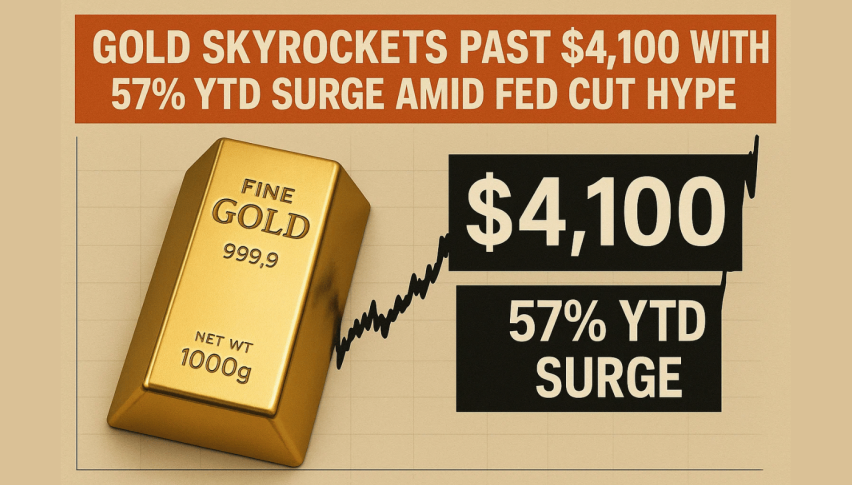

Gold Skyrockets Past $4,100 with 57% YTD Surge Amid Fed Cut Hype

Gold has just burst through the $4,100 per oz barrier , marking a major milestone in a period of turmoil , as investors scramble...

Quick overview

- Gold has surpassed $4,100 per oz, driven by investor demand for safe-haven assets amid increasing macro risks.

- Silver has also reached record levels, with gold prices rising 57% this year due to expectations of US rate cuts and increased central bank purchases.

- Geopolitical tensions are escalating, particularly with China's export controls and potential tariffs from the US, adding to economic uncertainty.

- Traders are advised to consider long positions within the $4,060-$4,090 range, while maintaining tight stop-losses due to market volatility.

Gold has just burst through the $4,100 per oz barrier , marking a major milestone in a period of turmoil , as investors scramble to stash their cash in safe-haven assets while macro risks start to look much more serious.

Silver has followed suit and is now sitting at record levels. So far this year Gold has risen a staggering 57% and thats all down to one thing – expectations of multiple rate cuts in the US, central banks snapping up more of it and a massive influx of new investors into Gold-backed EFTs.

Philadelphia Fed chief Anna Paulson has been warning about the growing threat to the labour market and is saying we can expect more of the same – in other words she thinks the Fed will ease off a bit more, which is backing up what everyone else is thinking – that rates are on the way down

Its clear that the market is pretty much convinced that we are going to get a 25 basis point cut in October , and a 94% chance of it in December – according to the CME FedWatch tool.

Oh and by the way – the situation on the geopolitical front has worsened – China has gone ahead and tightened its controls on the export of rare earth minerals and in response President Trump has been talking about slapping 100% tariffs on all Chinese goods starting November 1st – though he has also confirmed that he is still going to meet with President Xi in South Korea – meanwhile the ongoing U.S. government shutdown is only heightening the worries about the economy and general policy stability.

Everyone is waiting with bated breath for Fed Chair Jerome Powell to give a speech at the NABE meeting , which is likely to give us an insight into what the Fed is thinking about cutting rates and its strategy for the balance sheet

Gold Technical Outlook on Gold’s Next Move

From a purely chart based perspective gold has been on a tear since recently bottoming out at $3,946 , but somehow has managed to keep itself contained by the ascending trend line. Just recently it tested resistance at $4,178 and to our surprise came out with a Shooting Star – a good old fashioned sign of the buyers having lost interest at the top.

If things do start to go downhill then we are looking at a potential dip towards the 38.2% retracement at $4,089 – or even down to the 50% zone at $4,062 – and if that happens and is met with some decent strength it could just kick-start a whole new push upwards.

Things are looking pretty good for the bulls – the RSI has cooled off a bit from being overbought but is still at 63 and showing a strong upward bias. Recent price action has also seen a string of higher lows – which is reinforcing the trend and making it look very strong.

Gold Trade Strategy for the Near Term

Here’s a trade idea which even newer traders can get on board with – look to go long within the $4,060-$4,090 range especially if you spot a Bullish Engulfing or Hammer candle forming. Try setting your stop-loss at $3,995 and then you could be looking at targets of $4,178 and $4,220 and – providing you do it right – you should be sitting pretty on a risk-to-reward ratio of 3:1.

For more experienced traders you might want to hold off a bit and look for confirmation – say a close above $4,178 on strong volume – before jumping in. That way you’ll catch a cleaner breakout with the price and volume on your side.

In the midst of all this volatility its more important than ever to keep a level head , stick to your trades and keep a tight lid on your stop-losses. This one is likely to be a bumpy ride , but for now the outlook still looks pretty favorable for the bulls.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account