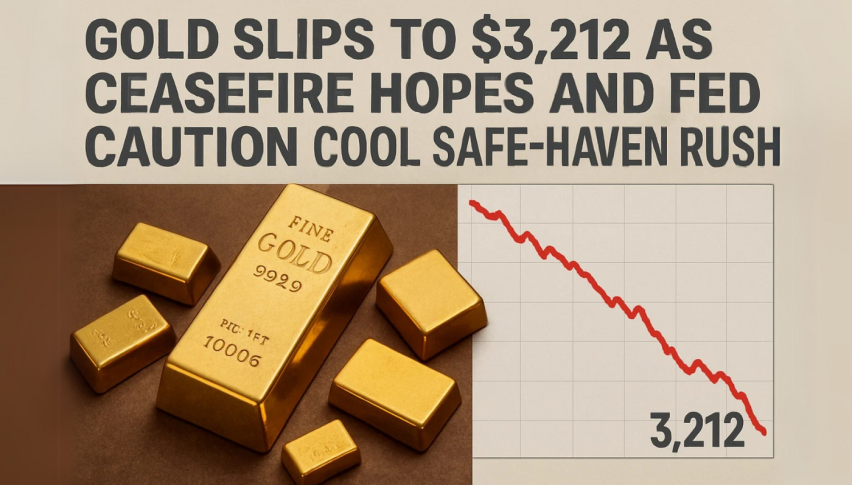

Gold Slips to $3,212 as Ceasefire Hopes and Fed Caution Cool Safe-Haven Rush

Gold prices took a breather on Tuesday, trading near $3,212 in spot XAU/USD. That's because optimism about a possible ceasefire...

Quick overview

- Gold prices are currently around $3,212, influenced by optimism for a ceasefire in the Russia-Ukraine conflict and a stronger U.S. dollar.

- Moody's downgrade of the U.S. credit rating to 'Aa1' has not caused panic, but markets are stabilizing as attention shifts to upcoming comments from Federal Reserve officials.

- Traders are anticipating a potential rate cut from the Fed in Q4, with current market sentiment suggesting easing may begin as early as October.

- Technically, gold remains in a downtrend, with immediate support at $3,168 and resistance at $3,224, indicating caution for potential buyers.

Gold prices took a breather on Tuesday, trading near $3,212 in spot XAU/USD. That’s because optimism about a possible ceasefire in the Russia-Ukraine conflict—and a slightly stronger U.S. dollar—softened demand for safe-haven assets. The dollar index (.DXY) recovered a bit from its one-week low, making gold less appealing to international buyers as a result.

That shift in sentiment came after U.S. President Donald Trump spoke with Russian President Vladimir Putin. Trump’s comments, and the resulting talks between the two leaders, prompted a cautious risk-on tilt in global markets. “Buyers are emerging on dips below $3,200,” says Kyle Rodda, a market analyst at Capital.com . “But if geopolitical risks ease further and fiscal concerns push yields higher, we could see a pullback that’s even deeper than that.”

Investors are also digesting Moody’s recent downgrade of the U.S. credit rating to “Aa1” from “Aaa”. The reason for that downgrade was rising debt levels and higher interest payments. Despite the downgrade, markets seem to be stabilizing. Attention is now turning to what Federal Reserve officials have to say.

Fed Signals and Rate Cut Bets in Focus

The Fed is walking a tightrope. Officials on Monday offered cautious remarks on the credit downgrade and the economy. They didn’t commit to any significant policy shift. Yet traders remain convinced the Fed will start easing soon. Fed funds futures are pricing in roughly 54 basis points of rate cuts this year, with the first move expected as early as October. Any dovish comments from Fed officials this week could reinforce gold’s long-term appeal.

But short-term headwinds remain. With safe-haven flows easing, gold’s recent gains are now under threat of a correction.

Key points to watch:

Moody’s downgrade hasn’t sparked panic. Yet.

The first rate cut is expected in Q4-this year.

Markets are waiting for comments from Fed officials this week

Gold Price Outlook: Still in a Downtrend

From a technical perspective, gold remains in a descending channel on the 2H chart. That channel is capped below the 50-EMA at $3,223. Gold failed to break above that resistance, so the downtrend remains intact. Lower highs and lower lows dominate the chart, confirming the bearish structure.

Momentum indicators are echoing caution. The MACD histogram is flatlining, and signal lines are starting to diverge bearishly. Unless gold breaks decisively above $3,224, rallies are likely to fizzle out.

Immediate support lies at $3,168. A close below that level could expose $3,123 or even $3,078 in the short term. Conversely, a bullish engulfing candle above $3,224 would challenge the $3,285 resistance zone.

For beginners: gold behaves like a staircase. Until bulls reclaim key resistance, gravity favors the downside. Wait for strong confirmation before entering.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account