EUR/USD Slips After Trendline Break – 95% Fed Cut Odds Underpin Pressure

The EUR/USD pair fell from recent highs on Monday, trading near $1.1720 during the European session after a small weekend bounce.

Quick overview

- The EUR/USD pair fell to around $1.1720 after a brief weekend bounce, influenced by a weak US dollar amid expectations of Fed rate cuts and a government shutdown.

- Markets are pricing in a 95% chance of a 25bps rate cut in October, with Fed officials divided on the need for deeper cuts to address economic slowdown.

- The Euro is receiving limited support from a stable ECB stance, with no immediate need for rate changes despite uneven growth in the Eurozone.

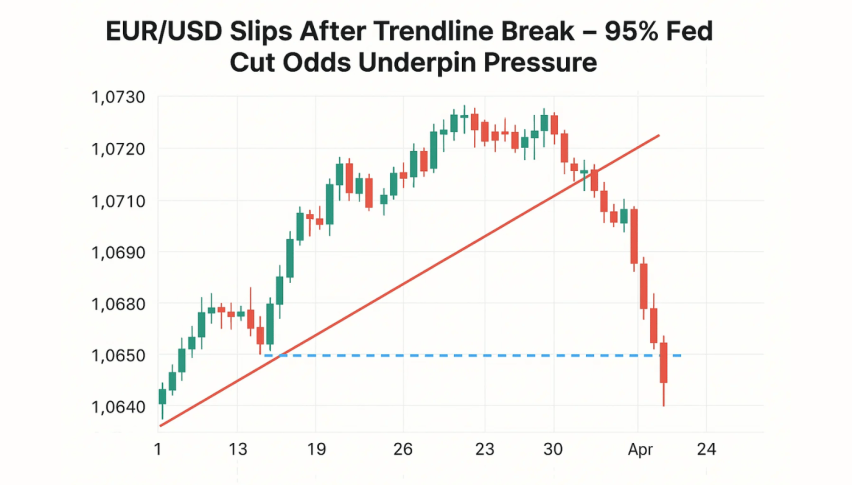

- Technically, EUR/USD has broken below key trendlines and moving averages, indicating a bearish trend with potential targets at $1.1640 and $1.1600.

The EUR/USD pair fell from recent highs on Monday, trading near $1.1720 during the European session after a small weekend bounce. The move comes as the US Dollar Index (DXY) can’t get traction with the Fed expected to ease and the US government shutdown ongoing.

According to the CME FedWatch Tool, markets now price in a 95% chance of a 25bps rate cut in October and an 84% chance of another in December. This dovish outlook is capping the dollar’s rally, especially with policymakers still divided on how much to act. Fed Governor Stephen Miran recently said he wants deeper cuts to counter the slowdown, while Dallas Fed President Lorie Logan is cautious, calling inflation in non-housing services “worrisome”.

Meanwhile, the Washington gridlock is weighing on sentiment. The government shutdown is in its 5th day, disrupting federal operations and delaying the release of key reports, including September’s nonfarm payrolls. With fewer data and more uncertainty, traders are not adding to longs in the dollar, which is supporting the Euro.

ECB Stability Provides Limited Support for Euro

Across the Atlantic, the Euro is getting some stability from a more measured ECB stance. ECB policymaker Martins Kazaks said current rates are “very appropriate”, no need to tighten or ease. This cautious tone is anchoring expectations for continuity even if growth in the Eurozone is uneven.

Investors will be watching Eurozone Sentix Investor Confidence and Retail Sales this week for signs of regional resilience. Also, ECB Vice President Luis de Guindos and Board Member Philip Lane will speak this week and may clarify the central bank’s view heading into year-end.

EUR/USD Technical Breakdown and Trade Setup

Technically, EUR/USD broke below the trendline near $1.1693 and below the 50-SMA ($1.1731) and 100-SMA ($1.1733). The RSI has dropped to 27, oversold for the first time in weeks.

But no bullish divergence, so it’s still weak rather than a reversal.Long bearish candles show strong selling, any consolidation near current levels could be a spinning top, a short term bounce. But below $1.1660 would open the way to $1.1646 and $1.1609.

Trade Setup:

- Entry: Sell on rallies near $1.1690-$1.1710

- Stop: Above $1.1740

- Targets: $1.1640 and $1.1600

As long as EUR/USD is below the trendline, the trend is bearish, short over recovery.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account