South Africa Market Outlook: JSE Top 40 Builds Momentum, Rand Steady Before CPI

Investor sentiment in SA was steady on Thursday, supported by a steady rand and the release of global and local economic data...

Quick overview

- Investor sentiment in South Africa remained steady, supported by a stable rand and the release of economic data.

- The rand was trading at 17.5325 against the US dollar, unchanged from the previous day, as markets awaited key US inflation data.

- South Africa's GDP grew by 0.8% in Q2, surpassing forecasts, but still reflects ongoing structural challenges in the economy.

- The JSE Top 40 Index is consolidating after a recent rally, with strong support levels identified for potential tactical long entries.

Investor sentiment in SA was steady on Thursday, supported by a steady rand and the release of global and local economic data.

At 07:26 GMT the rand was trading at 17.5325 against the US dollar, little changed from the previous day’s close. Analysts said the markets were quiet ahead of US producer price data later in the day and consumer inflation figures on Thursday. These numbers will shape the Fed’s interest rate outlook.

Meanwhile the 2035 government bond was slightly weaker, with the yield up one basis point to 9.495%.

Economy Shows Modest Growth

Fresh GDP data on Tuesday gave investors a bit of a boost. Statistics SA reported the economy grew 0.8% in Q2, above forecasts of 0.5% and better than the 0.1% growth in Q1.

But growth below 1% shows SA’s structural challenges – energy constraints and limited investment flows. Markets took the data in their stride as attention shifted to the mining, manufacturing and current account numbers due on Thursday which will give more insight into the state of the economy.

Key numbers at a glance:

- Q2 GDP growth: 0.8% (forecast: 0.5%)

- Rand vs USD: 17.5325 (unchanged from Tuesday)

- 2035 bond yield: 9.495% (+1 bps)

- JSE Top-40 Index: 96,056 (+0.3% in early trade)

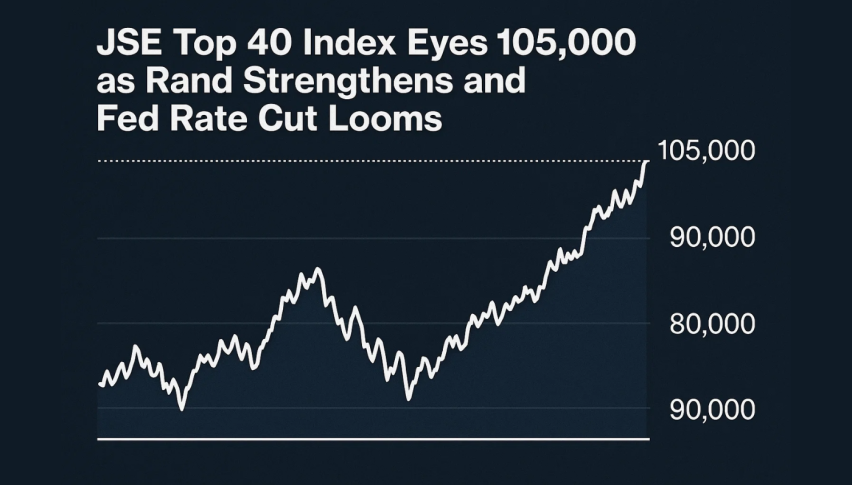

JSE Top 40 Index Technical Picture

The JSE Top 40 Index is trading at 96,050, consolidating after the rally that peaked at 97,050 this week. On the 4-hour chart the index has been in an uptrend since the September 3 low of 92,886, with higher lows confirming the trend.

Fibonacci retracement levels from that rally show strong support zones: the 38.2% retracement at 95,460 and the 50% retracement at 94,969, both aligning with the 50-SMA at 94,693.

This is a good demand zone if prices pull back. Momentum is strong, the RSI is at 63, not yet overbought.Candlestick patterns – including recent spinning tops – are showing near-term hesitation as price tests resistance. But the bigger picture is supported by the 200-SMA at 89,830, a longer term base.

Trade Idea: A tactical long entry could be considered around 95,450-95,500 on pullbacks, with stops below 94,700. Upside targets are 96,600 and then 97,050, the recent high. For beginners this means as long as buyers hold key support levels the index will go higher.

JSE Markets Outlook

SA equities are still doing well despite global uncertainty. Analysts at ETM Analytics said, “Stocks are still doing well and investor sentiment is positive…so the rand will still do okay.”

Looking ahead traders will focus on Thursday’s US CPI data and the local mining, manufacturing and current account numbers. The results will determine the near term direction for the rand and the JSE, and investor sentiment will hinge on whether local is in line with global signals of stability or volatility.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account