The levels have moved – Where have they relocated today?

As we said in our first market update this morning, the USD started a short term downtrend yesterday, which has extended this morning. So, the support and resistance levels are not the same as they used to be on Monday, the last day we covered these levels. They have been relocated with some of the support levels turning into resistance and vice versa.

EUR/USD – This forex pair has made a 100 pip trip north since yesterday, so the first resistance level comes at 1.1150s. Above there comes 1.1180 which has been a strong resistance level a couple of weeks ago. 1.1200 is always a good round number we can count on for some good risk/reward ratio and finally, 1.1230 is the best risk defining resistance level. That was the high before the US employment report was released on Friday. Support comes at the 1.11 which is where the 200 moving average stands on the H1 forex chart, then comes 1.1070-80 and 1.1050.

Support and resistance levels for EUR/USD

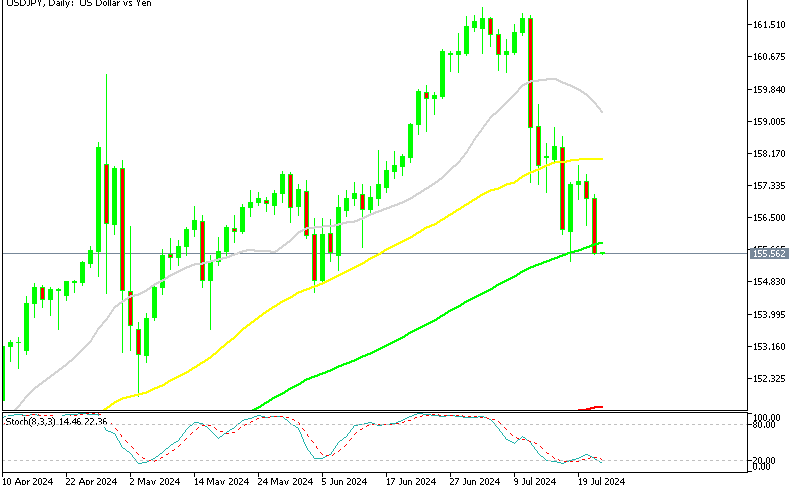

USD/JPY – This forex pair moved down nearly 150 pips since yesterday morning. It has entered the 100-101 area where we can find a number of indicators and levels which we can count on to provide support. The 101.00-101.10 level which was the low early this morning is definitely a support level we can count on. Below that comes 100.50 which was the low last week and finally the great 100 level. The first resistance level comes at 102, 102.50-60 which was the high earlier this week and 103.30.

These are the support and resistance levels for the two most traded forex pairs. Trade wisely and use them to reduce your risk and improve your risk/reward ratio.