Copper Price Forecast for H2 of 2020: Decisive Time Between Being Bullish or Bearish

Last Update: March 21st, 2021

Copper is a heavily traded commodity, therefore it has been quite volatile in recent years, since it also is a cheap investment, trading mostly between $ 2 and $ 4. Currently, it is right in the middle of that range, close to the $ 3 mark, which is quite a low price compared to gold and other investment assets. Copper is widely used as an energy conductor metal in many fields, particularly in construction, where it is used for electrical wiring and piping. Therefore, it mainly behaves like a commodity in the financial markets, going up when the risk sentiment is positive, as it has been in recent months, due to the global reopening after the coronavirus lockdowns. So, copper acts as an indicator of economic health, but sometimes, it also acts as a minor safe haven, following the opposite price action. Although, that having been said, in the last four months, both safe havens and risk assets have rallied, with copper following suit. However, these are not normal times, so as is the case for most assets, the price action for copper has not been very rational.

Recent Changes in the Copper Price

| Period | Change ($) | Change % |

| 30 Days | +$0.07 | +3.1% |

| 6 Months | +$0.32 | +1.2% |

| 1 Year | +$0.34 | +8.3% |

| 5 Years | +$0.58 | +26% |

| Since 2000 | +$2.08 | +5.5% |

Copper has already been trading in a bearish trend since 2018, losing nearly 30% of its value, or translated into real money, $ 1, as it has maintained a steady decline. With the trade war between the US and China starting back then, and escalating until Q4 of 2019, the investment sentiment has weakened continually all over the globe, dragging certain commodities, such as iron and copper, with it. Then came the coronavirus pandemic, initially in China. This gave metals like copper another big downward push, from $ 3 to $2 .50, and subsequently, the outbreak of the pandemic in Europe and the US sent all markets crashing this time, so Copper suffered its third hit in March, sending the price down to $ 2. But, the big reversal came after the crash in March, which picked up pace as central banks and governments threw all the cash they had at the market, and the world started to reopen again. Silver has been rallying since then, climbing back from $ 2 to $ 3, which means a 50% gain.

| Copper Forecast: Q4 2020 | Copper Forecast: 1 Year | Copper Forecast: 3 Years |

| Price: $ 3.40-50 Price Drivers: Economic reopening, USD correlation, monetary/fiscal stimulus | Price: $ 4 Price Drivers: China’s rebound, post US elections, improvement in the sentiment | Price: $ 4.50-60 Price Drivers: Global economic recovery, increase in the demand |

Copper Price Prediction for the Next 5 Years

As mentioned above, we are not living in normal times, especially speaking from a traders perspective. Usually the fundamental data, central banks and technical indicators move markets around, but politics have increased their influence on the markets, and now the coronavirus and its impact on the global economy have turned the market very volatile, especially the commodity markets such as copper, which are prone to shifts in the risk sentiment. The situation hasn’t been particularly positive for copper in the last decade, so even before the economic meltdown during the lockdowns, copper wasn’t in the best position. The situation seems to have changed, but the future doesn’t look too bright. Right now, looking 1 – 3 years ahead, the future is not certain for any asset, although the price is at a decisive level right now, as can be seen from the technical charts.

The copper price is on the descending trend-line now

Below are several factors that are likely to affect Copper in the next few months/years.

Risk Sentiment Commodities – Risk Assets and Gold are Climbing

The risk sentiment in the financial market is a very important factor, especially for safe haven assets and commodities, such as copper. The risk sentiment has switched around many times in recent years, as politics have interfered with economics on a constant basis. The sentiment has been particularly negative for commodities in the last two years, as tariffs between the US and China have been going up during the trade war, which is not over and might actually turn into something more dramatic. As a result, the copper prices fell during 2018 and 2019, although we saw a small increase in Q4 of 2019, as the sentiment improved due to prospects of the Phase One deal between the two giants. While other risk markets, such as the stock market, were little changed in January 2020, when the news about the coronavirus in China hit the wires, copper dived from $ 2.90 to $ 2.50, since the Chinese economy is closely correlated to the price of copper. The sentiment deteriorated further as the coronavirus spread to the West and the copper price dived lower, but as mentioned above, all the cash from governments and central banks made risk assets turn higher and the economic rebound coming from the global reopening is keeping the sentiment positive for copper and other commodities. There is weakness in many sectors, and the rebound won’t be too smooth, so the further increases in copper prices in the next months, and probably years, won’t be as strong from now on, as it has been over the last four months. But then again, the last four months have seen the strongest increase since 2011. So, I expect the sentiment to remain positive for a while, but not as strong as it has been in recent months.

Supply Vs Demand – Which Will Be Greater?

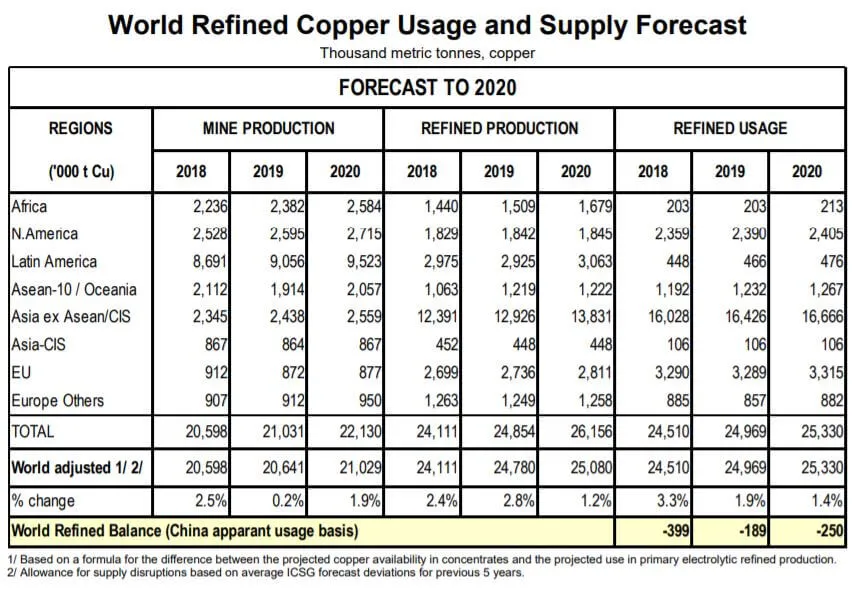

Demand – The world GDP is expected to decline by 4.9% in 2020, according to the IMF, which expects to see the consumption of the red metal decline by 22%. Such a massive decline in demand should affect silver prices considerably, obviously for the worse, sending copper tumbling lower in normal times. But copper has been making some very decent gains in the last four months, since the big market crash in March. However, this is due to expectations that the demand will increase because the world didn’t end, as some people seemed to expect, and the global economy started to rebound, followed by the total rebound for the Chinese economy. China is the main consumer of copper, and in fact of most other raw materials, and the Chinese economy has rebounded nicely from the coronavirus melt-down. In June, copper prices were buoyed by inventory drawdowns and increased demands from China. As of late June, stocks of copper in warehouses, monitored by the Shanghai Futures Exchange, had fallen to 17-month lows of 109,696 tons, from more than 380,000 tonnes in March, while in LME-registered warehouses, copper stocks stood at 233,400 tonnes, which has fallen by down more than 15% since May 13. That, coupled with the increased demand from the West, as it begins to reopen and the economy rebounds, will keep the pressure on the upside for this metal. But, it will all come down to how the coronavirus situation evolves, and what the economic rebound will be like in the West, in both the short and mid-term (1-3 years), because we are seeing many caveats already. But one thing is for sure, the demand from China will continue to increase, so copper bulls still have China to rely on.

https://investinghaven.com/forecasts/copper-price-forecast-2020-2021/

New Home Construction and the Electric Car Industry – Copper is one of the main metals used in the electrical industry. Now, with the car industry switching from diesel to electricity, the consumption of copper will go up, and so will the demand. The housing sector, on the other hand, is in a state of constant expansion, with the increase in the global population, which doesn’t look like it’s going to be slowing down anytime soon, and increasing wealth, which will also increase the demand for new homes to be built, more cars and other consumer goods. This means that the demand for copper will keep increasing in the longer term, but prices will also depend on the supply side. If the demand is higher than the supply, inventories will fall, as in the case of the grand global reopening, and the price will go up.

Supply – However, we also have to consider the supply side when it comes to commodities. One of the main reasons for copper being bearish from 2011 until 2014, despite the global economic expansion during that period, was the increase in production/mining. The copper mining supply doubled between 2002 and 2014. Although the copper demand fell dramatically during the lockdown months, from March to May, so did the supply side, as many mining plants were closed during that time. But the supply and the demand have now increased for crude oil again, although we will have to watch to see which side will show the biggest increase. If the demand increases more than the supply, which is likely, as global growth requires more copper, while mining is becoming increasingly difficult, as open pit mines running out of copper ore, this will mean that the demand will outpace the supply, which will help increase the price in the coming years.

Copper Company | Copper Reserves |

| Codelco (Owned by the Chilean government) | 78 million tons |

| Southern Copper (NYSE:SCCO) | 69 million tons |

| BHP Group (NYSE:BHP) | 47 million tons |

| Freeport-McMoRan (NYSE:FCX) | 45 million tons |

| Glencore (OTC:GLNC.Y) | 28 million tons |

DATA SOURCE: SOUTHERN COPPER INVESTOR PRESENTATION. NOTE: RESERVE DATA AS OF SEPT. 5, 2019.

Copper/USD Correlation

Since most commodities are quoted or traded in USD, commodity traders should also keep an eye on the USD, because the moves in the US dollar affect commodity prices as well. The USD surged during the first two weeks of March, as the coronavirus pandemic hit Europe and the US, and traders turned to the USD, as a global reserve currency. The price of copper fell from $ 2.55 to $ 1.97, but soon the USD reversed, with traders realizing that the coronavirus wasn’t really going to reshape the world, and the USD turned bearish. That helped copper turn bullish, as of March 2020, also helped by the improvement in the sentiment, but the reversal wouldn’t have been so dramatic without the crash in the USD. If the USD continues to fall, as it is currently declining, and in my opinion should continue to decline, at least until the US presidential elections in November, then copper should keep climbing higher. The question is how the USD will behave after the elections. If there is a clear win by one of the candidates, the USD is likely to turn bullish for some time, which will weigh on copper. But, uncertainties related to the US elections are too great right now, and this will keep the USD in check until November, thus keeping commodities bullish.

Technical Analysis – Will Copper Break the 100 Monthly SMA?

Commodities Live Rates Copper Monthly Chart

In the longer term, copper has been bullish, like most commodities. The reason for that has been mostly fundamental, as the world evolves and the need for copper increases, but since 2008, the technical indicators have become important as well. The 200 SMA (purple) has been providing support for copper, holding it during pullbacks, first after the 2008 global financial crisis, then in 2015-16, during the great pullback, and again in March 2020. The technical analysis in copper right now is particularly interesting. On one hand, we have the descending trend-line, as shown in the weekly chart above, connecting the highs from 2011, 2018 and now. Copper is trading right at the descending trend line, moving above and below it a few times, although we can’t say that there has been a break. According to this trend line, copper should turn bearish now, and fall to $ 2 until the end of 2020. This is also what the 100 SMA (green) suggests on the monthly chart. This moving average turned into resistance immediately in late 2014, when it was broken as the price declined, and it provided solid resistance during late 2018 and early 2019, reversing the price back down. So, copper should reverse down if the 100 SMA is to hold as resistance again. This is the first time in two years that buyers are trying the strength of the 100 SMA, so we have no indication yet, as to how strong this moving average will be this time, or whether it will hold at all, so this is a decisive time for copper. Buyers and sellers will have a tough battle here, but if the copper bulls win, the first target will be $ 3.40-50, which is the high from back in 2018. Above that, we have the previous resistance at $ 4, and then the all-time high at $ 4.50-60. The pace of the increase has been quite strong recently, but if the buyers remain in charge, the pace will probably decline, and it will take a few years to reach those levels again. If buyers fail at the trend-line and the 100 SMA, then the price is bound to fall to $ 2.50, where the 50 SMA (yellow) stands on the monthly chart, and then to $ 2, which is just below the 200 SMA.