Pi Network Faces Perfect Storm: Token Unlock and Stablecoin Competition Drive 16% Daily Drop

Pi Network (PI) is under a lot of pressure to go down. It is currently trading at about $0.48, which is a 16% drop in the last 24 hours.

Quick overview

- Pi Network (PI) is experiencing significant downward pressure, currently trading at $0.48 after a 16% drop in 24 hours.

- Technical indicators suggest oversold conditions, with the RSI nearing 36 and the price falling below critical support levels.

- A massive token unlock event in July, releasing 268.4 million tokens, raises concerns about increased supply and potential further price declines.

- Despite market challenges, Pi Network's ecosystem is developing, with over 7,900 AI-powered apps created, indicating ongoing technological progress.

Pi Network (PI) is under a lot of pressure to go down. It is currently trading at about $0.48, which is a 16% drop in the last 24 hours. Even though the ecosystem has seen some recent technological advances, the cryptocurrency is facing a number of problems that might cause prices to drop below important support levels.

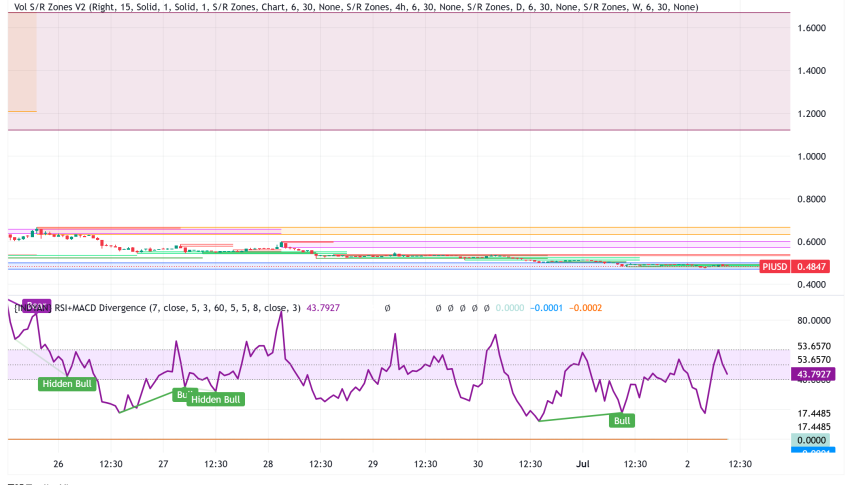

PI/USD Technical Analysis Reveals Oversold Conditions Amid Bearish Momentum

Pi Network is showing classic signals of capitulation from a technological point of view. The Relative Strength Index (RSI) has decreased to 35–36, which is close to the oversold level and shows that there is too much selling pressure. The Moving Average Convergence Divergence (MACD) is very close to a bearish crossover, which confirms the negative momentum that has been going on for six straight trading days.

The price has gone below the $0.50 level, which is a psychologically crucial barrier. This is the first time since February 20th that PI has traded at these levels. The $0.47 support level is the most important one to watch right now, followed by the $0.4711 support level from June 22nd. If these levels don’t hold, the next goal is the all-time low of $0.40 set on April 5th and June 13th.

The 20-day exponential moving average at $0.56 has been broken, but the 50-day simple moving average at $0.66 is still a strong barrier. The trading volume has dropped to $92.6 million, which is more than 1% lower than before. This means that fewer people are buying and selling during the selloff.

Massive Token Unlock Creates Supply Pressure Concerns

The release of 19.2 million PI tokens on July 4th will be one of the biggest unlocks in the project’s history. This is the biggest problem Pi Network has faced with its tokenomics so far. This event starts a month that will be very unstable. 268.4 million tokens will be released slowly over the course of July, which is the largest monthly unlock until October 2027.

This big rise in the amount of money in circulation comes at a bad time, as the market is already under pressure to sell. If current holders decide to sell their tokens before the unlock event, the extra tokens coming into the market could make things worse.

Stablecoin Competition Emerges as Strategic Threat

Market expert Kim H Wong says that the growing popularity of stablecoins is a big threat to Pi Network’s aspirations for adoption. The US stablecoin law, the GENIUS Act, was passed recently, which has made people more confident in stablecoins. They offer price stability, compliance with regulations, and widespread adoption, which are all things that Pi doesn’t currently offer.

Pi Network’s natural instability, lack of liquidity, and unclear regulatory status make it less likely to be widely used than stablecoins. But the network’s unique mobile-first mining strategy and 65 million users give it an edge that might be used if the network’s usefulness in the real world improves.

Pi Network Ecosystem Development Shows Promise Despite Market Weakness

Even though the price is going down, Pi Network’s technology is still getting better. More than 7,900 AI-powered apps have already been made by users since the Pi App Studio launch during the Pi2Day event. This no-code platform makes it more easier for developers to make decentralized apps by letting them use natural language prompts.

Some of the most well-known apps are Ayai (an AI assistant), Universe of Pi (an app that focuses on ecosystems), and instructional platforms for learning about Web3 and DeFi. The Ecosystem Directory now contains a staking feature that lets users stake tokens to move applications up the rankings on the mainnet.

Pi Network Price Prediction: Bulls Defend $0.47 Support Level

Technical evidence point to Pi Network reaching a very important point. If deal hunters get into the market, the RSI’s oversold state could cause a relief rebound from the $0.47 support level. But any attempt to recover will probably meet heavy resistance at the 20-day EMA ($0.56) and the more important 50-day SMA ($0.66).

If the $0.47 support level holds, PI might rise again toward $0.60. If it doesn’t, though, it could test the $0.40 all-time bottom again. Market experts say that the Pi Core Team, which owns 90% of all tokens, has reasons to keep the price above $0.40 so that the project stays in the top 30 by market capitalization.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account