The Euro continues to lose ground against the CHF on longer time-frame charts, declining from around 1.90 in the 1990s, when it was still called the ECU, to 1.05 earlier this year, when the attention turned towards safe havens, due to the coronavirus outbreak. That seems to be the bottom for now, although this pair declined to 0.87 when the SNB removed the peg for this pair at 1.20. That was a one-off situation, but it opened the door for this pair to fall below parity. However, since the middle of May, we have seen the EUR/CHF retrace higher, as the sentiment improved in financial markets, but the retrace seems pretty weak, and moving averages are standing above to provide resistance at around 1.10, so the retrace might end soon, just a few weeks before the end of the year.

Current EUR/CHF Price: $

Recent Changes in the Ripple Price

| Period | Change ($) | Change % |

| 30 Days | -0.01 | -1.0% |

| 6 Months | +0.21 | +19.4% |

| 1 Year | -0.07 | -6.5% |

| 5 Years | -0.06 | -5.5% |

| Since 2000 | -0.53 | -49.1% |

The EUR/CHF is a strange pair, because while the two currencies spread on the opposite sides of the forex spectrum, the CHF being a safe haven, while the Euro is a risk currency to some degree, the two are closely related to each other, because Switzerland is in the middle of the Eurozone, and therefore conducts most of its international trade in Euros. As a result, the Swiss National Bank SNB is trying to hold this pair stable, but without much success so far. It continuously intervenes by buying EUR/CHF, in order to weaken the CHF. The last time was in May this year, which was one of the main reasons for the reversal from 1.05, and the retrace is still on, but it seems like it will end soon, because the price has stalled in the last several weeks and the retrace wasn’t convincing to begin with. So, 1.10 seems like the target for this pullback, before heading to parity.

| EUR/CHF Forecast: Q4 2020 | EUR/CHF Forecast: 1 Year | EUR/CHF Forecast: 3 Years |

| Price: 1.08 – 1.10 Price Drivers: COVID-19 in EU, Brexit, Risk Sentiment |

Price: 1.70 – 1.75 Price Drivers: ECB, SNB, Post Brexit, Global Risk Sentiment, Post-US Elections, Global Economic Recovery |

Price: 1.40-1.50 Price Drivers: Market Sentiment, Global Economy, Global Politics, ECB, SNB |

EUR/CHF Price Prediction for the Next Five Years

Market Sentiment and COVID-19

This pair is quite affected by the market sentiment; since the Euro and the CHF move in opposite directions, regardless of whether the risk is on or off. The risk sentiment has been negative since early 2018, due the trade war between the US and China, hence the bearish move down from 1.20 in the last two years. But, the sentiment has improved somewhat since May, as the world reopened after the 2 to 3-month lockdowns, and the Eurozone economy began to rebound. This pair has retraced higher, as mentioned above, but the sentiment is softening again now, with all the talk about the second wave of the coronavirus and the occasional regional restrictions and possibly lockdowns. This does not help improve the sentiment, so as long as the coronavirus and restrictions are hanging over our heads, traders will turn to safe havens and the EUR/CHF will resume its bearish trend.

The ECB, the SNB and the Eurozone Economy

Central banks were already on an easing cycle last year, as the global economy was slowing down. But they pressed the panic button in March after the coronavirus breakout, which forced governments to close borders. The European Central Bank set Refinancing Rates at 0.00% and deposit rates at -50%, while the Swiss National Bank Policy Rate stands at -0.75%. But they introduced some extreme measures, such as the EUR 1.35 billion pandemic emergency purchase programme (PEPP), in an attempt to make funds more available by providing lower lending costs for European citizens and businesses. The M3 money supply increased drastically, from around 4% before March to above 10% in August. The Swiss National Bank and the Swiss Government also introduced some major programmes to help the economy in such times. But, the Eurozone economy is slowing down again, with the service sector falling into contraction in September. This means that the ECB will keep the easing measures, while the US economy is keeping the rhythm of the rebound. This will lead to a weaker Euro eventually, sending EUR/CHF down. But the SNB keeps intervening in the markets, buying this pair and they will do so if the Euro weakens, as they have promised. So, the decline won’t be too smooth and I hope that not many traders get caught on the DNB bounces.

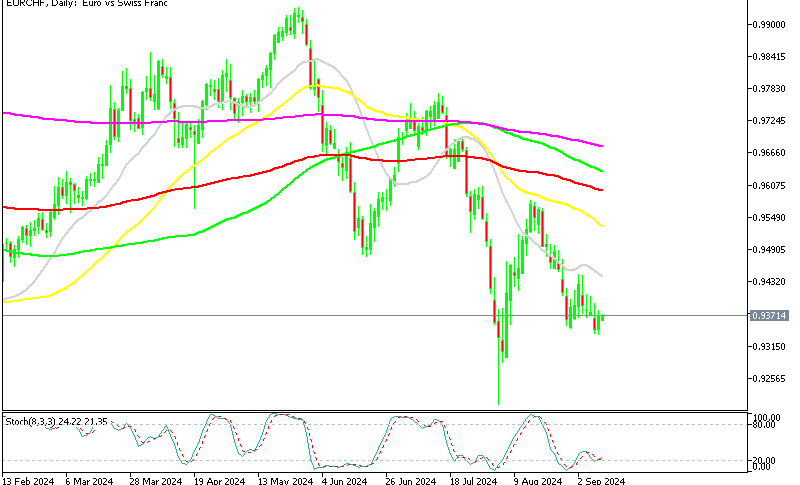

EUR/CHF Technical Analysis – The Pullback Seems Exhausted

The technical analysis for this pair is quite straightforward. This pair has been on a bearish trend and we have tried to sell the retraces higher. The decline has been imminent since the early 1990s, when it was trading at around 1.90. The steepest decline took place from the financial crisis in 2008 until 2011, when this pair lost more than 60 cents. In January 2011 we saw another steep decline, after the SNB removed the peg for this pair at 1.20, sending it crashing lower to 0.87. But the price pulled back up, and it has been above parity since then – although, that’s where the EUR/CHF seems to be headed.

This has been the weakest retrace in EUR/CHF

During this time, moving averages were doing a great job in providing resistance for this pair during pullbacks, and right now, the price is trading right below the 20 SMA (gray) on the monthly chart. The pullback seems to have stopped now, so it might as well be over. Just in case, the 50 SMA (yellow) stands at 1.10, which is a big round level, so that looks like a good place to open a long term sell signal. Although, if the global economy improves, which will lead to the risk sentiment improving in financial markets as well, then safe havens will retreat and the EUR/CHF might reach 1.15, where the 100 SMA (purple) lies in wait. But I think that the most likely scenario is that the reversal will take place at around 1.10, and the larger bearish trend will resume once again.