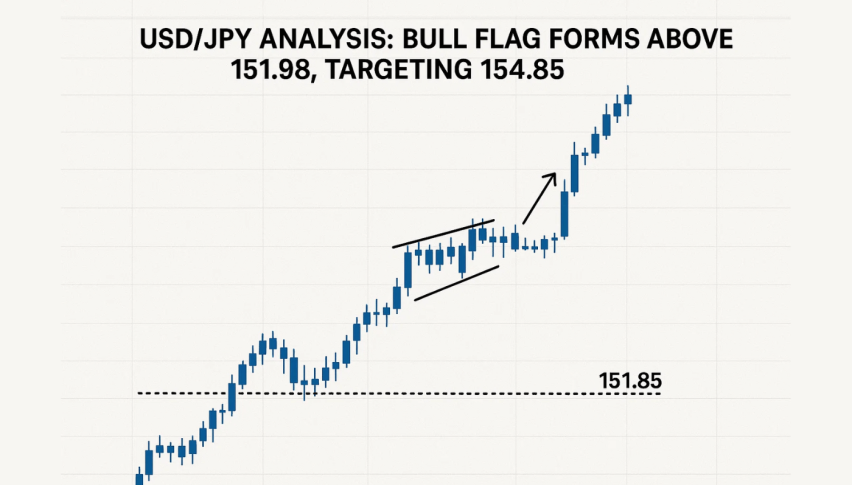

USD/JPY Analysis: Bull Flag Forms Above 151.98, Targeting 154.85

During the European session, the USD/JPY currency pair slid towards 152.00 as the yen got a bit stronger. There's growing speculation...

Quick overview

- The USD/JPY currency pair has declined towards 152.00 as the yen strengthens amid speculation of potential intervention by Japanese authorities.

- Expectations are rising for the Bank of Japan to raise interest rates later this year, supported by persistent inflation above the 2% target.

- The US dollar is facing downward pressure due to a high likelihood of Fed rate cuts and ongoing government shutdown, limiting its recovery potential.

- Technically, the USD/JPY pair is consolidating with signs of indecision, but a confirmed bounce above 151.70 could signal a bullish trend continuation.

During the European session, the USD/JPY currency pair slid towards 152.00 as the yen got a bit stronger. There’s growing speculation that Japanese authorities might step in and expectations are building that the Bank of Japan (BoJ) will raise interest rates later on this year which is pushing the yen’s value. Japan’s current political mess and the dovish US Fed outlook are also putting a bit of downward pressure on the yen before Fed Chair Powell comes out with his remarks.

Japan’s Finance Minister Katsunobu Kato has been flagging “one-sided and pretty rapid” currency moves and urging stability – which many people saw as a hint that the country might be looking at intervention.

Meanwhile in Japan, inflation is still stuck above the BoJ’s 2 % target and the economy is doing okay – which makes it a bit more believable that the BoJ might raise rates before the end of the year.

However, there are a bunch of internal politics getting in the way right now, like the ruling coalition breaking up and Sanae Takaichi being named as the new leader of the LDP – that’s all making it a bit uncertain whether the country can pass any major policy changes.

Dollar Getting Weaker As Fed Cut Odds & Fiscal Gridlock Rise

The US dollar, on the other hand, is kind of stuck. Market odds for a 25 bp Fed cut in October are now at 97% and roughly 90% for another one in December – that’s capping any chance that the dollar might make a big comeback.

The US government’s been shut down for over two weeks, which is making things worse. Meanwhile, key economic releases are being delayed and people are waiting on Powell’s speech to see if that will be a catalyst for the dollar to get stronger or weaker.

USD/JPY Technical Picture: Channel, Fib, & RSI Showing Some Signs

Technically speaking, the USD/JPY pair is kind of consolidating at 151.98 after backing away from resistance around ~153.24. On a 4-hour chart, it’s still above the 100-SMA (149.10), and it’s clear that an ascending channel of higher highs and higher lows is in place – basically meaning that the trend is still up.

The recent candles have been spinning tops and Dojis along that trendline – which is a sign of indecision rather than a reversal. And also the pullback matches up perfectly with the 23.6% Fibonacci retracement at 151.67, which has been a support zone before.

The RSI is hovering around 51, but has carved out a higher low – that’s a sign of a mild bullish divergence and suggests that there’s still some room to go before the pair becomes overbought.

Trade Setup:

Look to enter a trade once you see a confirmed bounce above ~151.70

Targets are ~153.25 first, then ~154.85

Stop-loss should be just below ~150.70 (just under the 38.2% Fib level)

All this points to a bull-flag consolidation inside an uptrend. If momentum picks up again and the resistance is broken, then the next leg higher could be underway.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account