free for most assets. However, shares CFDs may incur commissions, so it’s best to check the instrument-specific pricing details.

What is the commission on the Raw Account?

The Raw Account charges a commission per standard lot traded: 3.5 AUD, USD, NZD, SGD, or CAD; 2.25 GBP; or 2.75 EUR. This model is designed for traders who want the lowest possible spreads.

Do I pay additional fees for scalping or using EAs?

No. Eightcap fully supports scalping and Expert Advisors (EAs) across all account types without extra fees, allowing traders to implement any strategy without limitations.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap excels in offering flexible, transparent pricing structures. Whether you want tight spreads with commissions or commission-free trading with slightly wider spreads, Eightcap accommodates your style, making it ideal for both cost-conscious and strategy-focused traders.

Deposit and Withdrawal

Eightcap supports fast, convenient deposits and withdrawals through Visa, Mastercard, PayPal, Skrill, Neteller, bank transfers, and crypto. Most deposits are instant, withdrawals take 1–5 days, and there are no internal fees, though third-party charges may apply.

Frequently Asked Questions

What deposit methods are available on Eightcap?

You can fund your Eightcap account using Visa, Mastercard, PayPal, Skrill, Neteller, Wire Transfer, or cryptocurrencies like Bitcoin and USDT. These options provide flexibility for traders across different regions and preferences.

Are there any fees for deposits and withdrawals?

Eightcap does not charge internal fees for deposits or withdrawals. However, third-party providers, such as banks or e-wallets, may apply processing fees, which are passed on to the client.

How long does it take for a withdrawal to process?

Withdrawal processing time usually ranges from 1 to 5 business days, depending on the chosen method. E-wallets tend to be faster, while bank transfers may take longer to complete.

Can I withdraw to a different payment method than my deposit?

In most cases, withdrawals are returned to the same method used for the deposit. If you used multiple deposit methods, funds are typically prioritized back to the source first, following regulatory guidelines.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap provides convenient deposit and withdrawal options with instant funding through various global methods. There are no internal transaction fees, and processing times are reasonable, making it easy to manage your funds securely from anywhere in the world.

Broker Timeline – A Quick Overview

| Year | Milestone |

| 2009 | Founded in Melbourne, Australia, with a mission to provide exceptional financial services to clients. |

| 2015 | Officially launched as a global online trading platform, expanding its reach to international markets. |

| 2016 | Partnered with Paysafe to enhance client payment methods, offering more flexibility in deposits and withdrawals. |

| 2018 | Sponsored Carlton Football Club, marking its entry into sports sponsorships. |

| 2019 2020 | Served as an Official Supplier to Scuderia Ferrari during the Formula One seasons, aligning with a globally recognized brand. |

| 2021 | Expanded its offerings by adding over 250 cryptocurrency CFDs, catering to the growing interest in digital assets. |

| 2022 | Integrated with TradingView, providing clients with advanced charting tools and a comprehensive trading experience. |

| 2023 | Alex Howard appointed as CEO, with founder Joel Murphy transitioning to Non-Executive Chairman. |

| 2024 | Terminated services for proprietary trading firms, impacting several prop trading companies. |

| 2025 | Announced a partnership with WonderFi's cryptocurrency brands, Bitbuy and Coinsquare, to serve as their trading technology and liquidity provider. |

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Client-First Support Experience

Eightcap ensures every trader receives responsive, real-time assistance through live chat, phone, and email. With 24/5 live support and regional contact options, the broker focuses on fast, efficient, and friendly service worldwide.

| Support Type | Details | Availability | Languages |

| [email protected] | 24/5 | Multilingual | |

| Phone | +61 3 8592 2375 | Business Hours (AEST) | English + Others |

| Live Chat | Website chat button | 24/5 Real-Time | Multilingual |

| Regional Support | Location-based contact info on website | Depends on region | Based on location |

Frequently Asked Questions

How can I contact Eightcap’s customer service?

You can reach Eightcap’s support team via email at [email protected], call them at +61 3 8592 2375, or access live chat directly from the website’s bottom-right corner.

What are the support hours for live chat?

Eightcap provides 24/5 live chat support, ensuring you can get real-time assistance during trading hours across global markets, Monday to Friday.

Does Eightcap offer multilingual support?

Yes, Eightcap supports multiple languages through regional teams, helping international traders feel comfortable and clearly understood when seeking help.

Can I get help with platform issues or account setup?

Absolutely. Eightcap’s team assists with platform troubleshooting, account setup, verification, deposits, withdrawals, and general trading inquiries for a smooth trading experience.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap offers excellent customer support through multiple channels, including 24/5 live chat, global email, and direct phone contact. Whether you’re new or experienced, the support structure ensures your questions are answered quickly and professionally.

Eightcap Labs: Empowering Traders Through Education

Eightcap Labs is a comprehensive educational platform designed to support traders at all levels. It offers a rich library of nearly 300 resources, including articles, eBooks, and strategy guides, covering topics from trading fundamentals to advanced techniques. The content is tailored to various experience levels, ensuring that both beginners and seasoned traders can find valuable insights to enhance their trading skills.

Frequently Asked Questions

What resources does Eightcap Labs provide for traders?

Eightcap Labs offers a diverse range of educational materials, including articles, eBooks, and strategy guides. These resources cover topics such as trading fundamentals, technical and fundamental analysis, and specific trading strategies, catering to traders of all experience levels.

How can Eightcap Labs assist beginners in trading?

For beginners, Eightcap Labs provides structured learning paths with content tailored to foundational concepts. This includes guides on using trading platforms like MetaTrader 4 and 5, understanding market dynamics, and developing basic trading strategies.

Are there advanced tools available for experienced traders?

Yes, experienced traders can benefit from advanced tools such as FlashTrader for swift order execution and Acuity’s AI Economic Calendar for real-time market insights. These tools are designed to enhance trading efficiency and decision-making.

Does Eightcap Labs offer content on specific trading instruments?

Indeed, Eightcap Labs provides in-depth guides on trading specific instruments, including CFDs on indices, commodities, and cryptocurrencies. These resources delve into strategic approaches and market analysis for each instrument.

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Our Insights

Eightcap Labs stands out as a valuable educational hub for traders, offering a wealth of resources that cater to various skill levels. Its comprehensive content and advanced tools make it a go-to platform for those seeking to enhance their trading knowledge and skills.

Customer Reviews and Ratings

Eightcap maintains a solid reputation among traders, with high ratings on platforms like Trustpilot and the App Store. Users frequently commend its user-friendly platforms, competitive spreads, and responsive customer support. However, some concerns have been raised regarding withdrawal delays and execution speeds.

| Platform | Rating (5) | Highlights |

| Trustpilot | 4.2 | Positive feedback on fees and platform options |

| App Store (iOS) | 4.8 | High praise for intuitive mobile experience |

| Google Play (Android) | 4.6 | Users appreciate seamless trading on the-go |

| Forex Peace Army | 2.1 | Concerns about withdrawals and execution speed |

Trust in Action – What Users Are Saying

Top-Tier Broker with Stellar Support!

I’ve traded with a few brokers over the years, but Eightcap stands out. The Raw account spreads are incredibly tight, and I love using TradingView for analysis. Customer support was quick and professional when I had questions—absolutely 10/10! – Jessica T

Perfect for Both Beginners and Pros

As someone who mentors new traders, I always recommend Eightcap. The MT4 platform is stable, and the deposit/withdrawal process has been seamless. It’s rare to find such transparency and ease of use in a broker these days. – Mark

Reliable and Easy to Use

I’ve been trading with Eightcap for about a year. The platform is intuitive, and their spreads are among the best I’ve found. I’ve had no major issues—just wish there were more educational tools for beginners. – Sara B

Great Experience So Far

Eightcap has been a solid broker for my crypto and forex trades. I appreciate the fast execution and the fact that deposits are instant. One minor hiccup with verification, but it was resolved quickly. – Daniel

Mostly Good, But Room to Improve

I like Eightcap overall – the TradingView integration is a big plus, and spreads are fair. However, my withdrawal took longer than expected (about 4 days). Support responded, but I’d like to see faster processing in the future. – Peter

★★★★ | Minimum Deposit: $100 Regulated by: ASIC, FCA, CySEC, SCB Crypto: Yes |

Eightcap vs AvaTrade vs Exness – A Comparison

Pros and Cons

| Pros | Cons |

| Low forex fees | Slim product selection |

| Quick account opening | Limited research and education |

| Tight Spreads on Raw Accounts | No Proprietary Platform |

| Excellent TradingView Integration | Limited Asset Classes |

| Regulated in Multiple Jurisdictions | Inactivity Fees |

References:

In Conclusion

Eightcap is a trusted Forex and CFD broker offering 800+ instruments with tight spreads and flexible accounts. Regulated globally, it supports MT4, MT5, and TradingView, making it ideal for both beginner and advanced traders.

Faq

The minimum deposit for all three (Standard, Raw, and TradingView accounts) is 100 USD, making it affordable for beginners while supporting advanced features for experienced traders.

Eightcap fully supports the use of Expert Advisors (EAs) on MT4 and MT5 platforms, allowing traders to automate strategies, conduct backtesting, and run bots without restrictions. This makes it ideal for algorithmic trading.

Eightcap typically processes withdrawals within 1 to 3 business days, depending on the payment method used. Processing times may vary slightly based on your bank or provider, but Eightcap aims for fast, efficient withdrawals.

Eightcap’s global regulatory presence ensures it operates with transparency and integrity. From Australia to the UK, Cyprus, and the Bahamas, traders benefit from trusted oversight and a commitment to compliance across major financial markets.

- Overview

- Built for Innovation, Backed by Trust

- Global Footprint - Trading Without Borders

- Safety and Security

- Partnership Options

- Minimum Deposit and Account Types

- How to Open an Eightcap Account

- Three Powerful Trading Platforms and Tools

- Explore 800+ Markets with Eightcap

- Transparent Trading Costs at Eightcap

- Deposit and Withdrawal

- Broker Timeline - A Quick Overview

- Client-First Support Experience

- Eightcap Labs: Empowering Traders Through Education

- Customer Reviews and Ratings

- Eightcap vs AvaTrade vs Exness - A Comparison

- Pros and Cons

- In Conclusion