The Australian Dollar Is Rising In Anticipation Of The RBA Meeting Minutes.

The US dollar posted a rather weak performance to start out the week, with the Australian dollar being the strongest major on the day. It seems like market players are expecting a hawkish stance from the last RBA meeting if we consider today’s bounce in the AUD/USD. It was a holiday in Japan today, and trading volume has been relatively light. If you consider this, the Aussie’s bounce of more than 90 pips today, was quite impressive. The pair gave back some of these gains towards the end of the day but managed to end off the day with a reasonable 55 pip advance against the Buck. Let’s look at a few charts:

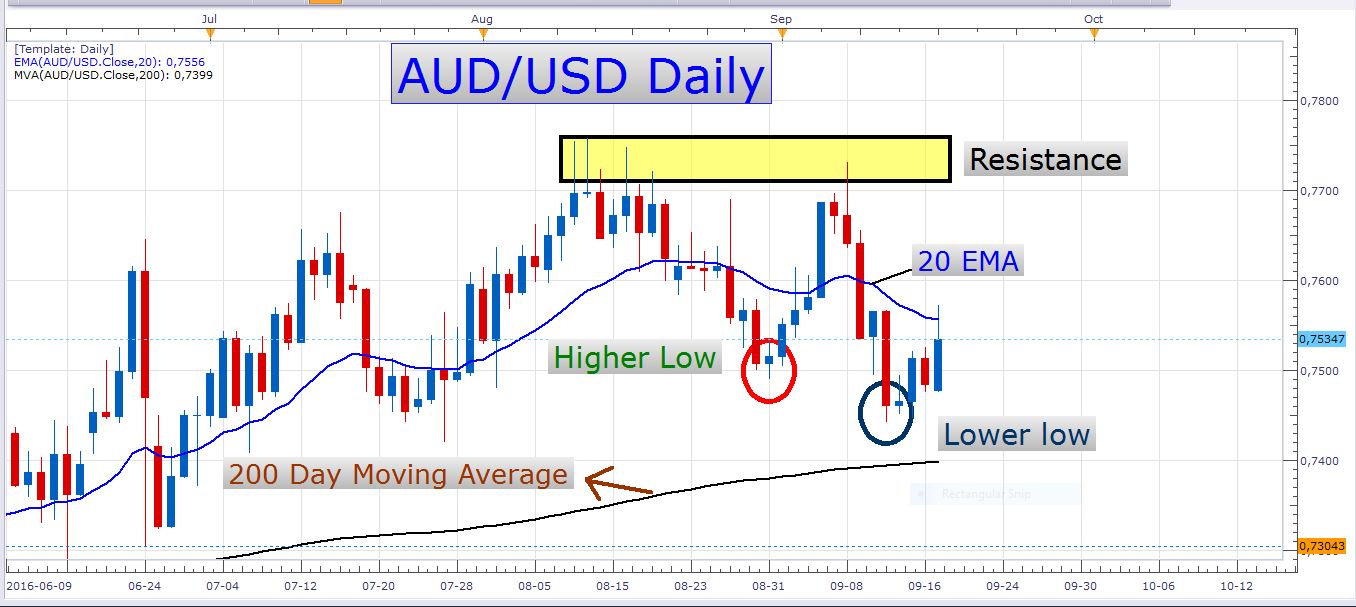

AUD/USD Daily Chart

Today’s candle is what we call a bullish engulfing bar. This is an indication of strong buying and normally points to a further appreciation in the price of the particular asset. Of course, we should never just isolate this type of candlestick pattern and make trading decisions based solely on it. We need to consider many other factors, like the current market trend, support and resistance levels, trend lines, fundamental factors, and other factors which I will not discuss right now. In the chart above you can see that a lower swing low has recently been formed and that an impulsive decline drove the price down to this particular low. The price is also trading below the 20-day exponential moving average and actually rejected off of it today. We also have a daily candle wick of about 40 pips to the topside, which testifies of some sellers being present in this zone, and that the pair is finally showing some weakness on the day. So we can come to the conclusion that this bullish engulfing candle may not be the best bullish signal we could get at this stage.

At this stage, I still like the downside on this pair, but I know that the RBA meeting minutes could push the pair in either direction. If they discussed further interest rate cuts at the last meeting, for example, this could weigh on the AUD/USD. On the other hand, if they discussed tightening the economic reins soon, this could cause a powerful pop in the pair.

If we get a dovish tone from the minutes, I would be on the lookout for short opportunities. I am still holding on to my short positions on this pair, which have been brought to breakeven already, so I would like a hawkish result tomorrow.

USD/CHF

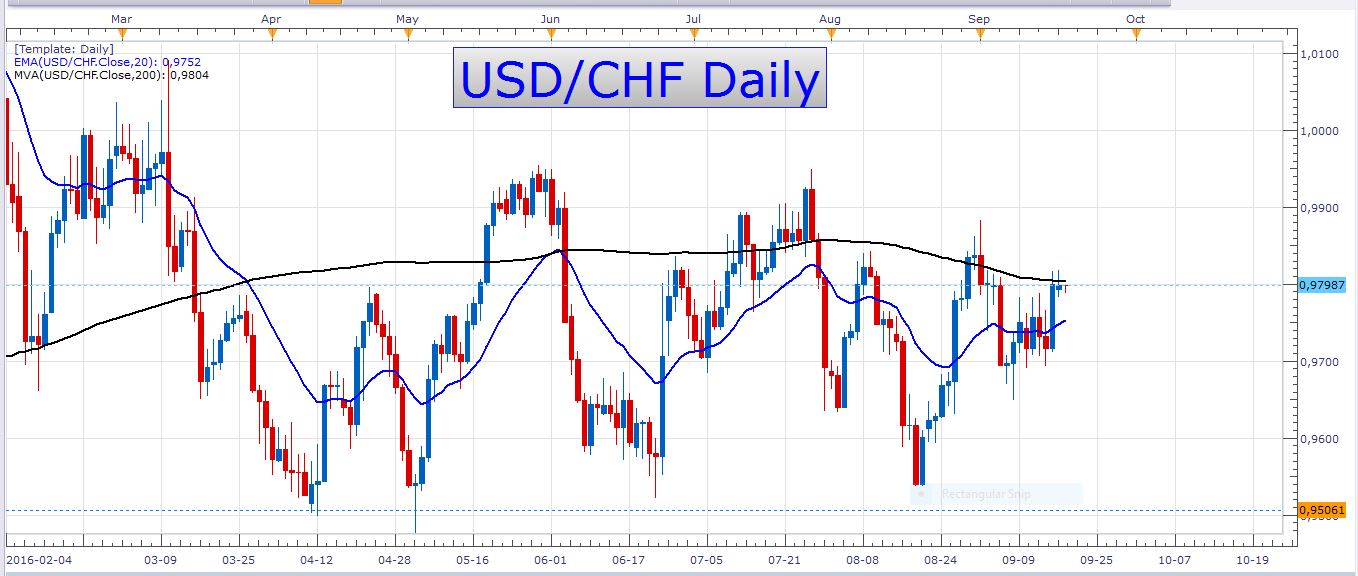

The USD/CHF is still capped by the 200-day moving average. If the FED fails to impress the market on Wednesday, we could see the pair decline from this level once again. Look at this daily chart:

USD/CHF Daily Chart

The black moving average is the 200-day moving average. In forex trading, this particular moving average is widely considered to be an important trend gauge. Sometimes it is also a support or resistance barrier to the instrument’s price.

This pair has been trading in a range for quite a long time now, and although there is potential to make a few pips here, it will probably not be as many as on a trending pair. It may also be more tricky to execute accurate trades on this pair than on a trending pair.

Economic data

The RBA meeting minutes release is scheduled for 01:30 GMT. Then we have US building permits numbers later in the day at 12:30 GMT, with the Bank of Canada’s Poloz speaking at 16:45 GMT. I don’t expect phenomenal volatility tomorrow, as market players are anxiously anticipating the big news on Wednesday, which is the interest rate decisions of the USA, Japan, and New Zealand.

Great trading!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account